It all starts here!

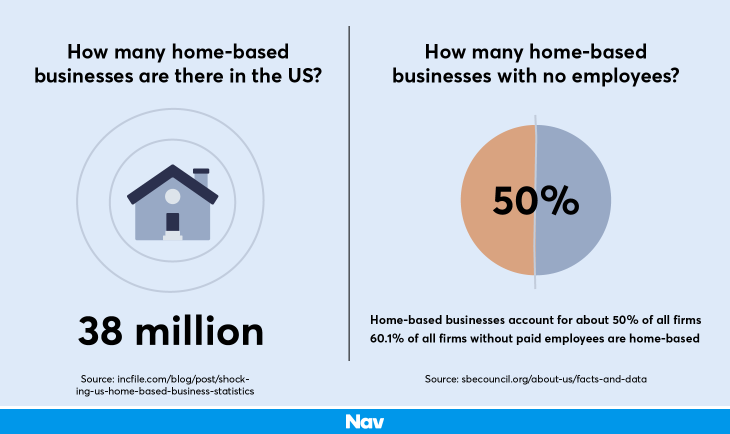

Starting an at-home business is exciting, whether it’s a side hustle or a full-time thing. You get to be your own boss, and maybe even turn your startup into a multi-million-dollar enterprise (after all, Google and Amazon both began as home-based businesses).

But just how do you start a small business from home, especially with limited money? Do you need a license or permit? What about taxes?

In this post, we’ll give you the lowdown on how to do it.

- No new business comes without risk, but there are ways of making the transition from employee to business owner easier

- Starting a business inside of your home comes with a few legal considerations, all permits and licenses need to be set up properly

Have fun! It is easy to get caught up in all of the hardships of starting a business in your home, but remember your WHY and thingsd will get easier

What type of business to start

The first step is to decide what type of business you want to launch. You’ll need to be realistic and ask yourself “What kind of business can I run from my house?”. For example, if you live in a small apartment, that rules out the ability to keep lots of stock to hand.

Apart from the practicalities, you have to come up with a unique idea. Above all, this should be something you’re passionate about.

Budget and skills

The type of business you start will depend on your budget. You might want to choose something with low setup costs, such as an online business you can run from your computer, or consider dropshipping to avoid storage costs for a product-based enterprise. To minimize setup expenses, consider purchasing refurbished equipment such as used lockers, desks, and monitors.

If money is tight, it makes sense to tap into skills you already have. This way, you won’t require training, and you’ll be able to launch the business pretty much immediately. For example, if you’re a qualified artist, you might be confident in starting your own design business.

Market research

If you’re stuck for ideas, take a look at the US Bureau of Labor Statistics and see which business types are on the up. As of August 2022, the top-growing industries were healthcare support, computing, personal care, food prep, community and social service, and legal occupations.

Once you’ve chosen a field, think about a specific gap in the market or a problem your business could solve for customers. Often, a great business idea stems from the need to solve a pain point in your own life.

You must carry out extensive competitor research, and develop an understanding of your target market.

Service vs product

Another key decision is whether to offer physical products or services. Thanks to the many ecommerce platforms, you can now sell goods online without even needing your own website.

You might decide to create subscription boxes, upcycle vintage items from thrift stores, or just sell your own stuff via Facebook Marketplace. There’s also a demand for handmade products, from jewelry to cupcakes to print-on-demand items.

Alternatively, you could use your home to offer daycare, ironing, or dressmaking or set up a photography studio or beauty salon. Or you might offer online-only services, like graphic and web design, freelance writing and marketing, or virtual courses and training.

Another option is to provide a service that takes place outside your home, such as pet-sitting, cleaning, or gardening. In this case, you’d only use your property for doing business admin or storing any necessary equipment.

The limitations of starting a business from home

It can be challenging to run a growing business from home without disruption. You may have to convert space for an office or for keeping inventory, so it doesn’t encroach into your living space. Even so, it can be hard to separate your work and home life and switch off from the business.

