With most freelancers, quarterly taxes are deeply misunderstood. While knowing answers to questions like “When are Quarterly Taxes Due?” may seem like a huge pain, the truth is quarterly taxes help you out at tax time.

Not only does knowing when quarterly taxes are due keep you from getting creamed by a large tax bill, but quarterly tax payments also even out your cash flow, which means you won’t drain your bank account all at once.

Here’s what you need to know about when quarterly taxes are due so you can go from dreading them to using them to stabilize and grow your freelance business.

What are quarterly taxes?

Quarterly taxes, also called estimated taxes, are quarterly payments you make towards your annual tax bill. Since you don’t know how much your tax bill will be until you file your taxes, your quarterly taxes are due throughout the year and are estimates of what you’ll owe.

Your quarterly tax bill includes taxes for Social Security, Medicare, and income tax. Knowing when quarterly taxes are due and paying them ensures your money gets divvied up between these buckets and subtracted from your annual tax bill.

When are quarterly taxes due?

For most freelancers, this is the critical question: when are quarterly taxes due?

Quarterly taxes are due four times a year. The dates when quarterly taxes are due are:

- January 15

- April 15

- June 15

- September 15

If any of these days fall on a weekend or a holiday, then quarterly taxes aren’t due until the following business day.

Answers to the top 8 questions about your quarterly taxes

1. How much money do you have to make to file quarterly taxes?

If you think your annual tax bill will be more than $1,000, then you’re on the hook for quarterly taxes. This is the case for all entities except C corps. If you’re a C corp, then you’ll have to file quarterly taxes if you think you’ll owe more than $500.

How do you know if you’ll owe more than $1,000 in taxes? Your taxable profits, filing status, and personal tax credits all impact your tax liability.

Each of these is unique to the individual, so it’s impossible to give a hard and fast rule about how much money you have to make.

If you’re unsure if you’ll owe more than $1,000 at tax time, here are some questions to ask yourself:

- Is your business profitable? If not, and your business is taking a loss, then you won’t have any profits to tax and don’t need to pay quarterly taxes.

- How much did you owe last year? If it was more than $1,000 and your income and expenses are consistent, you’ll likely need to file quarterly taxes.

- Do you have new tax credits or a new filing status that will impact your return? If you’ve had significant life changes that affect your filing status or tax credits, it’s a good idea to talk to a tax preparer about your potential tax liability.

2. Who has to pay quarterly taxes?

If you’re self-employed and your business is relatively profitable, then you’ll need to pay quarterly taxes.

For businesses with one owner, like a sole proprietor or single-member LLC, the owner will file quarterly taxes.

For businesses with multiple owners, like a partnership, multi-member LLC, and an S corp, each owner will file quarterly taxes if they think they’ll owe more than $1,000 on their share of the profit.

For a C corp, both the business and the shareholders will file quarterly taxes. The company will file quarterly taxes based on its taxable profits, and the owners will file quarterly taxes based on their dividend payments.

Here’s a summary of who needs to file quarterly taxes:

| Type of business | Individual files quarterly taxes | Business files quarterly taxes |

| Sole proprietor | X | |

| Single member LLC | X | |

| Partnership/ Multi-member LLC |

X  AdvertisementAdvertise Here (each member or partner files quarterly taxes) |

|

| S corp |

X (each shareholder files quarterly taxes) |

|

| C corp |

X (each shareholder files quarterly taxes) |

X |

3. How do I calculate my quarterly taxes?

There are two ways to calculate your quarterly tax payments: the Mathlete way and the Slacker way. Here’s what each method looks like:

Mathlete:

