If you want to be a full-time freelancer, skill alone will not take you there. One thing I learned early on in my career is that being a freelancer or “independent professional” or “consultant” is really not a job, but a full-fledged business. And every successful business survives on client acquisition and retention.

My goal was to develop a constant flow of clients so that I wouldn’t have to worry about where the next project would come from. That’s when I started doing cold outreach.

A quick background: I first started freelancing in 2018 as an SEO expert for affiliate projects. I invested time and money learning link building and cold outreach and in just 8 months I increased my monthly recurring revenue by 700%. And I haven’t looked back since.

Today, I work with a lot of talented freelancers and their skills are top-notch. But the biggest challenge they face is building a steady base of clients. Cold outreach, despite being essential, is hard to pull off. It requires a proper strategy, loads of planning and researching.

Here are 3 outreach methods that will take your freelance business to the next level, but first, let’s discuss the prerequisites:

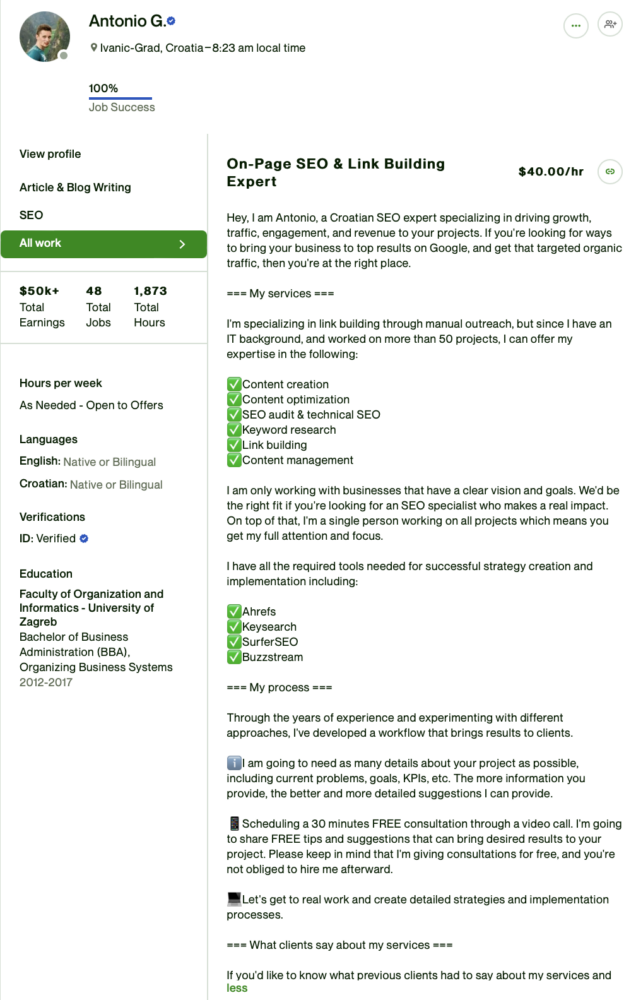

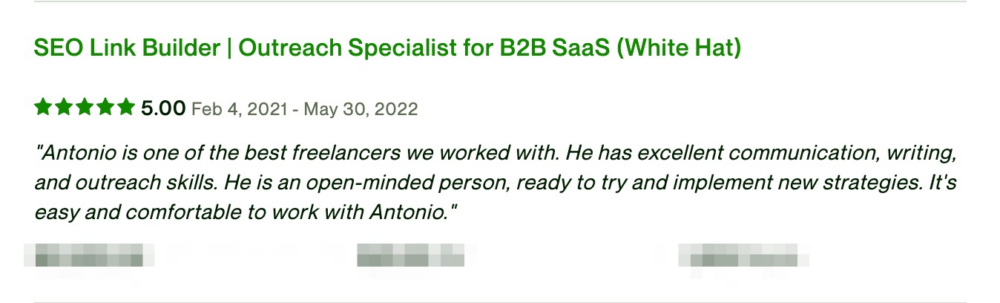

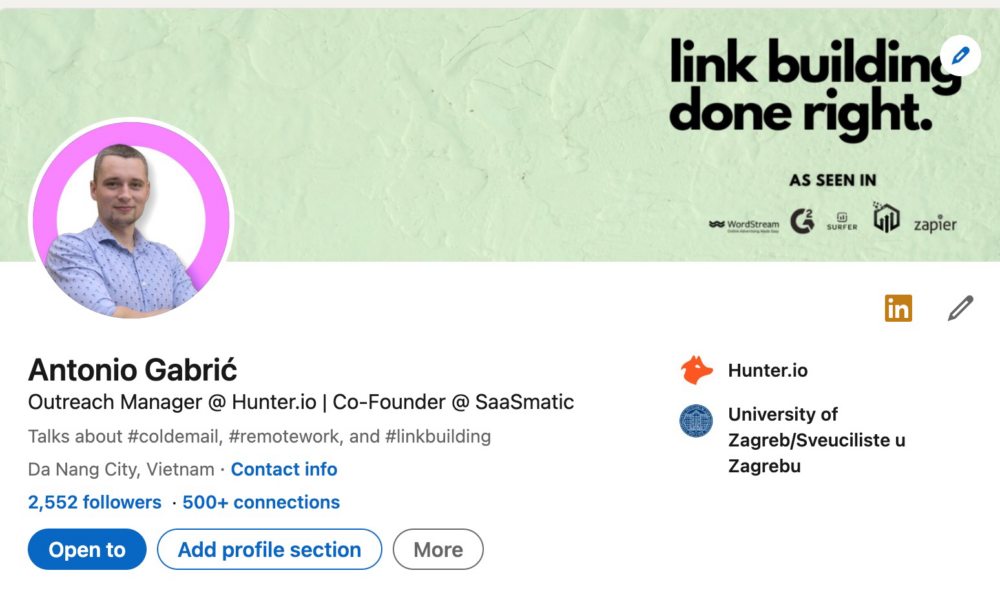

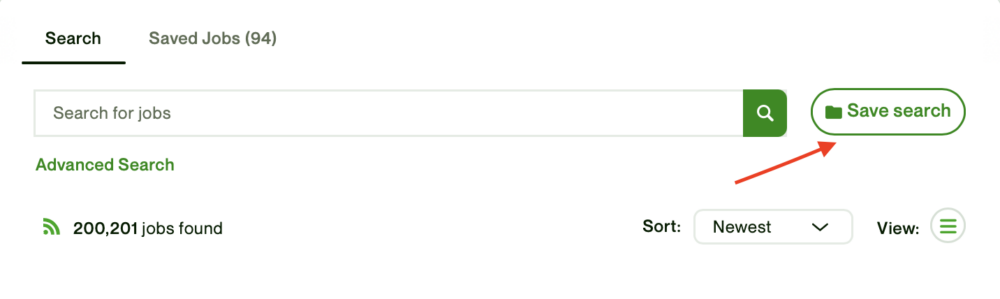

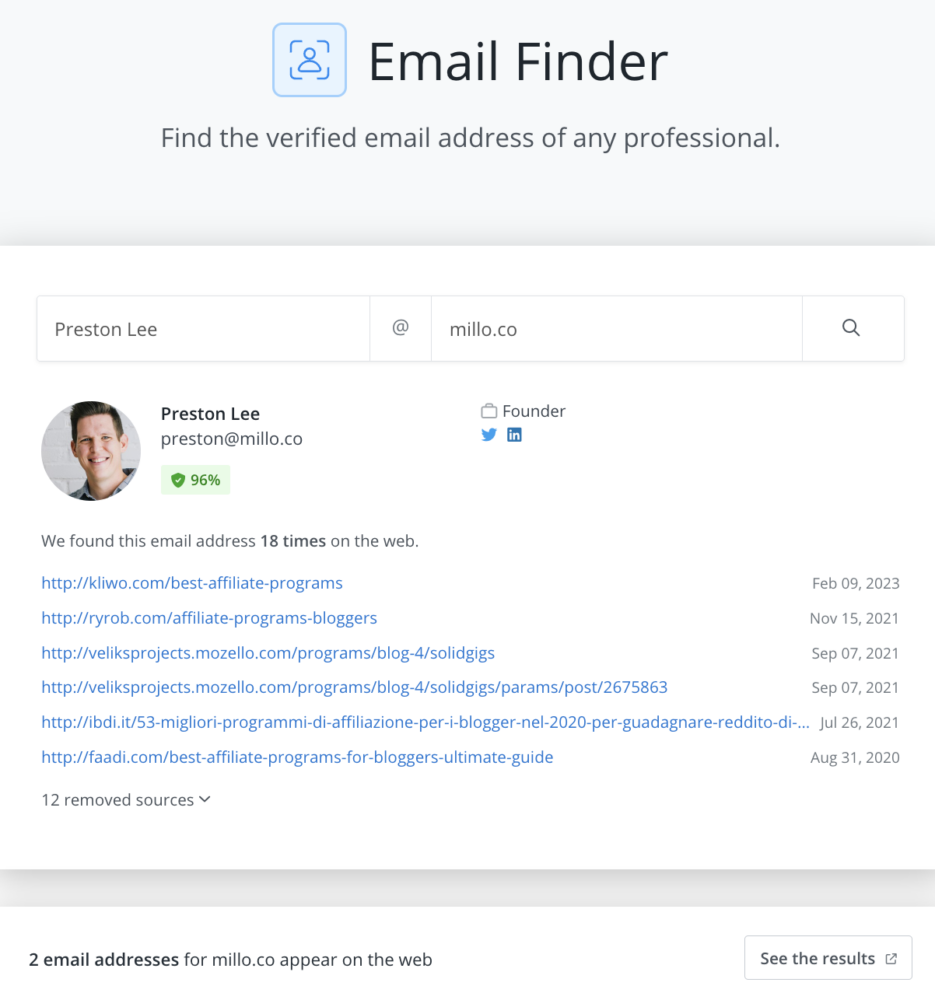

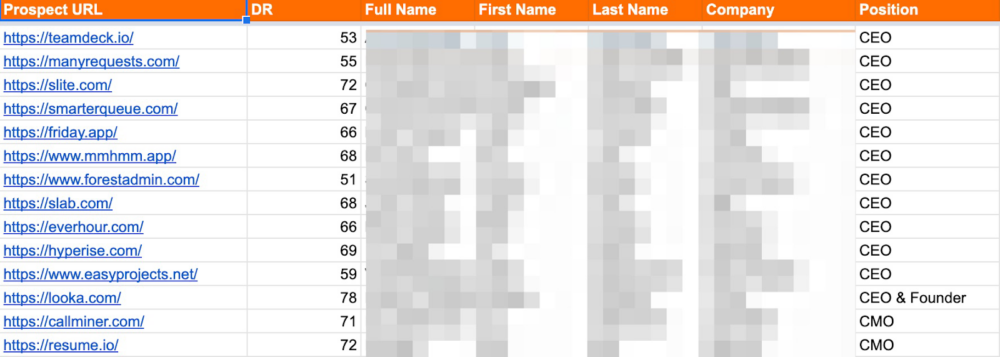

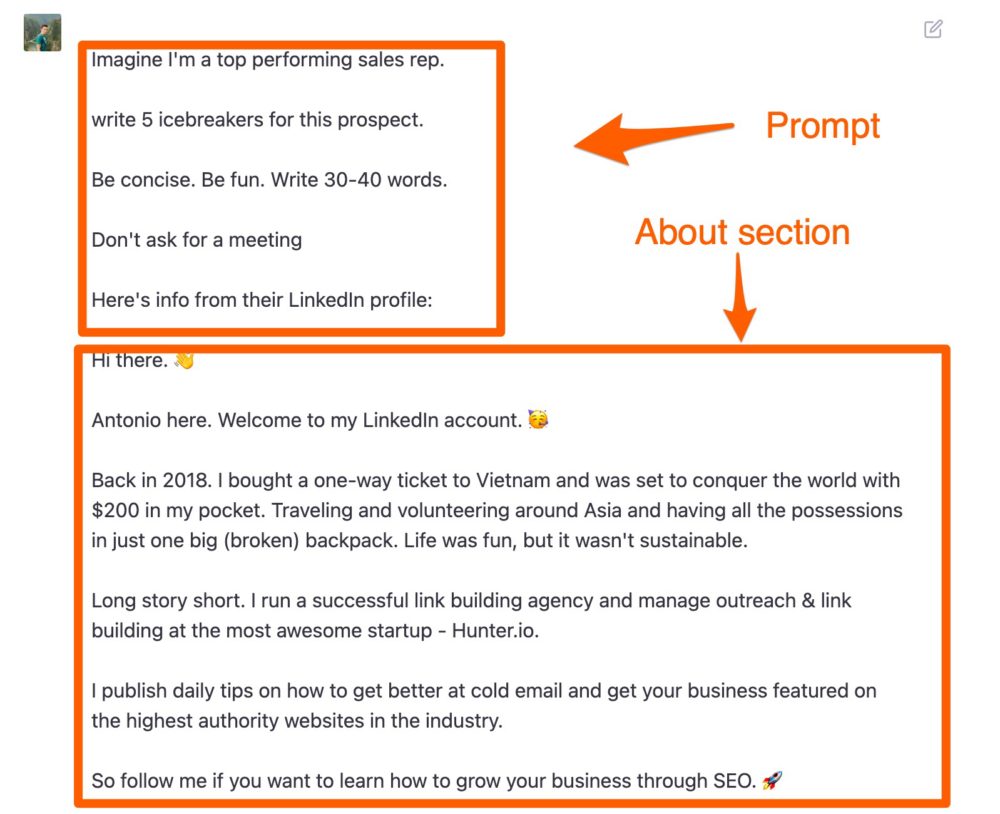

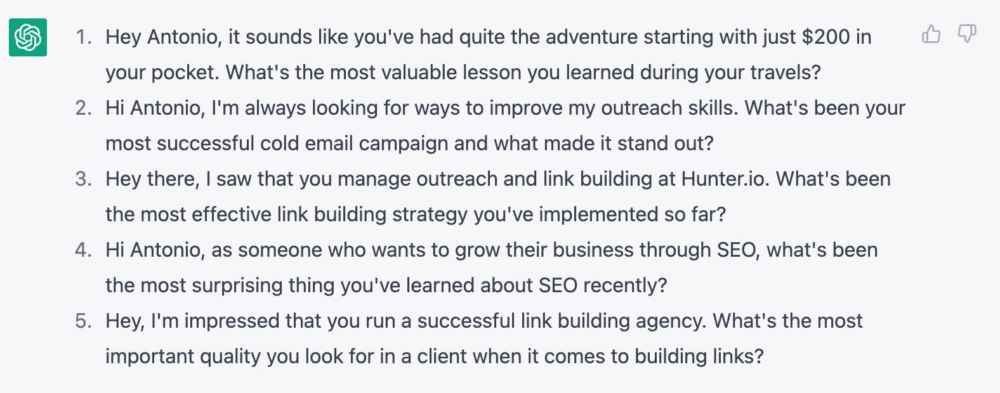

Every successful cold outreach campaign hinges on two things: trust and social proof. When you’re a stranger to a client, you need to show why you’re a good fit for the job and why they should trust you. Here are 2 ways you can achieve that: You should have a complete profile in one of the popular freelancing platforms in your industry. These platforms are a great way to showcase your client base, experience, and expertise. Since I’m active on Upwork, I’ll share a few tips to make your profile