Have you heard of the Freelance Isn’t Free Act? Despite the freedom and flexibility of freelancing, the practice exposes freelancers and other independent contractors to exploitation.

Wage theft, for instance, is a term used to describe payment issues in traditional employment. It is illegal, and the US government has put in place several employee safeguards and laws to protect regular employees.

Freelancers also confront these specific challenges but aren’t typically protected by laws. Many freelancers, particularly newcomers, operate on the assumption that they will get compensated at some point. They work on a per-day basis. I am doing this for you, and you will pay me this amount.

Sometimes, though, they don’t get paid at all. Although many freelancers are adamant about having a contract in place before they start working, the payment issues have never gone away. If you are a freelancer, you understand how difficult it is to get paid on time. You should be aware that there is no guarantee of payment in the absence of a contract.

The phrase “Freelance Isn’t Free Act” may sound like a social movement, but it isn’t. Let’s go through this statement one by one to learn everything about it.

What is the “Freelance Isn’t Free Act”?

The Freelance Isn’t Free Act (FIFA) was passed by the New York City Council in 2016 and it took effect on May 15, 2017.

In a nutshell, the law aims to protect freelance employees’ labor rights. It establishes a legal definition for freelance labor in New York City and is aimed at freelancers who have payment issues with their clients.

With the passage of the law, New York City became the first city in the United States to protect freelancers from the financial exploitation of some companies.

The law’s passage also came at an opportune time since New York City has reported that one-third of its workforce was composed of freelancers. Of that figure, a whopping 74% of those freelancers have experienced nonpayment or late payment.

This law puts several legal restrictions on people and businesses who hire freelancers. It also specifies the compensation and damages for the freelancer for violations of independent contractor rights. That means, with the law, it’s easier for freelancers to request payment from clients.

How the “Freelance Isn’t Free Act” protects freelancers

If your clients delay or entirely withhold payment, you’re entitled to the payment and much more under the law. This law imposes sanctions on the erring client and specifies your entitlement to statutory damages and double damages, among others, should your client be proven to have erred. The Freelance Isn’t Free Act protects the following independent worker rights:

The right to a written contract

When the work is worth $800, the law requires companies to craft a written contract for hired freelancers. Companies are still obligated to pay freelancers after completing tasks even if they don’t have a contract. Clients are ultimately liable for failing to enter into a contract, and refusing to work under one might result in fines.

The right to complete and timely payment

You must be paid for all completed services by the hiring party. You must receive payment on or before the date that is in the contract. Clients cannot compel freelancers to take less than they are owed in return for timely payment. This is a welcome break from sending multiple follow up emails for payment.

For example, a videographer agrees to create a video for $20,000 under the terms of a contract. The customer expresses dissatisfaction with the finished movie and pays just $15,000 to the videographer.

If the client was proven to have erred under the law, the videographer might get $5,000 on the initial contract plus another $20,000 double damage under the Freelance Isn’t Free Act, for a total of $25,000 received from the same client.

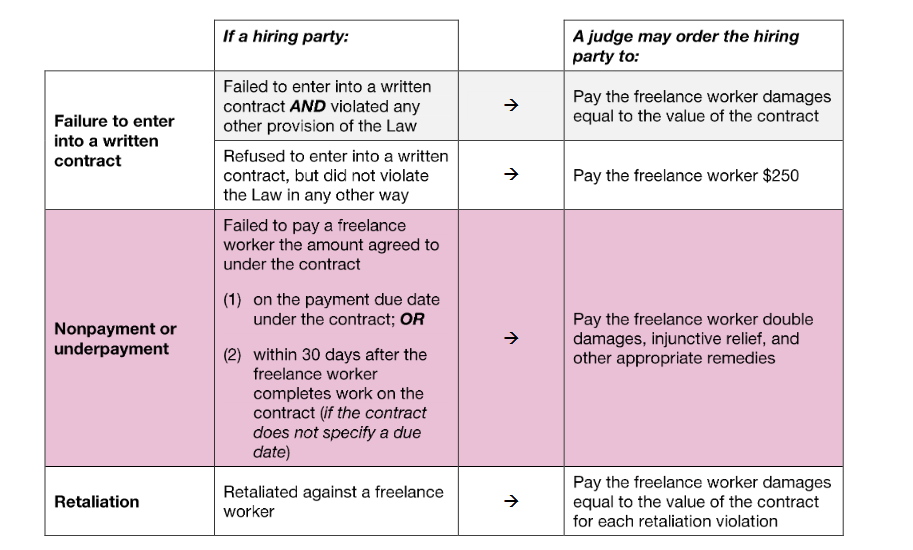

Here’s a table that shows how much a judge may award a freelance worker in damages if the freelancer successfully argues their case:

Protection from retaliation

The hiring party cannot penalize, threaten or otherwise mistreat freelancers for exercising their legal rights under the Freelance Isn’t Free Act.