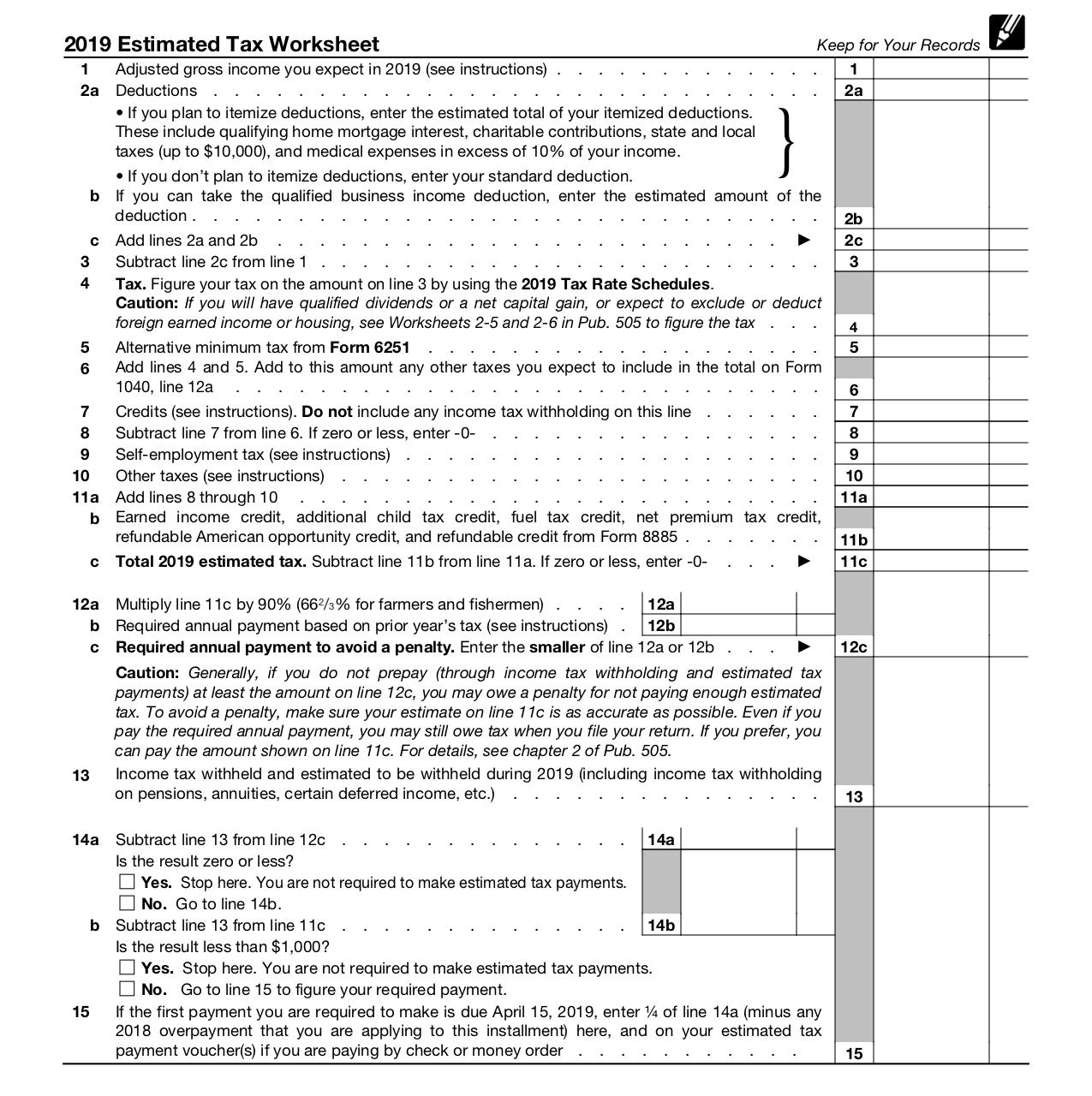

The Mathlete method is definitely the most precise way of figuring out your estimated taxes. You take all factors that affect your tax liability into account using the worksheet in IRS Form 1040-ES and doing a series of calculations.

The drawback? You have to rely on the IRS written instructions which is like slogging through the Eternal Bog of Stench. Turn back, Sarah. Turn back.

If you’re adamant about getting into the nitty-gritty of calculating your estimated tax payments, this is the method for you. But, if you’d rather watch The Ring on repeat than deal with 15 lines of math, move on.

Slacker:

The Slacker method is less accurate, but way easier. With this method, you divide what you owed last year by four. Those are your quarterly tax payments.

