In this Freshbooks review, I share my honest assessment of this popular all-in-one accounting software. As someone who’s struggled to juggle billing, bookkeeping, and client management across multiple platforms, I understand the real-world challenges that small business owners face when searching for a unified financial management solution.

Freshbooks

Stop wasting hours on invoices and expenses. FreshBooks automates your accounting, so you can focus on what you do best: your freelance work. Get paid faster, track every dollar, and save time – just like the pros.

Why we like Freshbooks ‣

FreshBooks stands out as an excellent choice for freelancers and small businesses who want to grow. Its user-friendly interface and seamless onboarding process allow users to set up their accounts and start working quickly. FreshBooks offers a range of features tailored to service-based businesses, including unlimited invoicing, time tracking, and client retainer options even in its most basic plan.

The software's flexibility is particularly appealing, allowing users to easily upgrade as their business grows without losing functionality. FreshBooks also excels in customer support, providing readily accessible phone and email support, which demonstrates their commitment to user satisfaction.

Read the Full Review

Freshbooks Pros & Cons ‣

Pros:

- User-friendly interface with easy onboarding

- Flexible pricing plans that grow with your business

- Unlimited invoicing, time tracking, and estimates on all plans

- Excellent customer support with readily available contact options

Cons:

- Limited to 5 billable clients on the basic plan

- Additional cost for each team member added ($10/month)

During my trial period, I focused on testing FreshBooks’ core promise: the ability to run billing, bookkeeping, and other important business tasks all in one place. I’ll walk you through my experience with creating invoices and getting paid faster, generating instant reports for business health insights, staying organized for tax compliance, and collaborating with clients while monitoring project profitability.