The law levies penalty fees on companies that violate provisions of these. You can seek protection under the Freelance Isn’t Free Act by filing a retaliation complaint with the Office of Labor Policy and Standards (OLPS).

Let’s assume a translator signs a contract for a book project for $50,000. The hiring party ignores them and refuses to pay after the freelancer has completed the work. When the translator files a claim under the Freelance Isn’t Free Act, the hiring party threatens to sue and leave negative feedback or destroy their reputation.

For nonpayment, the contractor can collect $50,000, an additional $50,000 for double damages, and $50,000 for retaliation. As a result, the company will have to pay the freelancer $150,000 if proven guilty.

Access to legal services if freelancers pursue a case

You have the right to legal support from New York State in your collection attempts. The agency will conduct an investigation, try to collect on behalf of the freelancer, and, if necessary, provide court navigation assistance.

Double damages

Freelancers might earn double the value of the entire contract for late payment, underpayment, or non-payment of the hiring party. Also, businesses in New York City that fail to pay on time may risk a lawsuit and civil fines of not more than $25,000.

For instance, a building contractor agreed to a $125,000 project, but the hiring party did not pay. If the hiring party fails to pay within 30 days of the project’s completion, the contractor has the right to sue for the contract’s $125,000. If they prove their case, they can be entitled to as much as $25,000 in damages. That’s a total of, at most, $150,000 that may be collected from the hiring party.

In addition, freelancers who have not received payment might engage a lawyer to preserve their rights. The Freelance Isn’t Free Act covers attorney fees for freelancers who successfully prove their case in court.

So, if you’re a freelancer who hasn’t been paid or has any payment issues, file a complaint. For as long as you prove your case, you don’t have to worry about those exorbitant fees you might incur.

Who the Freelance Isn’t Free Act can affect

The problem should start with a payment issue. Then, a written contract is what you will need. It’s the most crucial part. According to the law, freelancers in New York City must acquire a written contract that has a value of $800 or more, outlining the service they will provide and the fee they will charge.

Unfortunately, only 33% of freelancers always have a written contract, and the data reveals that New York freelancers are less likely to get a written contract than freelancers from other states. So, this law requires the hiring party to supply you with one.

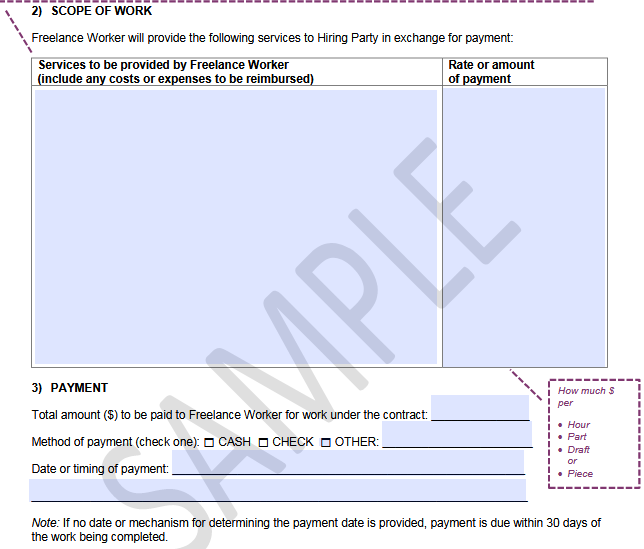

Also, the law requires that the following information be included in the contract:

- Both the hiring party’s and the freelancer’s name and mailing address.

- A detailed description of the services to be delivered and the value of the services provided. The rate and method of payment should also be included.

- The deadline by which the hiring party must pay the agreed-upon compensation or the method by which this deadline will be decided.

A copy of the written contract must be kept by both you and the hiring party. A written contract prevents parties from going to court and denying the existence of an agreement’s provisions.

Word of mouth or a verbal contract doesn’t count. They make it difficult to show the agreement’s terms, or even that one existed at all.

You may start with a fundamental agreement. The New York City website includes a contract template you can use to avoid any legal issues should payment problems arise. Also, the contract uses text that cannot be subject to other interpretations. This template can assist you in more accurately describing your freelance work.

Once you have the contract in place, you should check if you satisfy the following conditions. The Freelance Isn’t Free Act lays out specific standards for independent contractors. The law will cover you if:

Your work, whether stipulated in a contract or, in aggregate, 120 days before the law took effect, is worth $800, and you have not been paid within 30 days: If you have worked for someone and your bill is more than $800, the hiring party must pay it within 30 days. Keep in mind, if you do not have a contract or a contract with a deadline, the default is 30 days.

