Note: This article contains legal advice. We recommend you consult a lawyer before making legal decisions in your business.

- There are multiple options for a tax deduction that include your mortgage, internet, and utilities

- Education expenses such as conferences, meetings, and Masterminds can be deducted from your taxes

- Always check with IRS if there is ever any uncommon tax situation to ensure you are okay to deduct

Have you ever filed your tax return only to realize that you could’ve deducted a significant business expense? Hopefully, a tax deduction cheat sheet can ensure that you never miss out on another deductible expense again.

As a freelancer or self-employed sole trader, you can claim deductions on any business purchase that is ordinary and necessary in your line of work. So, everything from your home utilities to your business meals are classed as tax deductible.

👋 Psst...Have you seen the all-new Feedcoyote yet? They've got a new look, more freelance opportunities, and the best collaboration tool for freelancers! Join over 100,000 fellow freelancers who network, find clients, and grow their business with Feedcoyote. Join for Free »

But, like pretty much every tax-related activity, there are a lot of rules and even more confusion.

Forget tax deadline stress—tax return stress is a very real thing. According to Credello, one-third of Americans are worried that they failed to maximize their tax refund. And, 25% worry that they’re going to get audited by the IRS because they’ve made a mistake.

So, we’ve created a tax deduction cheat sheet to help you maximize your tax refund or reduce your tax bill. We’re also going to discuss some best practices for filing your tax return to hopefully ease some of your tax deadline stress.

Tax deduction cheat sheet for freelancers and self-employed

What tax-deductible business expenses can you take advantage of? Let’s take a look at some of the main expenses that you can deduct regardless of your industry.

Rent, mortgage, and utilities deduction

If you work from home, you’ll be entitled to the home office space deduction regardless of whether you own or rent. This is probably the most substantial tax deduction you can claim, but it’s also the most complex.

Put simply, the home office space you use regularly and exclusively for business operations is tax deductible. So if, for example, your home office amounted to 20% of your entire home, you can deduct 20% of your rent as a tax-deductible expense.

The same goes for your mortgage interest and utilities too. If 10% of your electricity bill powers your home office, then you can deduct that portion. This is called the regular method for calculating home office space deductions.

Of course, actually making these calculations is a pretty intensive task. Communicating them on your tax forms is even more so—you have to complete form 8829, which is a lengthy 43 lines. For this reason, IRS has devised a simplified method.

The simplified method deducts $5 for every square foot of your home office space (up to 300 square feet). This means that home office deductions using this method are capped at $1,500.

Despite the cap, many freelancers find value in the simplified method. There’s no need for form 8829 (the worksheet for the simplified method is only six lines), so it’s a serious time-saver. Additionally, you don’t need to make lots of individual calculations for your different expenses.

If you have a small home office, you’re likely to see financial benefits, too.

For those of you freelancing in the UK, home office tax deductions are even easier. HMRC uses simplified flat-rate deductions based on the number of hours you work in your home office per month. Like the US simplified method, this includes utilities, insurance, etc.

Work-related education expenses

The IRS recognizes that continuous training and education are critical to freelancers. Because you don’t have an employer to cover these costs for you, the IRS has made work-related education expenses tax deductible.

So, what counts as a work-related education expense?

You can deduct any conference you attend, course you enroll in, or textbook you buy as long as it directly relates to your current professional occupation. They must also be for the purposes of maintaining and refining your professional skills.

So, if you were a freelance graphic designer, you’d be able to claim on design-related refresher courses but not on the food nutrition course you completed for fun—not even if you were planning on switching careers.

The same rules apply to UK freelancers, too. HMRC allows you to deduct training courses that are directly related to your current area of business. This means that you can’t write off a training course that helps you venture into a new area of business, even if it relates to your current business.

Business insurance

If you pay for insurance to protect your business, you can deduct them as business expenses. For example, you might have business liability insurance, special events insurance, or insurance to protect your business in the case of a fire or natural disaster.

