Note: This article contains legal advice. We recommend you consult a lawyer before making legal decisions in your business.

Collective is an all-in-one financial solution for freelancers and solopreneurs making $100,000+ per year. This Collective.com review will share my experience (the good and the bad) as a Collective member since 2020.

I’ve been running my own business full-time since 2017. But I was struggling to manage all the financial and tax requirements on my own. Like many self-employed entrepreneurs, I found myself spending more time on paperwork than working with clients and growing my business. That’s when I discovered Collective.com.

In this Collective.com review, I’ll share my first-hand experience using their services over the past couple years, including the signup process, tax savings, support received, and whether it ultimately improved my peace of mind running a solo business.

👀 The way clients search for freelancers has changed — stay visible across Google, ChatGPT, and AI platforms with Semrush One and land your next freelance client. Click here to see what you’re missing »

Short Answer: Should You Join Collective?

Collective offers a lot of appealing benefits, especially for overwhelmed solopreneurs who want to automate their finances.

The all-in-one platform, bundled services, tax savings, and education resources provide tremendous value. For most members, Collective delivers an “good enough” experience.

The scattered negative reviews suggest consistency and service quality could still be improved. And that aligns with my own personal experience as well.

Ultimately, Collective makes the most sense for solopreneurs who:

- Don’t enjoy finance tasks and want to automate them

- Will benefit significantly from S-Corp tax savings

- Prefer having guidance from professionals

- Are willing to pay for convenience and less stress

If you decide Collective is right for you, use this 50% coupon code to give it a try.

Discovering Collective and Signing Up

I first learned about Collective back when they were called Hyke. At the time, their main offering was helping sole proprietors form an LLC and elect S-Corp status to save on self-employment taxes.

As a solopreneur running my own business, this huge potential for tax savings really attracted me to Collective (then Hyke).

I had just gone full-time self-employed after losing my job and I had tried to alternatives:

Bench, which I really enjoyed for a while, but ultimately found the feature set to be a bit lacking.

and

Google Sheets, which I made do with some pretty sophisticated formulas.

But both were fairly time-intensive and, once I went full-time, I needed to devote as much time and attention as I could on actually growing my business.

In the end, the S-Corp election and estimated tax savings of $10k-20k per year convinced me to sign up. Beyond taxes, Collective offered bookkeeping, accounting, payroll, and ongoing support – everything I needed but didn’t want to handle myself.

Organizing My Business as an S-Corp

One of the best parts about Collective was how simple they made the process of forming an LLC and S-Corp election. I just provided some basic business information, and their team handled all of the required paperwork and filings.

I was relieved I didn’t have to figure out every step myself since I really don’t enjoy all the tax and legal stuff when it comes to business. Within a few weeks, my business was officially organized as an S-Corp thanks to Collective.

The transition was smooth and surprisingly painless. I expected some headaches trying to get everything submitted properly, but Collective’s advisors were experts who made it easy.

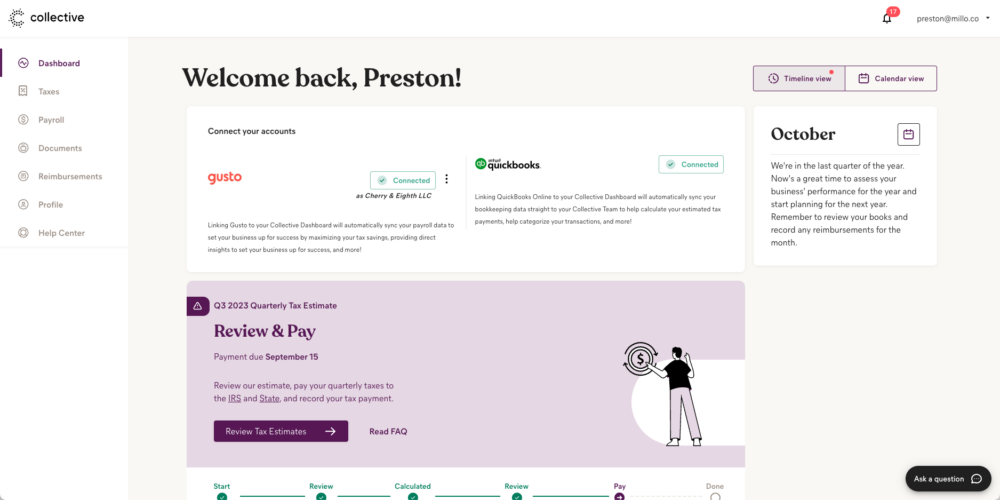

The only real learning curve was that they had me join two software I had never used before: Gusto (for payroll—even just to myself) and Quickbooks (for accounting). While the cost of these tools is included in my monthly Collective fee, I still found it a bit odd that we weren’t using Collective technology. I think it’s because they’re more of a service company than a tech company. More on that later.