Here’s an example: If you owed $20,000 in taxes last year, this year you would pay $5,000 each quarter.

$20,000 / 4 = $5,000

The great thing about this method is, besides ditching the math, it protects you from incurring a penalty. If you pay at least 100% of the tax you paid in the previous year, even if you end up underpaying, you’ll avoid an underpayment penalty.

The drawback of this method is that it’s only accurate if you have consistent income year to year. If your business goes through a growth spurt, you might avoid a penalty, but you’re still going to owe a lot of extra money come tax time.

4. How do I figure my estimated payment if my income fluctuates?

So what happens if your income changes drastically from year to year? Or you’re a new business and have no idea how much money you’ll make? There are two ways to figure out your estimated payments.

Annualize your income

Annualize is just a fancy of saying that you’ve projected your future income based on what you’ve already earned.

Here’s how it works:

- Calculate your taxable profits year to date.

- Example: It’s May and your year to date net income is $45,000

- Example: It’s May and your year to date net income is $45,000

- Divide your total year to date taxable profit by the number of months in your year to date income. This is your average monthly profit.

- Example: $45,000/ 5 = $9,000

- Multiply your average monthly profit by 12. This is your estimated annual taxable profits.

- Example: $9,000 x 12 = $108,000

After you have your estimated taxable profits, you’ll get down with your bad Mathlete self and use the worksheet in IRS 1040-ES to calculate your quarterly tax payments.

Pay based on your real-time income

The second method is to pay your quarterly taxes based on what you’ve earned in real time. The way it works is that, for every period that you’re paying your taxes, you make a payment that is 25-30% of your taxable profits.

For example, if you’re paying quarterly taxes on April 15, you’ll calculate your taxable profits from January 1 – March 30. Then, you multiply that amount by 25-30%. That’s your quarterly tax payment.

Here’s an example: You have $30,000 in taxable profit in the first quarter of the year. You multiply that by 25%. Your quarterly tax payment is $7,500.

$30,000 x 0.25 = $7,500

The benefit of this method is that you coordinate your tax payments with your cash flow. When you make more money and have more cash on hand, your payments are higher. When you make less, your payments are lower.

5. How do I make sure I have enough money for my quarterly taxes?

The biggest reason people blow off their quarterly tax payments is that they don’t have the cash to pay them. The best way to prepare for your quarterly taxes is to save for them monthly.

If you have a fixed amount you pay every quarter, divide that amount by three. That becomes your monthly tax savings.

If you’re using the real-time method, every month multiply your taxable profit by 25-30%. That becomes your monthly tax savings.

The last, and most important, step is to transfer your monthly tax savings into a dedicated tax savings account. This ensures that you don’t dip into your quarterly tax payment money and you have the money to stay on top of your payments.

6. How do I pay my quarterly taxes?

To pay your quarterly taxes, you can go old school or go digital.

First you need to note when are quarterly taxes due — don’t be late!