We all know that it’s better to be safe than sorry. But there’s no denying that insurance premiums can put a huge dent in your finances. Hopefully, being able to list insurance premiums as tax deductions can motivate you to bulk up your business protection.

Credit card loans/interest

Any credit card loans you’ve taken out are tax deductible as long as the funds are used solely for business purposes. For loans that you use for business and personal purchases, the funds need to be distinguished accordingly. The same goes for credit card interest, too.

Travel expenses

From your plane fare and mileage to your hotel room and meals, you can write off a significant portion of your travel expenses.

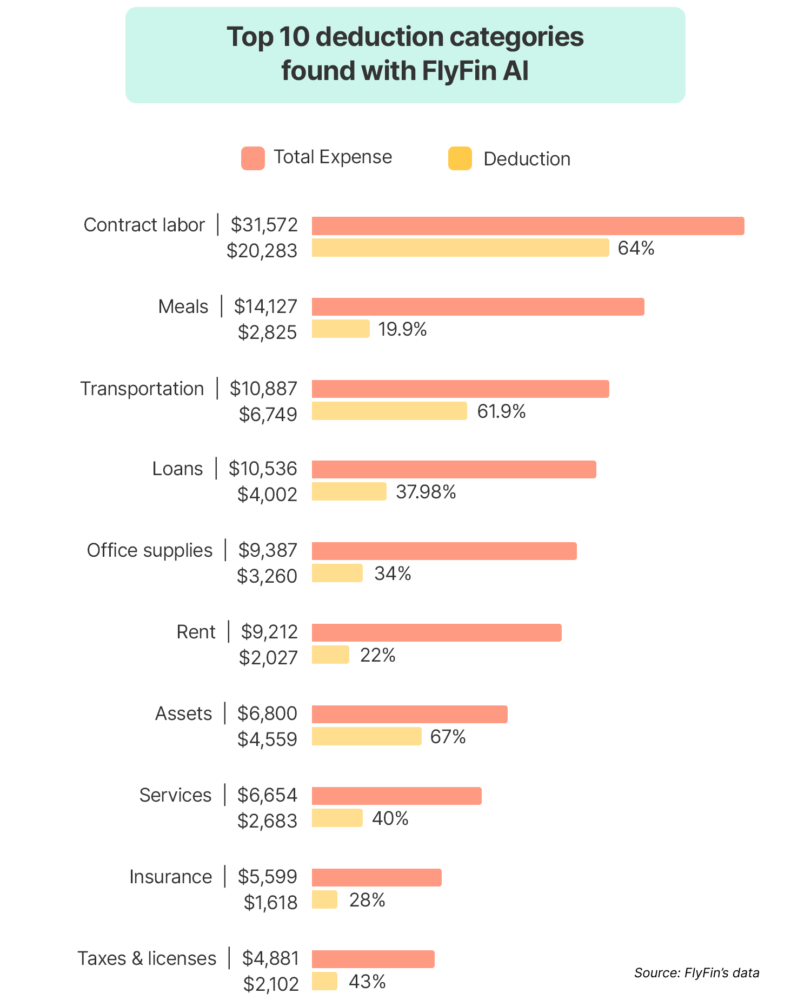

In fact—after contract labor—meals and transportation are the two most commonly deducted business expenses, according to a recent analysis by FlyFin.

With that being said, the IRS is pretty strict about this category and there are a lot of rules regarding business travel expenses.

For one, business travel must be a sizeable distance from the regular place of work and, in their words, “substantially longer than an ordinary day’s work.” So, as a general rule, you can’t deduct the costs of day trips or trips within your city.

Additionally, the trip is only classed as deductible if it’s made for business purposes (e.g. attending a conference or meeting a client). If you want to take a mini-vacation once you’ve finished your business activities, none of those costs are deductible.

As for the travel expenses that you can claim, some of the main ones include:

- Long-distance transportation: Such as the plane, train, and car expenses used to reach your business destination.