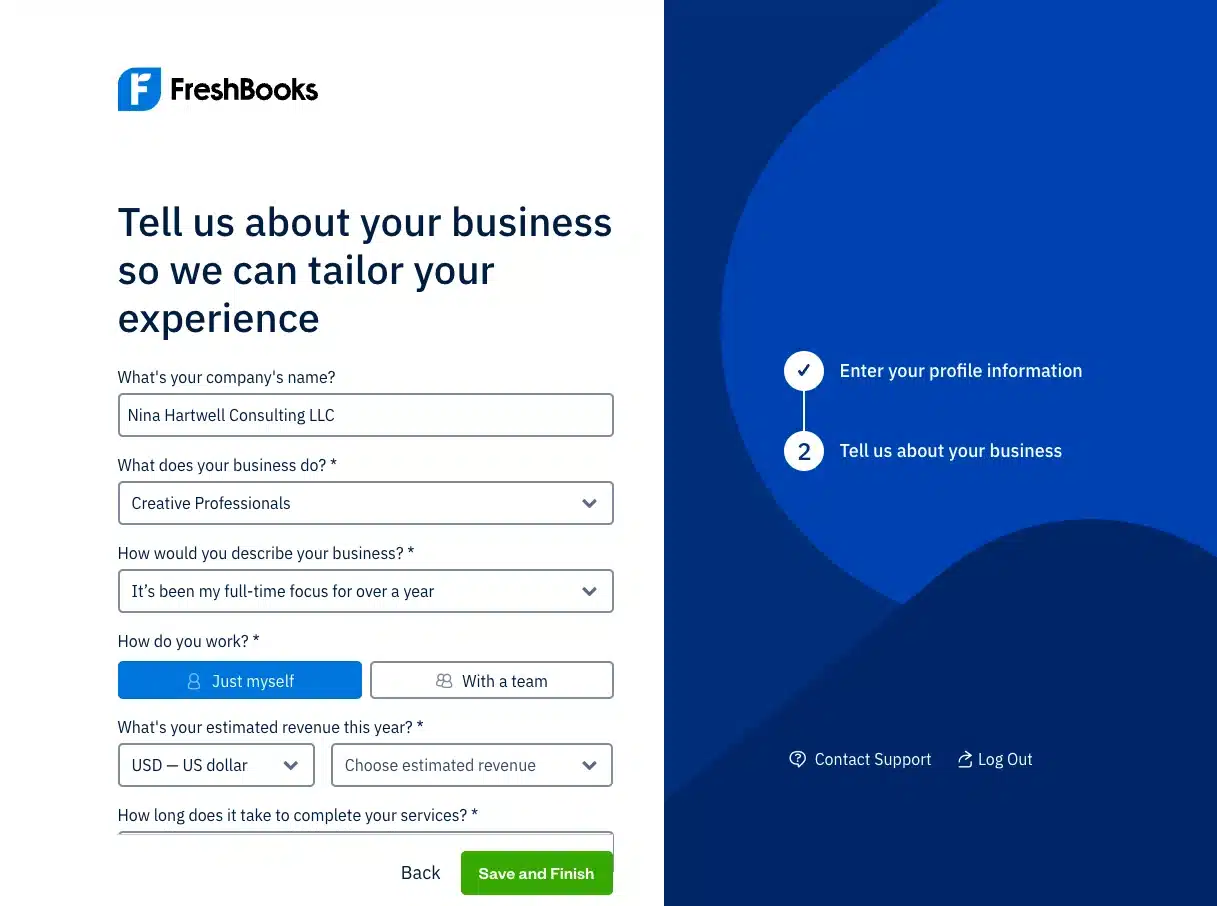

Getting Started: The FreshBooks Onboarding Experience

Account Creation and Initial Setup

The FreshBooks sign-up process impressed me with its simplicity. Unlike some accounting platforms that bombard you with complex questionnaires, FreshBooks takes a conversational approach. The system asks straightforward questions about your business type, typical services, and whether you work alone or with a team.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

What I appreciated most was the intelligent defaults. Based on my responses about running a brand consulting business, FreshBooks automatically configured relevant invoice templates, expense categories, and tax settings for my location. This saved me considerable time compared to other platforms where I’ve had to manually configure dozens of settings before getting started.

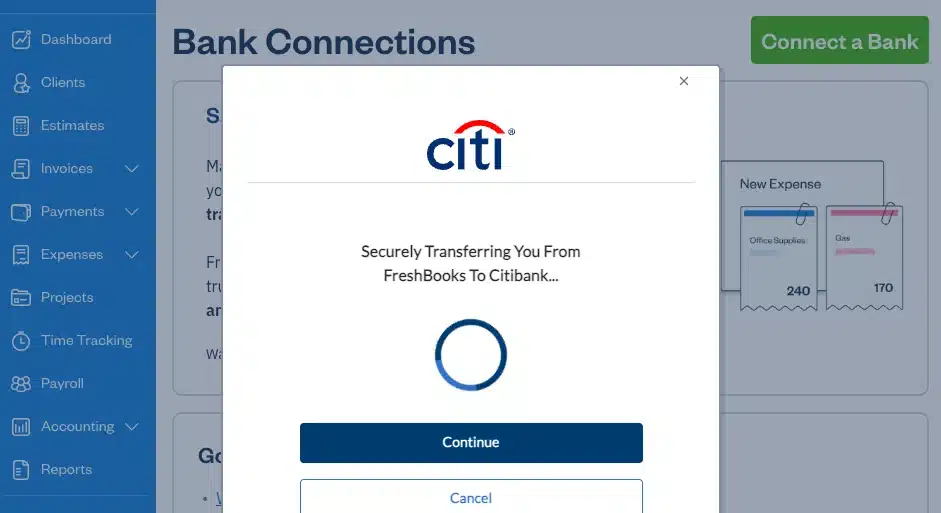

Data Import and Bank Connections

Migrating from my previous accounting system proved more seamless than anticipated. FreshBooks’ import wizard handled my client contact list, historical invoices, and expense data without major issues. The platform supports various file formats, including CSV exports from QuickBooks, Excel spreadsheets, and even manual data entry for smaller datasets.

