As someone who’s spent years helping freelancers optimize their businesses, I recently had the opportunity to dive deep into Marcus, Mesha’s AI-powered invoicing solution.

Like many of you, I’ve experienced the headache of chasing down late payments and managing invoice follow-ups – it’s the least enjoyable part of running a freelance business.

When my team first told me about Marcus, I was skeptical.

Another invoicing tool? We’ve seen dozens. But after getting a thorough demo of the platform, I realized this might be different.

💔 Break up with bad clients: There are better clients waiting for you. And SolidGigs can help you find them. Get a team of gig-hunters and a custom dashboard. Starting at just $31/mo. Learn more »

Instead of just sending automated reminders, Marcus actually understands client communication and adapts its approach based on payment patterns.

Here’s the thing: freelancers don’t need more complex accounts receivable software to manage. We need tools that actually reduce our workload while maintaining professional client relationships.

That’s exactly what I set out to evaluate with Marcus. In this review, I’ll break down exactly what I discovered about this AI-powered system, and help you decide if it’s worth adding to your freelance toolkit.

Let me walk you through what I found after seeing Marcus in action…

Setup and Integration

If there’s one thing that makes me instantly wary of new software, it’s a complicated setup process. Fortunately, Marcus surprised me here. The onboarding is refreshingly straightforward – you literally just click “Continue with Google” and select which email you want to use for sending invoices. That’s it.

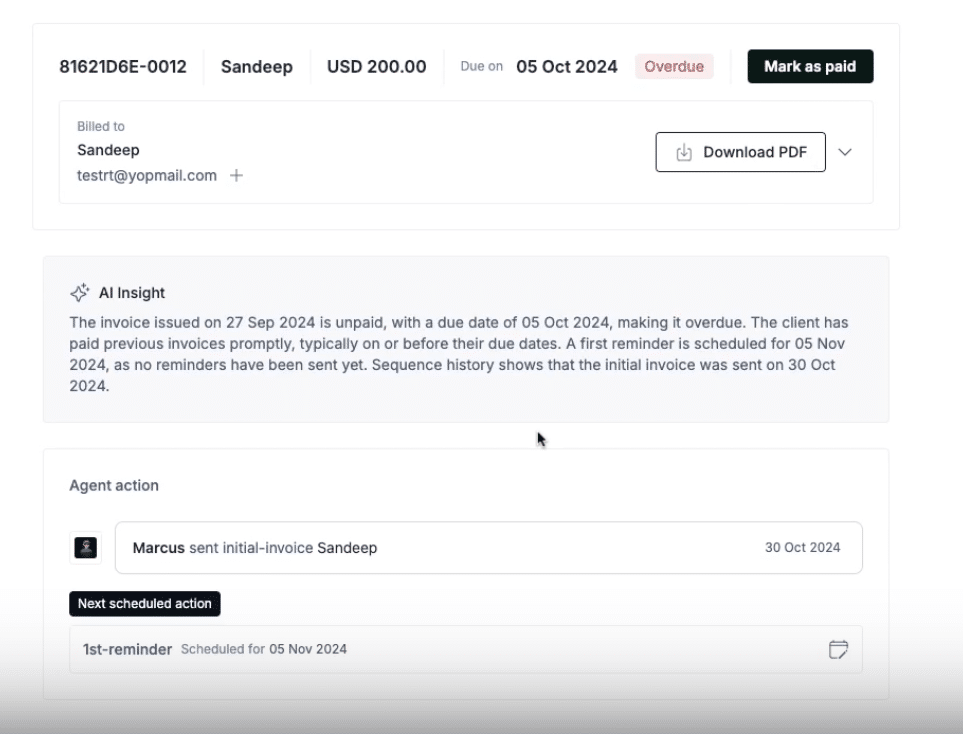

What impressed me more was what happens behind the scenes during setup. While you’re essentially just connecting your email, Marcus is quietly doing the heavy lifting: pulling in your invoice history, analyzing payment patterns, and building client profiles. It’s like having a virtual accountant who speed-reads through your entire billing history in minutes.

During my demo, I watched as Marcus processed this initial data and started generating insights almost immediately. It quickly identified which clients typically pay on time and which ones need more follow-up. For freelancers who’ve been in business for a while, this automatic analysis of payment histories is golden – it’s like getting a bird’s-eye view of your accounts receivable without spending hours in spreadsheets.

The Stripe and PayPal integrations are particularly seamless. If you’re already using Stripe or PayPal for payments (as many freelancers do), Marcus automatically includes payment links in your invoices and updates payment statuses without any extra work on your part.