- Short-distance transportation: For example, the taxi or Uber between the airport and the hotel.

- Lodging: You can deduct the cost of your hotel stay, although it shouldn’t be unreasonably extravagant.

- Meals: This is for business meals only and, once again, can’t be unreasonably extravagant.

In the US, things like baggage shipping, dry cleaning, and even tips are also classed as tax-deductible expenses.

HMRC are equally as strict about business travel and thus all of the above rules apply. Along with all of the main travel expenses we’ve mentioned above, you can claim tax relief on things like congestion charges, tolls, and parking fees.

Business advertising

Many of us pay for advertising in some form, whether it’s on social media, Google, or in a magazine. It can be a costly expenditure for freelancers who rely on continuous paid advertising to attract new clients. Luckily, it’s also a tax-deductible expense.

As well as traditional and online advertising, the IRS allows you to deduct the costs incurred from any business cards or brand-focused merchandise you create. HMRC allows you to deduct free samples and website costs.

Telephone and internet

You can claim a percentage of your telephone and internet expenses as tax-deductible expenses. To work this out, you’ll need to calculate how much of your internet and telephone usage is credited to business operations.

If you use the same phone for business and personal communications, you’re going to have to pick your phone bills apart with a fine-tooth comb. By using two separate phones for business and personal use, you can simply deduct 100% of your telephone expenses (and avoid running into issues with the IRS or HMRC).

Software subscriptions

Depending on your industry, you probably rely on at least one software subscription. Whether it’s image-editing software like Photoshop or word-processing software like Microsoft Office, you can deduct the cost of all the software that your business needs to thrive.

You can even claim tax deductions on the online accounting software you use to manage your finances.

While we’ve covered most of the main tax deductible expenses, you can also claim deductions on things like office supplies and equipment, depreciation, and even contract labor. So, make sure you do your research to get the most out of your tax refund.

5 Tips for filing freelance taxes

It’s all well and good knowing which business expenses you can deduct. But, if you don’t have a streamlined tax management and returns strategy, it’s easy to run into problems with your tax authority.

Remember the Credello study we mentioned earlier? Well, not only are 25% concerned about getting audited by the IRS, but 14% worry that they won’t get any money whatsoever because of a mistake they’ve made on their tax return.

This, along with the common worry of missing deadlines and misplacing documents, all make for a very stressful tax return experience.

Following some simple best practices can make filing your freelance taxes much less frustrating. One of the first things you should do is consider using an accounting or tax return system.

Take advantage of an accounting system

We get it—manual tax filing can be so laborious that calculating your tax deductions might feel like just another chore.

The solution? Accounting software that automates much of the tax filing process for you.

Opting for software that specializes in managing self-employed taxes is a good idea. For example, solutions such as Moxie and Sage are designed to meet the unique needs of sole traders. This software can import all of your transactions automatically, giving you real-time insight into your different income streams.

Accounting software isn’t only for helping you manage your money as a freelancer. Along with storing and organizing your tax information, the best accounting software can recognize any tax deductions you’re entitled to and calculate them automatically. All you need to do is enter your tax information into the system, and the software will do the rest.

As well as being a time-saving shortcut, accounting software minimizes the risk of human error.

Paper-based tax filing practices are prone to disorganization and miscalculations that can have significant time and money repercussions. Accounting software ensures that all of your tax information is strictly organized and correctly calculated. If you do enter something wrong, the best accounting software will flag it as a potential error.

Also, because consumer-based accounting systems are designed for non-tax professionals, they’re incredibly user-friendly and more affordable than hiring an accountant. What’s more, many providers offer round-the-clock customer support from certified public accountants (CPAs).

For those self-employed in the UK, take note that you won’t be able to submit paper tax returns at all by April 2026. This is part of HMRC’s MTD (Making Tax Digital) initiative. Accounting software will help you prepare for tax digitization well in advance of the deadline, helping you stay compliant and organized.