Connecting my business bank accounts required some patience but ultimately worked well. The initial sync took about 24 hours to pull in several months of transaction history. Once connected, daily transaction updates happen automatically, though I noticed occasional delays of 1-2 days during weekends—which is totally fine…

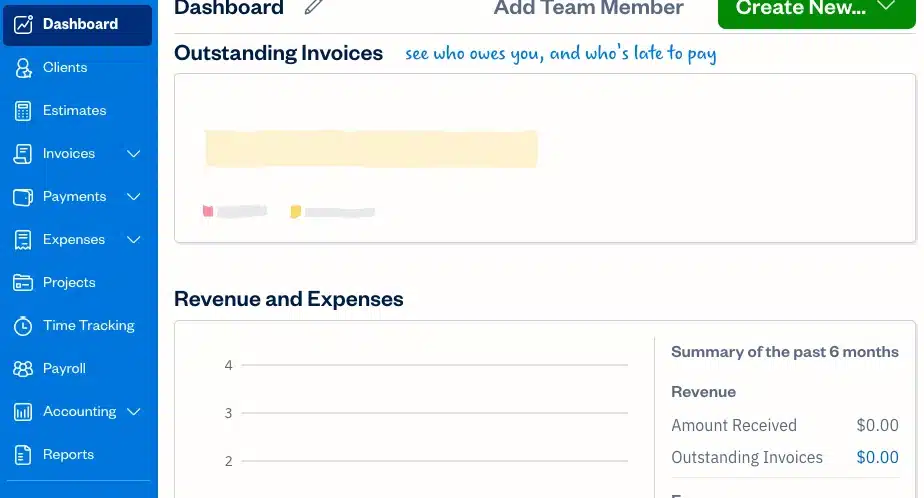

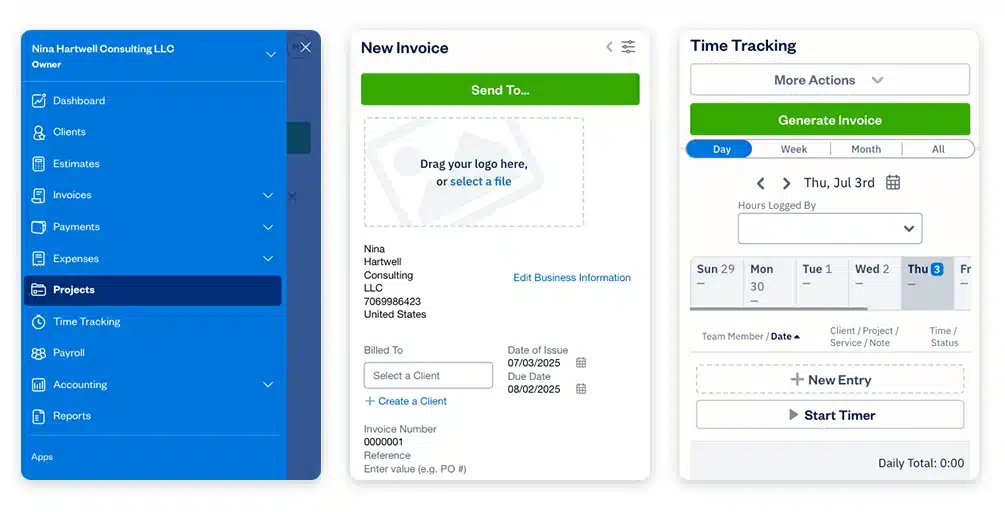

Dashboard and Navigation Design

FreshBooks strikes an excellent balance between functionality and visual clarity. The dashboard presents key metrics at a glance: outstanding invoices, recent payments, upcoming expenses, and cash flow trends. The color-coded system makes it easy to quickly identify overdue invoices or approaching payment deadlines.

Navigation follows intuitive patterns that most users will recognize immediately. Primary functions like invoicing, expenses, and time tracking occupy prominent positions in the main menu, while advanced features like reports and project management are logically organized in secondary menus. The search functionality works exceptionally well, allowing you to quickly locate specific clients, invoices, or expenses using partial keywords.