Realizing Significant Tax Savings

Just as advertised, becoming an S-Corp led to major tax savings for my solo business. That first year, I think I saved around $10,000—$15,000 on my business income taxes thanks to Collective guiding me through the process.

The S-Corp election allowed me to take advantage of tax rules that reward business owners like me. I was able to deduct much more and ultimately kept tens of thousands over the years that I would have otherwise paid in taxes.

As a freelancer, every dollar counts when trying to grow your business and support yourself. The tax savings I realized working with Collective gave me peace of mind and more money to reinvest in the business.

Ongoing Bookkeeping & Payroll Support

Beyond the initial S-Corp formation and tax savings, Collective has provided immense value with ongoing bookkeeping, payroll, accounting, and taxes.

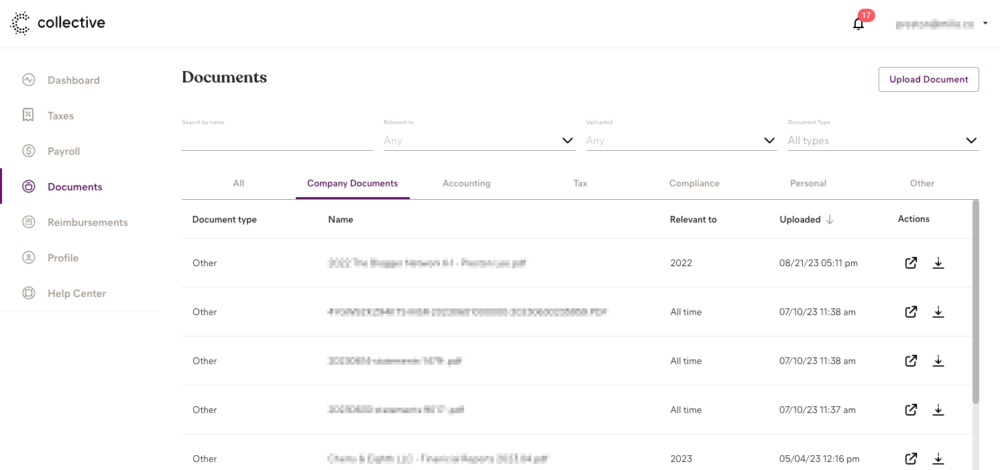

Every month, my dedicated bookkeeper categorizes all of my income and expenses, reviews everything with me if needed, and provides detailed financial reports.

Having this professional bookkeeping handled for me is a massive time and sanity saver! I can just review the categorized reports instead of spending hours sorting transactions and receipts myself.

Collective has also fully handled payroll, including filings, forms, and integration with Gusto for easy, automated payroll runs. For now, I’m technically the only one that gets “payroll” and I wish there were some better solutions for my team of contractors since I plan to continue with that for a long time.

At tax time, they help me file my personal and business returns using all the data they’ve collected and managed.

As a busy freelancer, I simply don’t have time to stay on top of all these financial details. With Collective’s ongoing accounting support, I can focus my limited time on serving my audience and my clients and growing my business.

Expert Tax & Accounting Support

In addition to the bookkeeping and payroll help, I’ve received tremendous value from having direct access to Collective’s team of accounting and tax experts.

Whenever I have a financial, tax, or accounting question related to my freelance business, I can get answers and advice from real professionals. It’s incredibly helpful having this experience available whenever you need it. My only criticism is everything is done through email which can get a bit messy. And sometimes it takes them a while to respond to me.

During tax season especially, I’ve been grateful to have Collective’s CPAs guiding me to maximize deductions, avoid costly mistakes, and stay compliant with all IRS rules.

As much as I wish I could be an expert in taxes, accounting, and finance, that simply isn’t the case. Having Collective’s team as a resource provides immense peace of mind.

Not everything is perfect, though. I have had a few moments when I’ve had to correct the Collective team on something related to my taxes. Something they should have caught. Something which, if I hadn’t caught, probably would have cost me a few thousand dollars. So if you do switch to Collective, you’ll still need to monitor and carefully review everything they do. Which, ultimately, is a good thing to do as you grow your business anyway.

Cost of Collective vs. Value Received

Currently, I pay around $200 per month for Collective’s services. With all they provide, including S-Corp formation, bookkeeping, accounting, taxes, Gusto, and unlimited advisor access, I feel this is pretty fairly priced.

Considering a private accountant and bookkeeper would likely charge me over $200 per month each, Collective packs tremendous value.

For less than hiring one person, you get support from an entire team of finance and accounting pros. Plus, the tax savings alone often return 10x the cost or more.