One caveat: You’ll want to give Marcus about 10-15 minutes to fully process everything during initial setup. But trust me – use this time to grab a coffee. It’s doing hours of analysis work that you’d never have time to do manually.

Key Features

AI-Powered Payment Tracking – The Game Changer

Look, I’ve tested dozens of invoicing tools over the years, but Marcus’s approach to payment tracking is different. Instead of just sending blind reminders, it actually learns from your clients’ payment behaviors. During my demo, I saw how it identifies “high-risk clients” and creates custom strategies for each one. If you’ve got that one client who always needs three reminders versus another who pays like clockwork, Marcus picks up on these patterns.

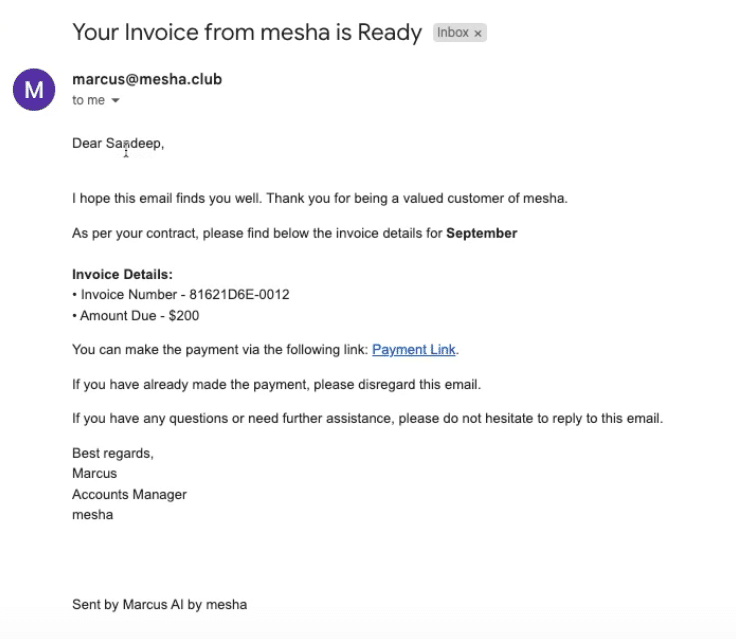

Smart Email Management That Actually Feels Human

Here’s what really caught my attention: the email sequences aren’t just your typical “Your payment is overdue” messages. Marcus crafts emails that progressively escalate in tone – starting friendly and becoming more firm over time. But here’s the clever part: there’s a 10-minute cooling-off period after you start a sequence. As someone who’s accidentally sent an invoice twice (we’ve all been there), I appreciate this safety net.

What genuinely impressed me was watching Marcus handle a test response. When I replied to a payment reminder with “I’ll pay tomorrow,” the system actually understood this promise and adjusted its follow-up schedule accordingly. It’s like having a smart assistant who knows when to back off and when to follow up.

Payment Processing That Makes Sense

The Stripe integration is rock-solid, embedding payment links directly in reminder emails. But Marcus doesn’t lock you into digital payments only. If a client pays you through another method, you can manually mark invoices as paid, and the system immediately halts any pending reminders. This flexibility is crucial for freelancers who juggle multiple payment methods.

Remember those insights I mentioned earlier? Marcus provides clear visualizations of your average days-to-pay metrics and flags at-risk accounts. For someone managing multiple clients, this kind of instant insight is invaluable for cash flow planning.

Additional Features – Beyond Basic Invoicing

I need to be straight with you here: while the core invoicing functionality is what initially drew me to Marcus, there are some extra features that make it more than just another billing tool. Let me break down the ones that actually matter for freelancers.

Email-Based Invoice Creation

This is slick: you can create new invoices just by sending an email. During the demo, I saw how you can simply email Marcus with your invoice details, and it handles the rest. For those of us who get random midnight ideas or need to quickly bill a client while on the go, this is genuinely useful. No need to log into yet another dashboard.

The Vault System

Marcus includes something called “Vault” for file storage. While I’m usually skeptical of all-in-one solutions trying to do too much, this integration makes sense. It keeps your invoices, payment records, and related documents in one searchable place. That said, I wouldn’t recommend ditching your current file storage system just yet – think of this more as a convenient bonus feature.

Email Automation Beyond Invoices

Here’s where things get interesting: Marcus isn’t just sending payment reminders. You can set up other types of automated email sequences too. While I didn’t get to deep-dive into this feature during the demo, it’s worth noting for freelancers who want to streamline their client communication beyond just payment collection.