Although you’ll be saving money on overheads, you’ll be using your own utilities. You’ll need to comply with relevant regulations for home businesses too. Plus, it can be lonely working on your own and boring with no change of scenery.

If you’re based in Florida and considering operating your small business from home—especially if it involves transferring real estate or altering property titles—it’s important to understand the relevant legal documentation required for property ownership changes. Obtaining a properly executed quitclaim deed florida can streamline the process if you need to update ownership information, add family members to a title, or resolve ownership disputes as part of your business launch. Ensuring you have the correct form and follow all state requirements will help avoid complications down the road.

Becoming your own boss also means taking responsibility for administrative tasks that would normally be handled by your employer. You’ll need to do things like implement a fraud detection strategy when accepting payments and ensure you have reliable payments software in place. Additionally, you’ll have to deal with legal considerations, as we’ll discuss later.

The pros of starting a business out of your home

Running your business from home does have its upsides though. It means you don’t have to pay for office or warehouse space, and you can claim tax deductions on your utilities and any equipment you use for work. You’ll save money through not commuting, not to mention the reduction in stress and your carbon footprint.

It also gives you the chance to be your own boss and set your own hours. This means a more flexible schedule and a better work-life balance, which you can fit around your kids or other commitments.

If you’re not keen on sitting at your home computer all day, you could always choose a business that takes you out and about, such as being a handyman or offering gardening services.

How to start a business from home

First steps

It’s a good idea to test the water by initially starting your new business as a side hustle. This way, you can see what works and what doesn’t before you quit your main job.

Business plans

A well-thought-out business plan is essential, especially if you hope to encourage investors or apply for a loan. It should serve as a roadmap that describes where you want to go, how you plan to get there, and the resources required to achieve this.

There are plenty of online templates and business plan checklists you can use, but the basic information it should contain is as follows:

- Executive summary

- Overview of your business

- Description of your products/services

- Market analysis

- Plan for marketing and sales

- Budget and financial projections.

Business name

Choosing a name is harder than you might think! This should be simple and easy to search for, so don’t be too creative with the spelling—if you have to explain the name to people, it’s got limited viability. It also needs to be memorable so your business stays top-of-mind.

Pick a name that will work even if you expand your offering, and avoid linking your business to a specific area. Finally, ensure your chosen name isn’t already in use or trademarked and that the matching domain name is available for your website.

Business types

Now you have to decide on the legal structure of your business. The type of entity you choose will affect various aspects, including taxation and hiring employees. Here are the four main types:

- Sole proprietorship. This means the business is owned and run by one person. It’s simple to set up, but you’re liable for the business, so your personal assets could be at risk if you were ever sued.

- LLC. A limited liability company is a private limited company, which protects the owner from personal liability. LLCs don’t have to pay federal taxes directly: owners report profit and loss on their personal tax returns.

- Partnership. If the business is owned by two or more people, you can set up a partnership. Income tax is pass-through, the same as for an LLC, but partners are personally liable for any business debts.

- Corporation. A corporation makes your business into a legal entity separate from its owners. You can set up a C-corp, which pays corporate income tax, or an S-corp, which has pass-through taxation. Corporations are the most complicated entity, so it’s best to get professional help when setting one up.

Legal considerations

There are many legal considerations to take into account when setting up a new business too, from deciding on a business entity to understanding the differences between freelancing vs self-employment.

Here are some of the key things you need to know.

Registering the business

Requirements for registering your business will vary depending on its structure and location. Most SMEs simply need to register their business name with state and local governments.

To become a legal entity, you typically need to file for a federal tax ID, but you don’t have to register with the federal government (unless you want tax-exempt status or trademark protection).

If you’re an LLC, partnership, or corporation, and you conduct business activities in more than one state, you might need to file for a foreign qualification in other states where your business is active.