Core Features Deep Dive

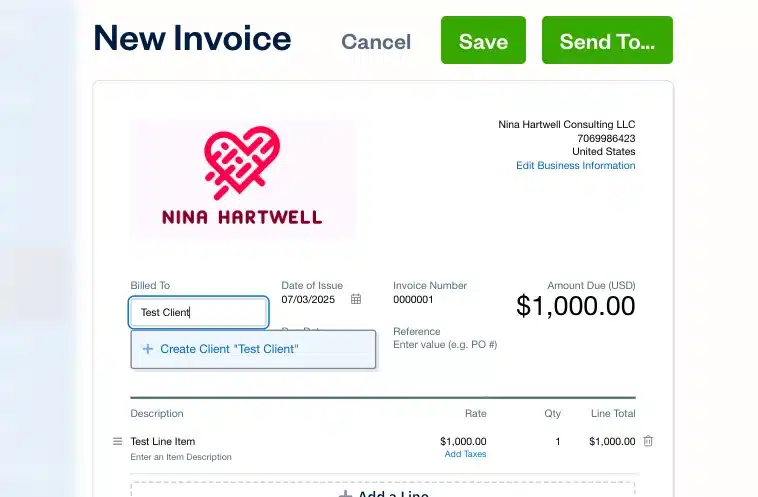

Creating Invoices and Getting Paid Faster

FreshBooks’ invoicing system immediately impressed me with how quickly I could create professional invoices. The platform’s templates are clean and customizable, allowing me to add my logo, adjust colors, and include all necessary business details within minutes. Then those settings stick for the next invoice…which is nice.

Then the “Pay Now” buttons made it effortless for clients to complete transactions directly from the invoice.

During my trial, I noticed a significant improvement in payment speed compared to my previous manual invoicing process. The automated payment reminders follow up with clients professionally without requiring my intervention, and the system’s ability to accept credit cards, bank transfers, and digital payments removes common barriers that typically delay payments.

If you’re like me and you’re tired of sending reminder emails, this is a huge deal too…

Running Billing and Bookkeeping in One Place

One of FreshBooks’ most compelling advantages is the seamless integration between billing and bookkeeping functions. Instead of managing separate systems for invoicing and expense tracking, everything flows together naturally. When I created an invoice, the system automatically recorded it in my books. When clients paid, the payment was instantly reflected in my financial reports and cash flow tracking.

Right now, I have that all set up in different apps and services.

So getting it all in one place is awesome.

The payment integration ecosystem deserves special recognition. FreshBooks connects seamlessly with PayPal, Stripe, and other major payment processors. Clients can pay directly from the invoice using credit cards, bank transfers, or digital wallets. The “Pay Now” buttons are prominently displayed and the checkout process is smooth enough that I’ve noticed improved payment speeds since switching to FreshBooks.

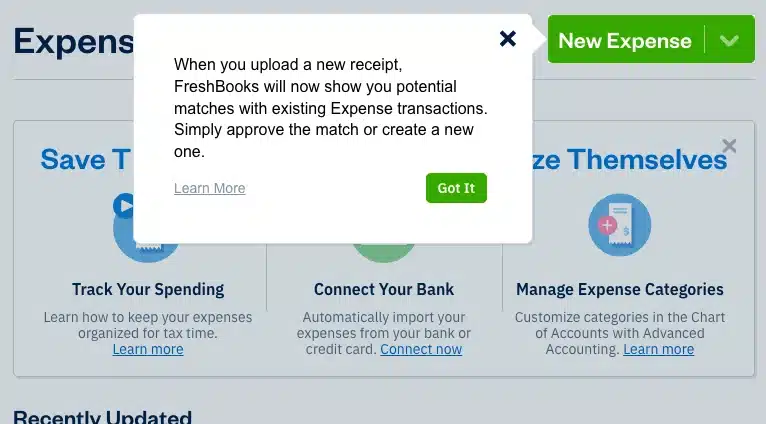

Comprehensive Expense Management

Expense tracking in FreshBooks goes beyond simple categorization—which is what I currently have…

You can photograph receipts on your phone, and FreshBooks’ optical character recognition automatically extracts key details like vendor name, amount, and date. The accuracy isn’t perfect, but it’s good enough to save significant manual data entry.

Bank reconciliation happens smoothly once you establish patterns for your regular expenses, so that’s nice…

FreshBooks learns from your categorization choices and suggests appropriate categories for similar future transactions. The system flags potential duplicates and unusual expenses, helping prevent accounting errors that could cause problems during tax season.

Staying Organized for Tax Season

FreshBooks excels at maintaining tax compliance and organization throughout the year. The platform automatically categorizes expenses into standard business deduction categories, tracks mileage for business travel, and organizes all financial data in formats that accountants can use directly. During my trial, I was impressed by how the system generated detailed tax reports that aligned perfectly with common business tax forms.