stand out. Upwork puts special emphasis on profile completeness for new freelancers as that leads to the Rising Talent badge and more job invitations. Here are a few elements in an Upwork profile you should pay attention to: Speaking of unique profiles, you can add a clip to your profile that might offer a video introduction or client testimonials. If you have certificates (AWS, Cisco, Oracle, etc.), don’t forget to add them as well! And what really makes a difference are testimonials from previous clients. This is the best trust and authority booster to add to your arsenal. There’s a good chance you already have a LinkedIn profile gathering dust. If you’re planning to use cold outreach as a freelancer, having an active and nicely formatted LinkedIn profile will go a long way—after all, it’s the stamp of authenticity! Before starting remember this one: LinkedIn is not a CV. Treat your profile as a landing page. If you have an old account or are planning to create a new one, here are a few things you need to cross off the list: Apart from the above sections, add education history and skills to come up higher in relevant searches. Collecting testimonials from past clients and co-workers can also help you establish authority. An active LinkedIn profile is useful for on-platform networking as well. Once you have the prerequisites covered, you’d need to move to the main task: cold outreach. Here are three tried and tested ways that got me leads that you can use to increase your recurring revenue: The first thing you need to do is find the businesses to reach out to. Most freelancers make mistakes here. They send a bunch of emails to random businesses and when they don’t get replies, they become frustrated and abandon the system. Successful cold emails are about precision and that comes from defining your ideal customer profile (ICP). Before running a cold outreach campaign, ask yourself these questions: This will give you a clearer understanding about businesses that might benefit from