If you conduct business as yourself under your own legal name, you won’t need to register at all—but you could miss out on personal liability protection, and legal and tax benefits. Or if you’re trading under another name, then “doing business as” (DBA) status might be legally required.

Licenses

Depending on your industry and the specific requirements of your state, county, and municipality, you may need a business license—even as a freelancer or consultant. There are several types:

- A general business operating license. All businesses must obtain a local city or county business license.

- An industry license. Some home-based businesses require professional licensing or certification at the state or federal level. This includes daycare centers, hair salons, and legal or financial services.

- A seller’s permit. This allows you to collect sales tax on the goods you sell. It may be part of the general business license, but some areas require a separate sales tax license as well.

- A VAT license. This is only applicable if you sell goods and services to foreign consumers.

Home permits

You’ll typically need a home occupation permit too, which shows that your home business doesn’t significantly increase noise or traffic in your neighborhood or harm the environment.

There are often neighborhood restrictions imposed by homeowners’ associations (HOAs), and if you’re renting the property, you need to get the go-ahead from your landlord.

If your business involves customers coming to your home—such as for daycare or beauty treatments—you may need an inspection and permit from the local fire department. And, if you’ll be selling food and beverage products, you’ll need a health department permit that covers food handling, preparation, and storage.

Property use and zoning permits

Properties in the US are divided into designated “zones” for commercial, industrial, or residential use. A zoning permit ensures your business complies with these ordinances. Your home will typically be in a residential zone, which means you’ll need special permission (called a “variance”) to run a business from the property.

You might want to promote your business with a sign on your home or in your front yard, but again, you’ll need to check if this is allowed. Most cities and counties have specific ordinances covering the size, type, and location of business signs. Please get permission from your HOA or landlord.

Licensing, permit, and zoning regulations vary widely across the US, so it’s a good idea to get advice from the Small Business Administration (SBA).

Financing and taxes

Sound financial management is essential for a small home business. That’s true whether you plan to stay small and local or your eventual goal is to reach IPO status and start trading on the stock exchange (in which case, you’ll need an accounting checklist for IPO).

Here are some ways to maximize every cent.

Bank account

It’s important to keep your business and personal finances separate, so set up a new bank account straight away. Create a business checking account for regular transactions, a savings account to put money aside for taxes and accrue interest, and consider a business credit card for expenses.

Before opening a business account, you’ll need to apply for your employer identification number (EIN). This is a federal tax ID that identifies your business entity. It only takes a matter of minutes to apply for free on the IRS website and receive your EIN.

Taxes

Small business owners need to get their heads around various types of taxation, so it’s worth hiring an accountant to help you. The amount of taxes you’ll pay depends on how much revenue you earn, your business entity, the state where you do business, and whether you have employees.

If you expect to owe more than $1,000 in taxes for the year, you’ll need to pay estimated taxes every quarter. These are deducted from your total liability when you file your tax return.

The good news is that you can claim tax deductions for a home business. This includes a proportion of your rent and utility bills, plus equipment and office supplies. For example, if you’ve bought software specifically for work, such as accounting tools or ERP solutions, you can deduct the cost.

Insurance

Business insurance is essential for a sole proprietor or partnership where you’re personally responsible for liabilities. It’s also worth having for LLCs or corporations.

Check your homeowner’s insurance to make sure the policy covers you for running a home-based business. If you’re planning to employ people or use freelancers, look at the insurance implications of this.

Ready to start a home business?

Running a home business is hard work. It can be lonely, and you might find it difficult to separate your work and home life. But on the plus side, you’ll be saving money through lower overheads and tax deductions, and you won’t have anybody telling you what to do—you’ll make your own decisions and set your hours.

If it’s something you want to pursue, don’t be afraid to ask for help when you need it. Consider using freelance accountants and legal advisors, and explore every avenue for finding customers. Freelancers can also use the myriad of articles and podcasts on Millo to discover tips and ideas for running a successful home business.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!