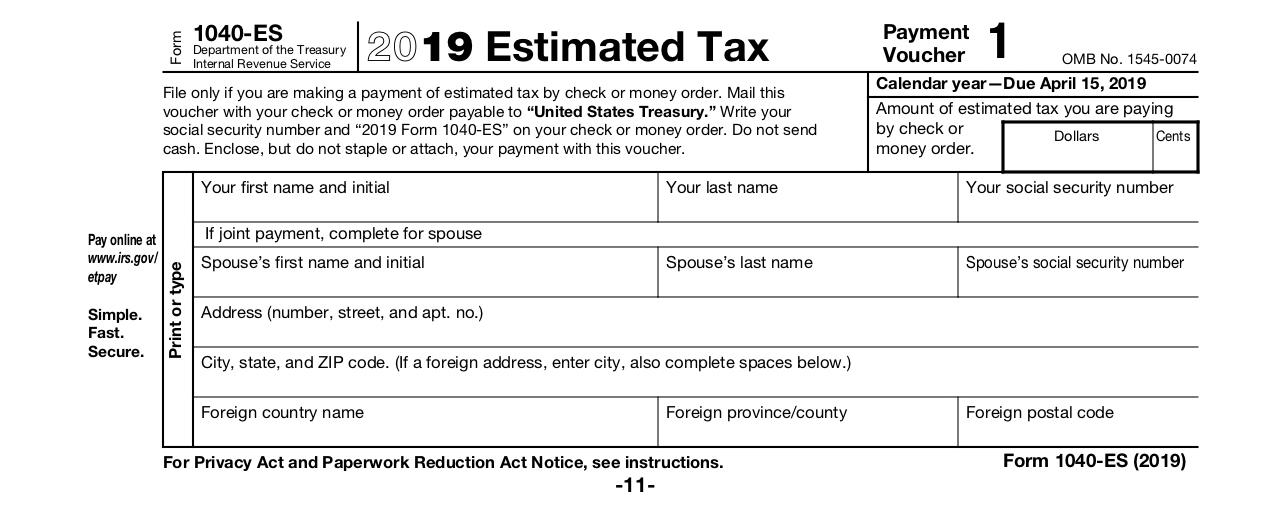

To go old school, write a check and then use the payment vouchers in Form 1040-ES. Don’t skip filling out the payment voucher! It provides the information the IRS needs to apply your payment to your annual tax bill.

You can also pay your quarterly taxes online through two sites, the IRS’s Direct Pay site and the Electronic Federal Tax Payment System (EFTPS).

The IRS Direct Pay site only accepts payments from a bank account. The EFTPS accepts payments from a credit card, but you’ll pay a 2% processing fee.

7. Will I get a penalty if I don’t pay my quarterly taxes?

Yes, the IRS turns into a mean girl if you don’t pay your quarterly taxes. So mean that you’ll pay a penalty on the money that you owe. Refer to when are quarterly taxes due above, and make a reminder for yourself.

The 2019 penalty is 6% of the total amount owed for the number of days your taxes remain unpaid. Sound confusing? It is, and so are the calculations.

You can learn more about how the penalty works, and how to calculate it, in IRS Publication 505- Tax Witholding and Estimated Tax.

8. What if I don’t pay enough towards my quarterly taxes?

Just like you’ll get hit with a penalty if you don’t pay your quarterly taxes, you’ll also pay a penalty if you don’t pay enough towards your quarterly taxes.

The underpayment penalty rate is still 6%, but this time the penalty paid is on how much you underpaid.

The IRS isn’t always such a Heather, though. You won’t be penalized if you pay at least 90% of your total tax liability through quarterly payments.

Also, if you pay 100% of your previous year’s tax liability through quarterly tax payments, you’ll avoid the underpayment penalty.

The only caveat is if you earn more than $75,000 as a single filer or $150,000 as a married filer. Then you’ll need to pay 110% of the previous year’s tax liability to avoid a penalty.

Just like Steve Urkel was the breakout star of Family Matters, your quarterly tax payments could be the breakout star of your finances.

Next year at tax time you could be celebrating a stress-free tax season with a pre-paid tax bill, leaving you enough cash in the bank for that accordion you’ve always wanted.

Navigate your quarterly business taxes with ease!

Whoa, that’s a ton of information. Feeling like your mind is blown? We don’t blame you! It’s hard to navigate quarterly taxes; never mind as a freelance business owner!

Everything rushes through your mind….when are quarterly taxes due? How much do I owe? How do I calculate my quarterly taxes? It’s a lot.

If you’re pushing hard and managing your clients and business, getting help to have your business run on autopilot can be incredibly helpful.

Using accounting tools like QuickBooks, Bench, Bonsai, and Hyke can help you manage your ‘books’ and rather than using the back of the napkin calculations, you can ensure you’re paying the exact right amount of quarterly taxes.

These tools act as your dedicated accountant and bookkeeper to ensure you get the support you need.

Avoid the 6% penalty

Everyone wants to save money come tax time, but they aren’t all well-versed in strategies that will allow them to do so, especially when they’re focused on running their companies and earning an income.

Thankfully, by being an informed freelancer, and accessing using modern business and financial technologies, you can be a savvy freelancer, not only when it comes to the actual work that you do, but also when it comes to saving more money and using it to grow your business.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!