The key thing to understand is that these additional features don’t feel bolted on – they’re integrated in a way that actually makes sense for a freelancer’s workflow. They’re there if you need them, but they don’t get in the way if you don’t.

User Interface and Management – Where the Rubber Meets the Road

As freelancers, we don’t have time to become software experts – we need tools that just work. During my walkthrough of Marcus, I paid special attention to the daily usability factor, because that’s what ultimately matters.

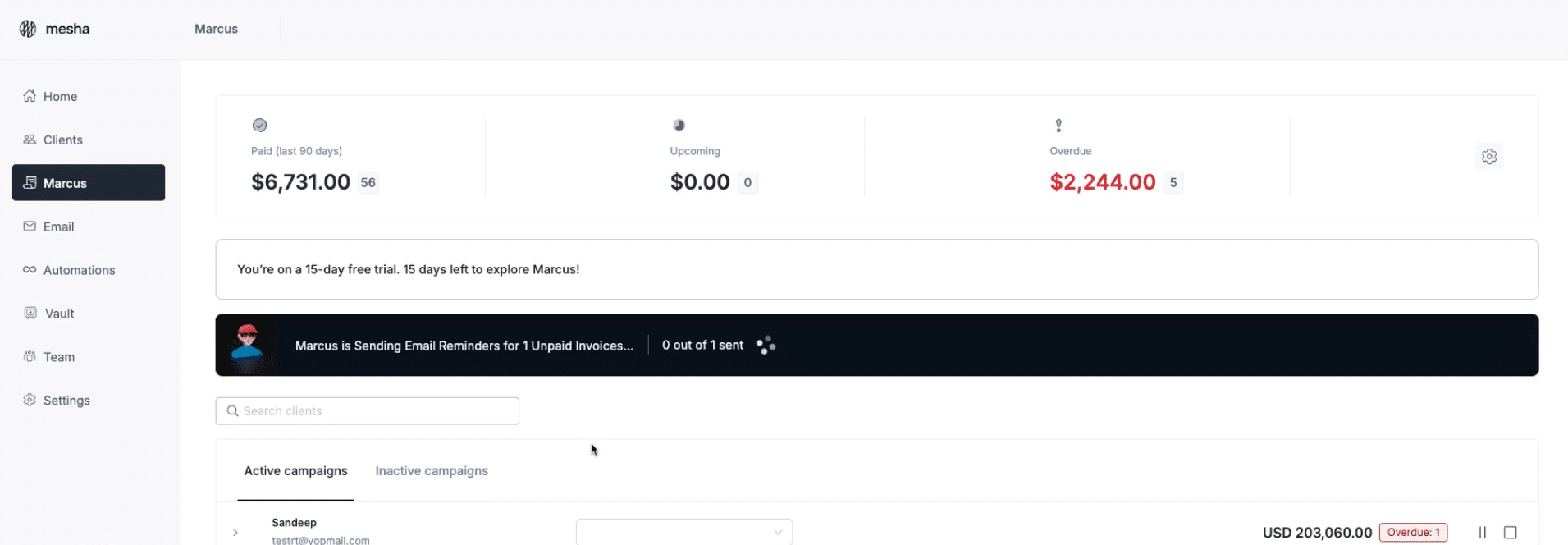

Campaign Monitoring That Makes Sense

The dashboard shows you exactly what you need to know: which payment reminders are active, which clients are being contacted, and what’s happening with each invoice. What I particularly liked was the clear separation between active and inactive campaigns. You can see all your overdue invoices at a glance, and starting a payment collection sequence is as simple as hitting a ‘play’ button.

Real-Time Invoice Tracking

Here’s something practical: when you click into any client’s profile, you get an instant snapshot of their billing history and current status. During the demo, I could see not only the outstanding invoices but also predictions about payment likelihood based on past behavior. For freelancers juggling multiple clients, this kind of instant insight is gold.

Customization Without Complexity

Let’s talk about the email sequence customization. While Marcus comes with pre-built reminder sequences, you can easily adjust the timing and tone of these messages. Need to push back a reminder by a few days? It’s literally a click and drag operation. Want to modify the message tone? The interface makes it straightforward without requiring you to be a copywriting expert.

The Payment History Insights

What really stood out was how Marcus presents payment history insights. Instead of drowning you in data, it shows you actionable information: average days to pay, risk levels, and top debtors. It’s the kind of information that helps you make better decisions about payment terms and client relationships.