your services which allows you to tailor your cold outreach approach. Narrowing down and specializing to solve problems in a specific niche is a way to go. It is good to have a general knowledge, but that’s not what sells. Let’s say that you provide website design services. Everyone needs a website, so reaching out to everyone won’t bring much success. You need to establish yourself as an authority in a specific niche. Here is how to do it: As you can see, this information gives you a better offer and the offer is what sells. Here is the offer you could use: “Did you know that 78% of tour bookings are done online? I noticed that your main competitors X and Y have a nice web presence, while you don’t. I am providing website design services to small tour organizers who don’t have a web presence.” In my case, I offer SaaS link building services to SaaS companies and following my ICP has been my goal since beginnings. For instance, I know HubSpot doesn’t require my services because it’s already an established brand. But I can help a new CRM challenger improve domain authority and backlink profiles. So I check competitors that are ranking but not beating HubSpot in SERPs and companies that have recently raised funding to move up the ladder. This way I narrow down my prospects and with a few more tweaks and filters, I have a set of prospects ready. Be ruthless in qualifying your ICP and specialize in one niche to have the best chance at success. Once that’s out of the way, it’s time to build a lead list of potential clients. If you’re on Upwork, searching for ideal projects is pretty straightforward. Use specific keywords to search for jobs and then apply filters to narrow them down. You can use the experience level, job type, budget range, number of proposals, and client location to find jobs that suit you. Another thing you should do is save the search keyword by clicking on Save search. For instance, if you’re a UX designer for CRM tools, use “CRM UX” as a keyword to create a custom