However, if you’ve signed a contract with a client for more than 30 days, what you stipulated in your contract will take precedence over the 30 days stipulated in the law. You should honor that contract and give your client the more than 30 days you said you’d give them.

You performed your work in the state of New York: The law may also cover other work if you completed a portion of that work in New York City if you were retained or hired in New York, or the operations of the hiring party are in New York.

So, if you sign a contract and start a job, or a portion of it, in New York City, then go out and work two days in Philadelphia, the law may cover you if you weren’t paid for your services and you meet the law’s specific requirements.

It’s after May 15, 2017: As previously stated, the law took effect in May of 2017. The law only applies to contracts entered into on or after this date. It doesn’t apply retroactively.

However, the law allows for a 120-day lookback period, which means the value of the services stipulated in all contracts entered into within that period can be included to reach the $800 threshold specified work value in the law.

You’re a single freelancer or a sole owner LLC that completed the work: The law covers you if you are an independent freelancer or have a legal business structure in New York City and accomplished the work within New York city limits. If you own or work for a big company, this law may not apply to you.

In other words, the law is designed for solitary freelancers who don’t have a lawyer on retainer or are not likely to have access to legal services.

This law, however, does not cover:

- Freelancers hired as employees.

- Freelancers who agreed to supply services to a client for free.

- Licensed medical professionals.

- Sales representatives.

- Attorneys who offer legal services under the contract at issue.

If you are one of the above, it is best to ensure you have a deeper grasp of your legal options should payment issues arise before you start freelancing. You can find more information at nyc.gov, or you may visit the OLPS for more information.

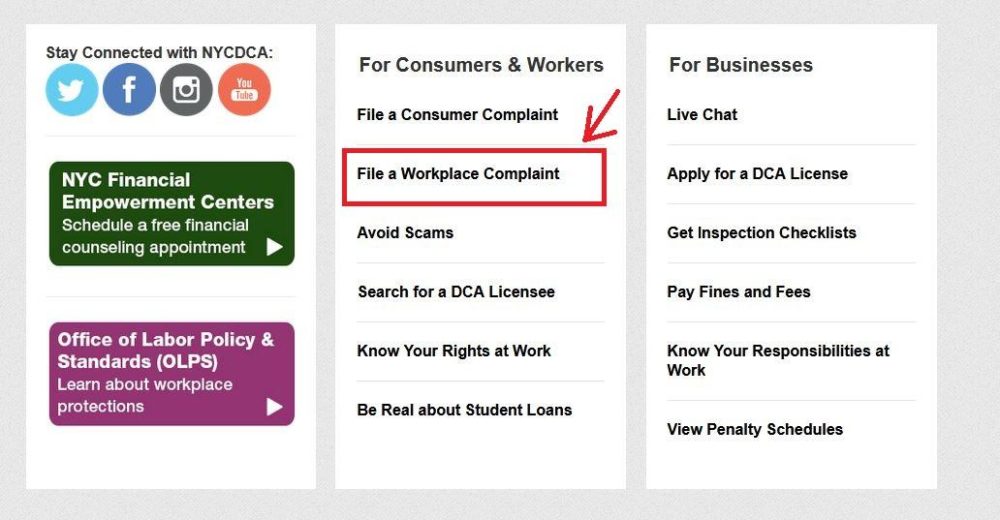

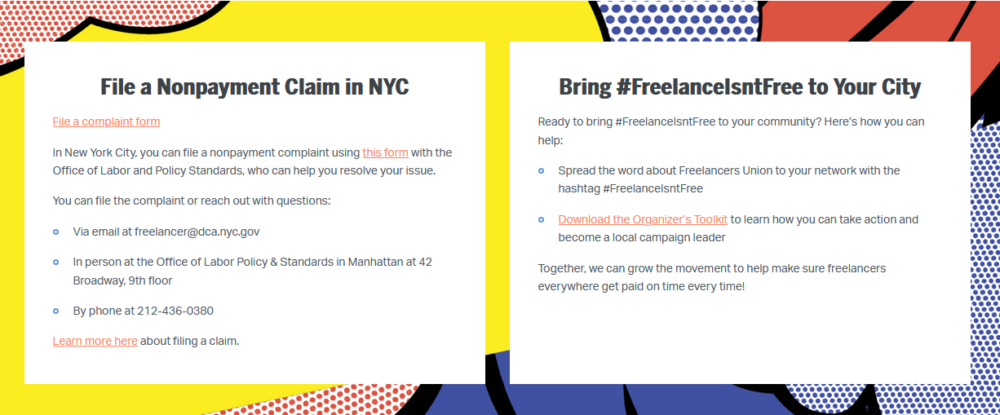

If the law covers you, though, when a client doesn’t pay, you can file a complaint. You can submit the complaint with the OLPS through email, mail, phone, or in person. You can access www.nyc.gov/dca to find the complaint template.