The receipt management system deserves special recognition for tax preparation. I could photograph receipts with my phone, and FreshBooks would extract key details automatically. All receipts are stored securely in the cloud, making them easily accessible during tax season or in case of audits. This level of organization eliminates the stress and scrambling that typically accompanies tax preparation time.

Time Tracking and Project Profitability

Client Collaboration and Project Profitability Monitoring

FreshBooks transforms client relationships through its collaborative features that handle billing seamlessly while providing clear project profitability insights. Clients can access dedicated portals where they view project progress, communicate directly with me, and see transparent breakdowns of billable work. This transparency has strengthened my client relationships and reduced billing disputes significantly.

The project profitability monitoring proved invaluable during my trial. I could set project budgets, track actual time against estimates, and receive alerts when projects approached their allocated hours. This real-time visibility helped me identify which types of work generated the best margins and allowed me to make adjustments before projects became unprofitable. The integration between time tracking, expenses, and invoicing provided a complete picture of project performance that I’d never had with other platforms.

Comprehensive Business Management Platform

What struck me most during the 30-day trial was how FreshBooks eliminates the need for multiple business management tools. The platform successfully combines billing, bookkeeping, and payroll management in one cohesive system. This integration means data flows seamlessly between functions—time tracked on projects automatically appears in invoices, expenses are immediately reflected in financial reports, and client communications are centralized alongside all financial interactions.

The payroll integration, while an additional service, connects seamlessly with the existing financial framework. Employee hours tracked within projects can flow directly into payroll calculations, and payroll expenses automatically appear in the appropriate accounting categories. This level of integration eliminates the data synchronization challenges that plague businesses using separate systems for different functions.

Instant Financial Health Reports

FreshBooks transforms complex financial data into clear, actionable insights through its comprehensive reporting system. Within seconds, I could generate profit and loss statements, cash flow reports, and expense summaries that provided an instant overview of my business’s financial health. The visual presentation makes trends immediately apparent, helping me make informed decisions without needing advanced accounting knowledge.

What impressed me most was the real-time nature of these reports. As soon as I logged expenses or received payments, the reports updated automatically. This instant access to current financial information proved invaluable for making day-to-day business decisions and monitoring overall performance trends.

Tax reporting features have proven particularly valuable. The platform generates detailed summaries of deductible expenses, organized by category and time period. During tax season, I can quickly pull reports for my accountant or export data directly to tax preparation software. The sales tax reporting handles multiple tax jurisdictions automatically, which has simplified my quarterly tax filings.

What sets FreshBooks apart is the visual presentation of data. Charts and graphs make financial trends immediately apparent, helping me make informed business decisions without needing advanced accounting knowledge. The ability to customize report parameters and save frequently used report configurations saves time during monthly business reviews.

Mobile Application Performance

Feature Completeness on the Go

The FreshBooks mobile app delivers most of the platform’s core functionality in a well-designed interface optimized for smartphones and tablets. I can create and send invoices, track expenses, log time, and communicate with clients from anywhere. The app syncs reliably with the web platform, ensuring that data entered on mobile devices appears immediately in the desktop version.

Invoice creation on mobile works surprisingly well, though I typically reserve complex invoicing for desktop use. The mobile interface makes it easy to send quick invoices for small projects or update existing invoices with additional line items. Push notifications alert me to new payments, client messages, and approaching deadlines, helping me stay responsive even when away from my computer.

User Experience and Performance

The mobile app’s interface follows modern design principles with clear navigation and appropriately sized touch targets. Loading times are generally fast, though I occasionally experience delays when uploading large receipt images or syncing extensive time tracking data. The app works reliably on both iOS and Android platforms, though I noticed slightly better performance on iOS devices.

Offline functionality is limited but adequate for basic tasks like expense entry and time tracking. Once you reconnect to the internet, the app syncs changes seamlessly with your account. This partial offline capability has saved me during client meetings in locations with poor cellular coverage.