job feed. Another way you can find relevant clients is by checking websites related to your ICP. For example, if you’re a web developer, you can find leads in GitHub, Stack Exchange, and even Discord. Find relevant networks and build up your online presence. Among all these platforms, LinkedIn works the best for most freelancers. When you start following relevant content creators and industry experts, LinkedIn will start showing you more personalized content. If you’re a developer, you can find CTOs and project managers of companies you want to work with and send them LinkedIn InMails. But I’d recommend something else. Instead of hard selling, try building a connection with them. Engage with their posts, tag them in conversations, and share helpful content. Once you build a professional rapport, you’ll understand what they need help with and plug your services, organically. But LinkedIn outreach alone may not yield results because clients check their emails more than LinkedIn messages. Apart from talking to them on LinkedIn, you should also shoot an email to make a strong case. Most clients have their emails mentioned in their social media profiles or websites but you can also use an email finder tool like Hunter to find valid email addresses. You can also outsource this part, but remember you’ll have better control over lead quality if you’re hands-on. Once you have leads flowing in, you’d need to use a CRM or a Spreadsheet to track leads. Freelancers often ignore this step and end up with chaotic lists of duplicate emails. Another amazing source of potential clients is ProductHunt. Just head over to the “Topics” section and narrow down your preferred industry. Once you identify the industry, it is time to collect all the potential companies in the spreadsheet. Later on, you can enrich your spreadsheet and prepare it for the next step which is the actual outreach. At this stage, you already built a list of target companies along with contact information of decision makers. It