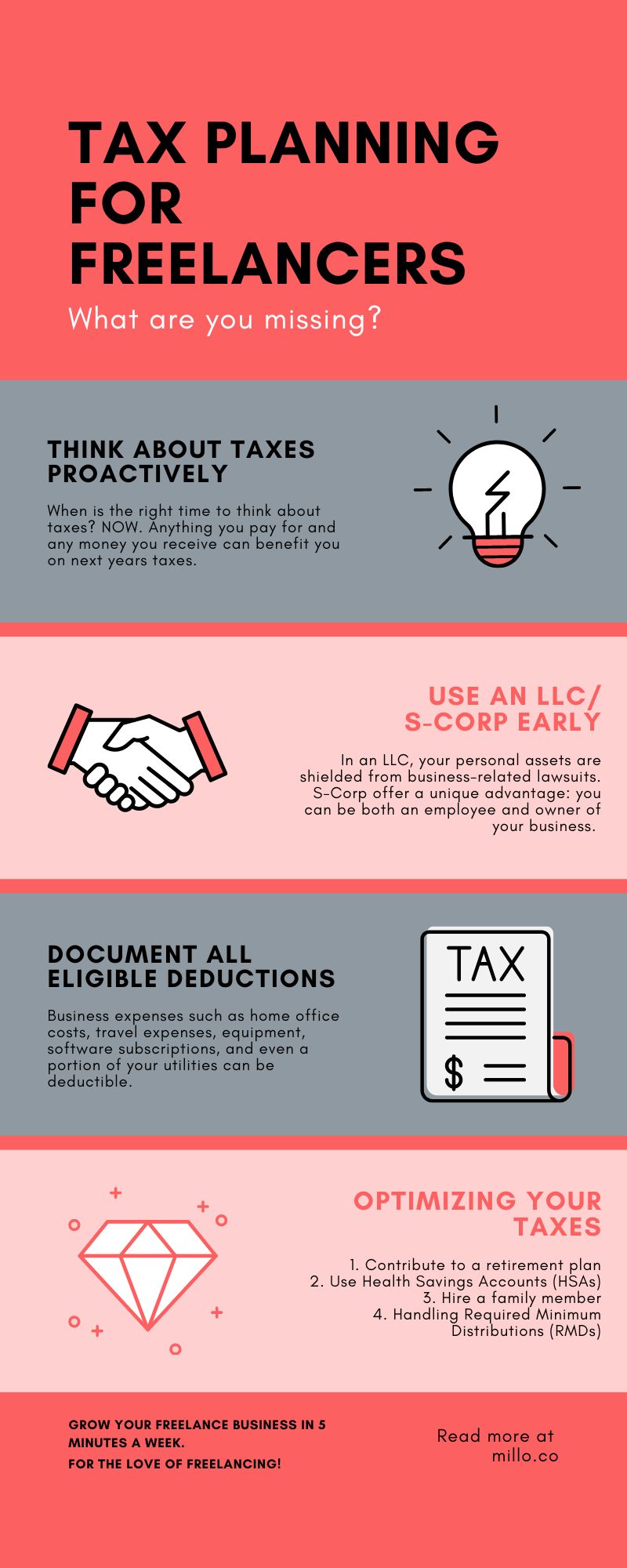

As a freelancer, managing your taxes can be a complex endeavor. However, proactive tax planning can significantly reduce this complexity, saving you both time and money. This article will discuss common mistakes freelancers make, such as failing to think about taxes proactively, not using an LLC/S-Corp early, and failing to document all eligible deductions. We’ll also discuss how to optimize your taxes and handle Required Minimum Distributions (RMDs).

You might be wondering, “Why a tax article AFTER this year’s tax deadline?” Because you need to be planning for next year; collating, annotating, and discovering, to make next year’s tax bill even more palatable.

Remember, you’re essentially a small business owner. Freelancers often make the mistake of treating their taxes as an afterthought, only considering them when tax season rolls around. This reactive approach can lead to missed opportunities for deductions and tax savings. Proactive tax planning for freelancers, or anyone really, involves regular reviews of your income, expenses, and potential deductions throughout the year. This ongoing process allows you to identify tax-saving opportunities, make necessary adjustments, and avoid unwanted surprises come tax season. It’s essential to consult with a tax professional who can help guide your decisions and provide advice tailored to your specific situation. As a general rule of thumb, to protect yourself, set aside 25-30% of your income for taxes. This will help you avoid the dreaded pain of owing thousands of dollars come tax season. Many freelancers operate as sole proprietors, unaware that changing their business structure could offer significant tax advantages. Operating as an LLC (Limited Liability Company) or S-Corp can provide legal protection and tax benefits. In an LLC, your personal assets are shielded from business-related lawsuits. On the tax side, an LLC provides flexibility as profits and losses can pass through directly to your personal income without facing corporate taxes. S-Corps, on the other hand, offer a unique advantage: you can be both an employee and owner of your business. This allows you to pay yourself a “reasonable salary” and take additional income as distributions, which are not subject to self-employment tax, potentially saving you thousands each year. Freelancers often overlook valuable deductions. Business expenses such as home office costs, travel expenses, equipment, software subscriptions, and even a portion of your utilities can be deductible. It’s crucial to keep detailed records of all your business-related expenses throughout the year. Remember, accurate documentation is key. The IRS requires proof of all expenses claimed as deductions. So, save your receipts, invoices, and bank statements. Consider using a mobile app or cloud-based system to track your expenses and store your records digitally. Tax optimization involves using legal strategies to reduce your tax liability. Here are some tax planning strategies freelancers can consider: 1. Contribute to a retirement plan: Self-employed individuals can contribute to a Simplified Employee Pension (SEP) IRA or a Solo 401(k) plan. These contributions are tax-deductible, and the funds grow tax-free until retirement. 2. Leverage Health Savings Accounts (HSAs): If you have a high-deductible health plan, you can contribute to an HSA. Contributions are tax-deductible, and withdrawals for eligible healthcare expenses are tax-free. 3. Hire a family member: If you have children or other dependents, consider hiring them. You can deduct their wages as a business expense, and they may be in a lower tax bracket. 4. Handling Required Minimum Distributions (RMDs) If you’ve contributed to retirement accounts like a 401(k) or an IRA, you’ll have to start taking RMDs when you reach the age of 72. RMDs are calculated based on your life expectancy and account balances. Failing to take your RMD can result in a hefty penalty—50% of the amount you should have withdrawn. In planning for RMDs, consider the following strategies: Navigating the tax landscape as a freelancer can be challenging, but proactive tax planning can help you minimize your tax liability and maximize your earnings. Regularly reviewing your income and expenses, operating under the right business structure, accurately documenting deductions, optimizing your taxes, and planning for RMDs are all key strategies. Always consult with a tax professional to ensure you’re making the best decisions for your unique situation. Proactive tax planning is not just about saving money—it’s about building a solid financial future. Become even more financial sound by using our free Freelance Rate Calculator. Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!

Failing to Think About Taxes Proactively

Failing to Use an LLC/S-Corp Early

Failing to Document All Eligible Deductions

Optimizing Your Taxes

You Work Hard For Your Money, Keep It

Keep the conversation going...