Free Trial Experience and Feature Access

FreshBooks’ 30-day free trial provides access to virtually all premium features, allowing genuine evaluation of the platform’s capabilities. Unlike limited trials that restrict functionality, I could test advanced reporting, client collaboration tools, project management features, and integrations during the trial period. This comprehensive access enabled me to fully assess whether FreshBooks would meet my business needs before committing to a paid plan.

The trial includes full customer support access, so I could get help with setup questions and feature optimization. This support during the evaluation period demonstrated FreshBooks’ confidence in their platform and commitment to user success, rather than hiding features behind paywalls that prevent proper evaluation.

Integration Ecosystem and Workflow Enhancement

Third-Party Application Connections

FreshBooks’ integration marketplace offers connections with over 100 popular business applications. I’ve successfully integrated my Google Workspace account, Slack workspace, and Shopify store, creating a cohesive business management ecosystem. The Google Drive integration automatically saves invoice copies and allows me to attach files directly from my cloud storage to client communications.

The Slack integration keeps my team informed about important financial events without requiring everyone to access FreshBooks directly. Notifications about new payments, overdue invoices, and project milestones appear in designated Slack channels, maintaining team awareness while preserving sensitive financial data security.

Integration Setup and Maintenance

Most integrations follow a standard OAuth authentication process that connects securely without sharing passwords. Setup typically requires just a few clicks and basic configuration choices. FreshBooks provides clear documentation for each integration, though some third-party apps require additional setup steps that aren’t immediately obvious.

Maintaining integrations has been largely trouble-free. Occasional authentication renewals are required for some services, but FreshBooks sends proactive notifications when these updates are needed. I’ve experienced only minor sync delays, usually resolved by reconnecting the affected integration.

Enhanced Functionality Through Integrations

Strategic integrations have significantly expanded FreshBooks’ capabilities for my business. The Zapier connection allows me to create custom automation workflows, such as automatically creating new FreshBooks clients when someone fills out a contact form on my website. The Mailchimp integration helps me maintain separate email lists for clients and prospects, improving my marketing segmentation.