Simply click on the file workplace complaint as indicated in the image to get the template filled out.

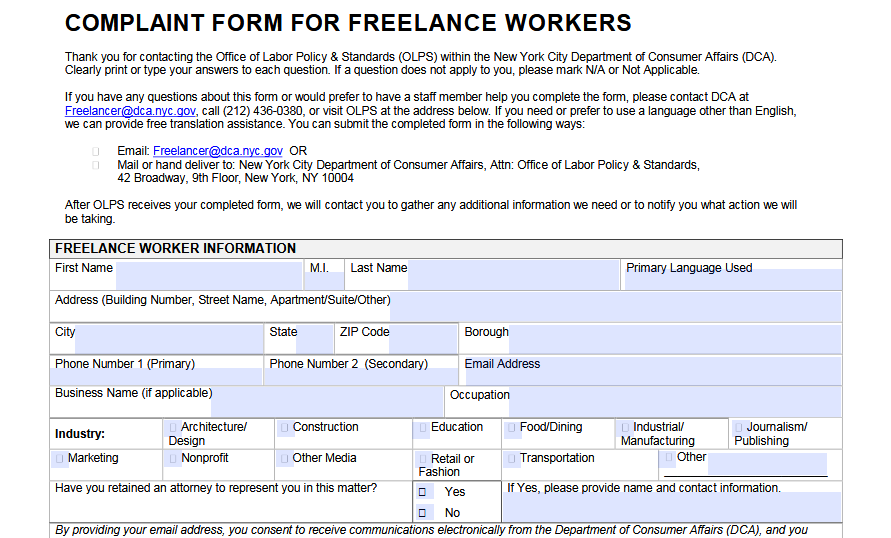

The following is an example of a complaint form from the New York City site.

Freelancers must submit a complaint with the OLPS for alleged failure to provide a written contract within two years of the supposed violation.

Covered freelancers may also file a civil action in court within two years of the hiring party’s alleged failure to provide a written agreement or within six years of a hiring party’s alleged failure to pay or act of retaliation.

Once a complaint has been filed with the OLPS, the hiring party is given time to respond to the allegations. Failure to reply can be presumed to be an acknowledgment of the offenses they have been accused of.

The freelancer can then use that in support of their argument should they decide to push through with legal proceedings.

Should the ‘’Freelance Isn’t Free Act” be put into law everywhere?

Of course, this is an excellent law. It tells freelancers that requesting payment from your client doesn’t have to be complicated. Many of today’s startup companies, especially those with online services or products to sell online, are powered by freelance employment.

Freelancers spend time, money, and energy on their work. They shouldn’t be deprived of what’s due to them.

So far, the law has only been passed in New York. Every state, however, should pass its version of the law so all freelancers in the US can be covered.

That version shouldn’t have to be the same law passed in New York City. It may even have improved provisions. For instance, a law with a work value threshold lower than the specified $800 in the New York City ordinance will cover more freelancers since even those just starting can get the legal protection they need when they demand payment.

Even better, the law can be passed at the federal level. That will help ensure that all freelancers in the US are covered. It will also ensure all companies toe the line. Wage theft, after all, is much like robbery. It’s a serious offense.

How you can take action

You can learn more about how to take action and how you can help by following the Freelancers Union. The Freelancers Union is a non-profit organization that has lobbied for the Freelance Isn’t Free Act and has contributed to its passage in New York. Through collaborations, the organization also delivers advocacy, programming, and selected insurance coverage to freelancers.

Here’s a section dedicated to the Freelance Isn’t Free Act on their website, freelancersunion.org.

We must demonstrate to the rest of the world that being a freelancer is a viable career path. Besides, with protections in place for a big part of the workforce, you can encourage more people to become freelancers.

That can help businesses thrive, too.

When there are more freelancers available for hire, businesses have more options for access to high-quality output—all that without having to break the bank.

Remember, unlike regular employees businesses need to invest resources in, businesses are not required to invest in freelancers’ training. After all, they’re already presumed to be experts in the field. That’s the reason they were hired in the first place. Freelancers and contractors can also present a great option as “contract-to-hire” team members who, after proving themselves, can join the team as an extremely valuable asset.

Conclusion

With more people opting for self employment and freelance work, the traditional work structures are changing. As the gig economy expands, freelancers and businesses must understand their rights and duties.

While the freelancer is responsible for delivering high-quality work on time, the company has the responsibility to pay what’s due to them.

But for as long as there are abusive companies, the freelancer’s right to be paid will continue to be violated. That’s where laws such as the Freelance Isn’t Free Act can help. With protective measures in place, hiring parties can no longer take advantage of independent workers.

You can concentrate on producing quality work and rest easy. You will be compensated for it.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!