With that in mind, they’re actually increasing my monthly fee from $200 to $300—a pretty significant increase. So I’ll go from $2,400/year to $3,600/year which definitely has me looking in a few other places just to make sure I’m getting the most out of my investment.

Tips for New Collective Members

For anyone considering joining Collective, I would offer these tips and insights based on my experience:

- Be prepared to have patience – their support can sometimes be slow to respond or hard to understand. The expertise is there, but customer service isn’t their strength.

- Take full advantage of the S-Corp tax benefits – meet with their advisors to maximize deductions and savings. Don’t leave money on the table!

- Proactively reach out with questions – their advisors have been very helpful but usually wait for me to initiate. Don’t be afraid to lean on their expertise.

Pros and Cons of Collective.com

Now let’s sum up a few of the pros and cons of using Collective to help manage your business finances. These come from my isolated experience plus reading reviews and doing other research.

Pros of using Collective.com

- All-in-one platform for finances instead of multiple services. Instead of switching between 4 or 5 different services just to know what’s happening with your money, Collective keeps it all tidy in one place so you always have your finger on the financial pulse.

- S-Corp election provides significant tax savings for your business. Forming an S-Corp and handling the election paperwork can lead to thousands in tax savings per year for solopreneurs and freelancers.

- Ongoing bookkeeping and automated expense tracking saves you time. No more manually categorizing every receipt and transaction – Collective handles it automatically and keeps clean books for you.

- Payroll is handled and integrated seamlessly with Gusto. Forget payroll headaches – Collective makes payroll a breeze through integration with Gusto and easy automation.

- Get advice from real CPA’s and accounting experts when you need it. Questions come up frequently when running your own business, and Collective’s team of advisors is there for you year-round.

- Educational resources help you learn finance skills. Collective provides useful content to help you become more financially savvy as a business owner.

Cons of using Collective.com

- Customer support and responsiveness needs improvement. Some members—including me—have experienced communication issues and lack of accountability from the Collective team.

- The tech platform still has some glitches that need to be worked out. Like many startups, Collective’s dashboard and tools have a few annoying bugs that seem like should be a simple fix.

- Service is less customizable than working with a solo accountant. Collective offers more convenience but less tailored 1-on-1 support compared to a dedicated accountant. If you fall within their “ideal customer,” this is perfect. If not, it can be a bit of a struggle.

What Others Are Saying About Collective (Good and Bad)

Based on over 60 reviews I found on TrustPilot and elsewhere, Collective has an average rating of 4.3 out of 5 stars. The majority of reviews are very positive, with 77% giving 5 stars. However, there are also some negative reviews that highlight areas for improvement.

On the positive side, many reviewers mention how Collective takes the stress out of managing finances and provides great value for the cost. They like the tax savings from the S-Corp status, the ongoing bookkeeping support, and the access to accounting experts.

However, a common complaint among the negative reviews is around communication issues and lack of responsiveness from Collective’s team. A few reviewers said they experienced problems with late tax filings, unresolved questions, and unclear points of contact. Some felt the service was disorganized and not as “hands-on” as advertised. My experience has been similar.

It seems that while most members have a pretty good experience with Collective, there are some inconsistencies with support and customer service that lead to poor experiences for some of us. Improving communication and accountability could help turn negative reviews into positive ones in my opinion.

So should you join Collective?

While not perfect, Collective provides immense value at a reasonable price point for freelancers like myself. If you’re making over $80k per year solo, it may be a good option for you.

Collective is an excellent fit for solopreneurs and freelancers who:

- Make over $80k per year: You’ll benefit the most from Collective’s S-Corp tax savings. Under this income, the monthly fee may not make sense.

- Are overwhelmed by finance and taxes: Collective shines by automating tasks like bookkeeping that many freelancers dread.

- Want to scale their business: The all-in-one platform, education resources and support help you grow.

- Place high value on convenience over customization: Collective trades tailored 1-on-1 support for bundled ease of use.

- Prefer guidance from professionals: You’d rather lean on a team of experts than figure everything out yourself.

You can sign up for Collective and save 50% using this coupon link.

Collective may not be the ideal solution if you:

- Are very price sensitive or cash-strapped: You may find cheaper DIY options sufficient for now.

- Enjoy and don’t mind finance tasks: If you prefer handling your own books and don’t mind it, Collective is overkill.

- Already have an established large business: You may benefit more from highly customized services.

- Had issues with unresponsive support: Check reviews and proceed cautiously if responsiveness complaints are recent.

- Want maximum hands-on control: Collective automates a lot, so less ability to customize processes.

If Collective’s not a fit, I recommend you look into Bench or hiring a CPA.

The bottom line – know what services you need, what problems you want solved, and what level of support you expect. This helps determine if Collective is worth the investment for your freelance or solopreneur business.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!