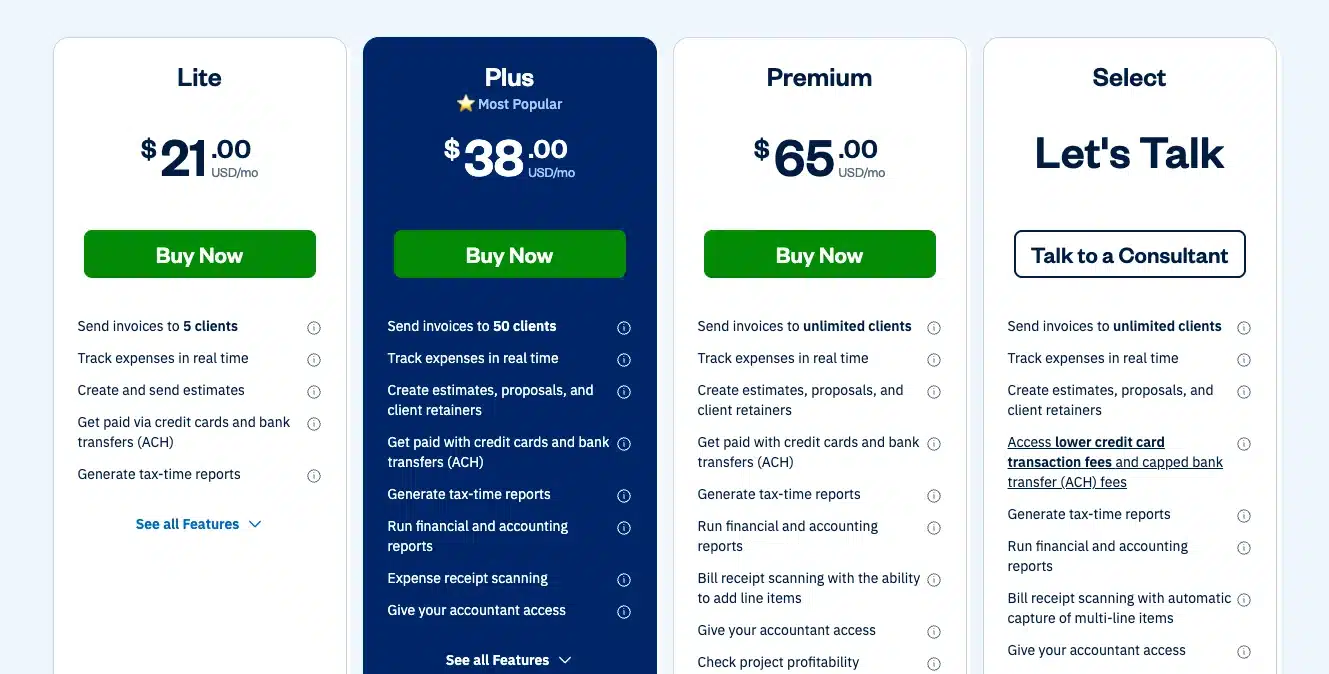

Pricing Structure and Value Analysis

Plan Comparison and Feature Distribution

FreshBooks structures its pricing across four main tiers: Lite, Plus, Premium, and Select. The Lite plan serves solopreneurs with basic invoicing needs, supporting up to 5 clients and essential features. The Plus plan, which I use, accommodates up to 50 clients and includes advanced features like time tracking, project management, and team collaboration.

The Premium plan expands client limits to 500 and adds advanced reporting, custom fields, and enhanced automation. The Select plan provides unlimited clients and includes premium support, advanced integrations, and custom onboarding. Each tier includes core features like expense tracking, mobile access, and payment processing.

Cost-Benefit Analysis for Different Business Sizes

For solo practitioners and very small businesses, the Lite plan offers excellent value at a low monthly cost. However, most growing businesses will quickly outgrow the 5-client limit and basic feature set. The Plus plan represents the sweet spot for many small businesses, providing comprehensive functionality without enterprise-level complexity or cost.

Larger small businesses and agencies will appreciate the Premium plan’s expanded reporting capabilities and higher client limits. The Select plan’s unlimited client capacity and premium support justify the higher cost for businesses with complex accounting needs or those requiring dedicated support relationships.

Scalability and Growth Accommodation

FreshBooks scales well with business growth, allowing seamless upgrades between plans as your needs expand. The platform maintains feature consistency across tiers, so upgrading doesn’t require relearning the interface or reconfiguring your workflow. Data portability ensures that if you eventually outgrow FreshBooks, you can export your information for use in other platforms.

Key Strengths That Set FreshBooks Apart

FreshBooks excels in user experience design, creating an interface that feels approachable rather than intimidating. The platform successfully bridges the gap between simple invoicing tools and complex accounting software, providing professional capabilities without overwhelming complexity. The customer service quality consistently exceeds expectations, offering genuine help rather than scripted responses.

The mobile experience represents another significant advantage. While many accounting platforms treat mobile apps as afterthoughts, FreshBooks has clearly invested in creating a genuinely useful mobile experience that enables real business management on the go.

Time tracking integration deserves special recognition. Unlike platforms that bolt on time tracking as an auxiliary feature, FreshBooks seamlessly weaves time management throughout the invoicing and project management experience, creating natural workflows for service-based businesses.

Final Verdict and Recommendations

Overall Assessment After 30-Day Trial

My 30-day trial experience convinced me that FreshBooks delivers on its core promises of streamlined business management. The ability to run billing, bookkeeping, and payroll in one place eliminated the data juggling that previously consumed hours of my time each week. Creating invoices became faster and more professional, while automated payment processing significantly improved my cash flow.

The instant financial reporting provided clarity about my business health that I’d never experienced with other platforms. Staying organized for tax season became effortless rather than stressful, and the collaborative features strengthened my client relationships while providing unprecedented visibility into project profitability.

Ideal Business Types and Use Cases

FreshBooks works exceptionally well for consultants, freelancers, agencies, and other service-based businesses that need to track time, manage projects, and invoice clients regularly. The platform particularly shines for businesses that value user experience and customer support over advanced accounting complexity.

Creative professionals, including designers, writers, photographers, and marketers, will appreciate FreshBooks’ project management integration and professional invoice customization options. The mobile functionality makes it suitable for businesses with significant travel or remote work components.

Product-based businesses can use FreshBooks successfully if their inventory needs are simple, but complex inventory management requirements would be better served by more specialized platforms.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!