is time to work on your cold outreach game. The job of cold emails is to fetch you a reply and your first task is to stand out. I may sound like a broken record at this point, but you must personalize each email by talking about the client’s pain points and directing them to the solutions. Don’t use off-the-shelf email templates to send hundreds of emails—it will not have a substantial impact. While researching your ideal clients you’ll come across relevant information that can be used in the subject line or email introduction to show you’ve done your homework. You’re essentially asking them to give you money so you need to impress them with your professionalism and ingenuity. Here is how you can automate creating super-personalized email introductions. Go to prospect’s LinkedIn profile and navigate “About” section. Copy that text and head over to ChatGPT. And here is the result: Use short subject lines (ideally 4-6 words), include the client’s name, and experiment with questions to get their attention. Once they open the email, focus on their challenges and requirements to keep their attention. When the client is interested, pitch your services by adding relevant links. An interesting subject line, short email body, thoroughly personalized content, and relevant results will get you more clients. This is what I implemented in my cold outreach campaigns and it got me solid results. Here is a good performing example: Subject Line: [first_name] – quick question Hi [first_name], [personalized_email_opener]. I wanted to quickly reach out because we help [company_name] grow their revenue by outranking competitors in organic results. We specialize in link building and recently helped [company_name] increase their organic traffic by 1797%, resulting in a boost in bookings value by 340% (case study). I would like to show you the gaps we can fill to help you increase you revenue through SEO. Mind if I send a quick Loom videos with some ideas? Thanks, Antonio. SOURCE: TheFreelanceFiles.com