One thing I particularly appreciated was how all these features are accessible without feeling overwhelming. The interface strikes that rare balance between power and simplicity – something that’s crucial when you’re managing your own business.

Pros – Where Marcus Really Shines

After spending time with Marcus, I’ve got to be candid about what makes this tool stand out. As someone who’s seen countless “revolutionary” freelance tools come and go, I’m usually pretty skeptical. But there are some genuine advantages here that deserve attention.

Dead-Simple Setup

Look, I can’t stress enough how refreshing it is to find software that doesn’t require a PhD to set up. The Google authentication and instant data analysis meant I was up and running in minutes, not hours. For busy freelancers, this matters – a lot. No complicated CSV imports, no manual data entry, just connect and go.

AI That Actually Feels Intelligent

I’ve seen plenty of tools slap “AI” on their features list, but Marcus’s implementation is legitimately useful. The way it learns from client payment patterns and adjusts its approach accordingly is impressive. During the demo, I watched it properly interpret a “I’ll pay tomorrow” response and adjust its follow-up schedule – that’s the kind of intelligence that actually saves you time and awkward client interactions.

Time-Saving Automation That Makes Sense

The automated sequences aren’t just blind reminder blasts. They’re thoughtfully escalating communications that maintain professionalism while getting progressively more assertive. That 10-minute cool-off period after starting a sequence? That’s the kind of feature that shows they understand real-world business relationships.

Flexibility When You Need It

Despite being highly automated, Marcus doesn’t lock you into rigid processes. You can easily override automation, adjust reminder timing, or mark payments received through other channels. This flexibility is crucial for freelancers who often deal with varying client payment preferences and situations.

Integration That Works

The Stripe integration is solid, and the email-based invoice creation feature is surprisingly useful. These aren’t just fancy add-ons; they’re practical features that fit naturally into a freelancer’s workflow. The fact that payment links are automatically included in reminders and status updates happen without manual intervention – that’s the kind of automation we actually need.

Marcus also integrates seamlessly with tools like Xero and Quickbooks to make sure everything is synced at all times.

Pricing – Simple and Straightforward

Let’s talk about cost – because for freelancers, every monthly expense needs to justify itself. Marcus keeps things refreshingly simple with their pricing structure. The Starter plan (best for freelancers) comes in at $29 per month, which positions it competitively in the market for professional invoicing solutions.

What’s particularly appealing about this pricing tier is that it includes all the core AI-powered features we’ve discussed: the intelligent payment tracking, automated reminder sequences, and Stripe integration. There’s no bait-and-switch here where the AI capabilities are locked behind a higher tier – what you see is what you get.

For freelancers handling multiple clients and regular invoicing, the time saved on payment follow-ups and client communication can easily justify the monthly investment. When you consider the potential improvement in cash flow from better payment tracking and faster collections, the ROI becomes even clearer.

Conclusion – Is Marcus Right for Your Freelance Business?

After spending hands-on time with Marcus, here’s my honest take: this isn’t just another invoicing tool – it’s a genuine step forward in how freelancers can handle their accounts receivable. But let’s get real about who this is really for.

Who Should Use Marcus?

You’ll get the most value from Marcus if:

- You’re juggling multiple clients with different payment behaviors

- You’re tired of playing email tag with late-paying clients

- You want to maintain professional relationships while being firm about payments

- You already use Stripe for payment processing

- You need to reclaim the time you’re spending on payment follow-ups

Who Might Want to Skip It?

Marcus might be overkill if:

- You only handle a couple of clients with reliable payment histories

- You prefer complete manual control over every client interaction

- You’re just starting out and don’t have enough payment history to leverage the AI insights

The Bottom Line

Here’s what it comes down to: Marcus isn’t trying to revolutionize invoicing – it’s trying to eliminate the headaches that come with it. The AI-powered response handling, intelligent payment tracking, and automated-yet-customizable reminder sequences all point to a tool that understands what freelancers actually need.

What impressed me most wasn’t any single feature, but rather how everything works together to solve a real problem: getting paid on time without damaging client relationships. The initial setup experience shows they understand that freelancers don’t have time for complex software deployment, while the intelligent features prove they know what matters in day-to-day operations.

For freelancers who’ve been looking for a way to professionalize their payment collection process without hiring a dedicated accounts person, Marcus could be the sweet spot between manual management and full-service accounts receivable.

Is it perfect? No software is. But it’s a solid step forward in freelance business management, and for many freelancers, it could be the tool that finally lets them stop worrying about payment follow-ups and focus on what they do best – their actual work.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!