Keep an organized record of your income and expenses

When you have multiple side hustles, clients, and projects on the go, keeping track of all your income streams can quickly become overwhelming. But, rather than hire an accountant (which can get really expensive), you can use an online spreadsheet or, even better, accounting or tax return software.

Accounting and tax return software automatically records and organizes your freelance earnings and business expenses. They eliminate the many inefficiencies of paper-based tax filing. And, unlike spreadsheets, they utilize automation which streamlines your entire record-management process.

Sort out tax-deductible expenditures

Using the tax deduction cheat sheet as a guide, you should sort out your tax-deductible expenditures well before the due date. This involves listing, categorizing, and continuously updating all relevant information, so it’s ready to submit on your tax date.

Now, where this can sometimes get tricky for freelancers is when it comes to distinguishing business and personal expenses. As a strict rule, you can only claim on business expenses. However, gray areas arise when an item is used for both business and personal use (e.g., a mobile phone that you use for business and personal communications).

To avoid running into issues with your tax authority, consider using separate items for business and personal use. If that’s not possible, make sure to correctly distinguish the portion allocated to business use. So, if you purchased a mobile phone that you use for business 60% of the time, only 60% of that cost would be tax-deductible.

To make things even easier, consider opening a separate bank account for your self-employed business.

Keep a calendar of tax due dates and file early

According to the IRS, freelancers who expect to owe more than $1,000 on their next tax return are required to make quarterly estimated tax payments. You should still file income tax returns annually on or before April 15

If you fail to meet quarterly repayments, you’ll incur significant penalties and reduce the benefits of tax-deductible expenses.

If you’re in the UK, the self-assessment tax deadline is January 31 for online submissions. The deadline for paper tax returns is a few months earlier. However, keep in mind that you won’t be able to file paper tax returns by April 2026. You can find out more about UK tax deadlines on the GOV UK website.

So, once you’ve collected your tax dates, add them to an online calendar or, even better, your accounting software to get automatically notified of upcoming dates. Using accounting software to file your tax returns early has a number of benefits.

For example, it can:

- Help you avoid processing delays: Early filers and electronic filers are less affected by holdups.

- Give you more time to prepare for tax bills: Knowing how much your bill will be ahead of time helps you budget accordingly and reduces financial strain.

- Eliminate some of your tax deadline stress: When you’re not rushing to meet deadlines, the entire tax return process becomes much less stressful.

Keep a digital record of invoices, receipts, or ledgers

Digital record-keeping is much more convenient than the paper alternative. Digital invoices, receipts, and ledgers can be stored and organized for easy accessibility and compliance. You can even digitize your paper documents by scanning them with a scanner or mobile scanner app.

There are a few best practices you should follow to improve the efficiency of your digital record-keeping. The most important thing you need to do is back up your documents in more than one place.

So, don’t just save all of your documents on your accounting system and be done with it. Save them on your Google Drive, Dropbox, or local hard drive, too.

Another best practice is to ensure that your documents are organized. Name your documents appropriately (preferably a name that describes the file’s context), and keep all your related files together. While you’re at it, consider using OCR (optical character recognition) software to convert images into text to make your documents searchable.

By implementing these best practices, you improve efficiency and eliminate the struggle that comes with sifting through mountains of paper. Plus, if your records are stored, organized, and backed up online, all your income and expenses will be accounted for should the IRS need to do an audit.

Conclusion

Filing your taxes as a freelancer doesn’t have to fill you with dread. By referring to this handy tax deduction cheat sheet and adopting the best practices mentioned above, you can make your tax return process as stress-free as possible while enjoying better tax returns.

And remember, the business expenses listed on this tax deduction cheat sheet aren’t the only ones that might be available to you.

Take a good look at any business expense you make and ask yourself whether it’s ordinary and necessary for your industry. If you’re not certain, consult a CPA before filing it as a tax deduction.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!