Prerequisites to your outreach

A complete profile on a freelancing platform

Title and overview

LinkedIn profile

Implement these 3 outreach methods and 7x your recurring revenue

Define your ICPs and build your lead list

Upwork

Find businesses online

Personalize and automate your email sequence

Once you get used to sending cold emails, you can increase volume and ROI by automating most of the process. Set up a cold email sequence and use a campaign monitoring tool to gauge metrics.

If you are just starting out with freelancing and the budget you want to spend on tools is limited, you can use Hunter Campaigns. It allows you to send automated cold emails to up to 500 recipients for free.

Don’t be afraid to follow-up

Now, the secret ingredient of successful cold outreach campaigns: follow-ups.

Far too many freelancers send one cold email and give up on a prospect when they don’t reply. But here’s the thing.

There could be several reasons why your first email doesn’t fetch a reply. The client might be unsure of your pitch, planning to know more, or simply doesn’t have the time to reply immediately. You have to stay top of mind by following up regularly.

Here are a few ways you can follow up without being obnoxious:

- The first follow-up email should be within 3-4 days (at worst, one week)

- It shouldn’t just repeat the same message. Offer new value to the email chain by adding more information. It could be a free SEO audit, a content framework, or examples of new leads—whatever you offer, make sure you add new value with each new email

- Learn to stop. If you don’t get a reply after 4-5 follow-up emails and within a month, focus your efforts on new clients

- Once you launch a follow-up campaign, you’ll find patterns in client replies. Use the data to tweak your follow-up schedules and don’t forget to experiment.

Follow-ups don’t make you look like a spammer, provided you do it well. I was first brought into this idea and I see many freelancers making the same mistakes even today. Here is a follow-up campaign that fetch me about 50% of all responses:

Just noticed your [specific_page] is almost ranking in the top 10. Did you know that the top 3 Google results get 54.4% of all clicks?

With a couple of relevant and authoritative backlinks, we can help you reach the sweet spot and get more clicks.

Want to see how we do it?

Thanks,

Antonio

SOURCE: TheFreelanceFiles.com

Bonus tip: Upwork outreach

If an Upwork job fits into your budget, location, and expertise, you’ll need to send a proposal that stands out and catches the client’s attention.

Before proceeding remember this: Don’t talk about yourself and jump straight into communicating how you can help clients solve their pain points.

Things to keep in mind for Upwork proposals:

- Read the job description carefully and understand what’s required of you. Most freelancers pay little attention to the details so this is how you’ll stand out

- Demonstrate what you can do to help the client and how you’d go about it

- Show relevant samples and close with a CTA

- Break the proposal into small paragraphs but keep it short and to the point

- You’re competing with multiple freelancers for the job so use a hook early on and get right into the meat of the proposal

Final words

This was a guide to cold outreach for freelancers based on my personal experiences. If you’re just starting out, you cannot go wrong with these methods. But if you reach a level where lead generation needs to be streamlined, you might have to invest in email marketing and sales tools. Alternatively, you can outsource some portions of cold outreach to keep a solid margin for yourself.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!