Taxes for any business, large or small, can be daunting — especially for those just starting out. They leave you with so many questions…who gets a 1099? What is a 1099? When are my taxes due?

I get it…it’s overwhelming. We procrastinate on it because the reality is — taxes suck.

But you have to do them, so it’s better to educate yourself now to be prepared for next year.

We hope by reading this article you have a better, and more clear understanding of the one thing none of us can avoid — taxes!

What is a 1099?

When filing your taxes, you are required to send them to the IRS (Internal Revenue System) via many various forms. The most common form that almost all freelancers need to be familiar with is a 1099.

Additionally, understanding how to make paystubs can aid in maintaining accurate financial records.

So what is a 1099? A 1099 is a tax form used to report income for everything from self employment earnings (freelancers) and government payments to interest and dividends.

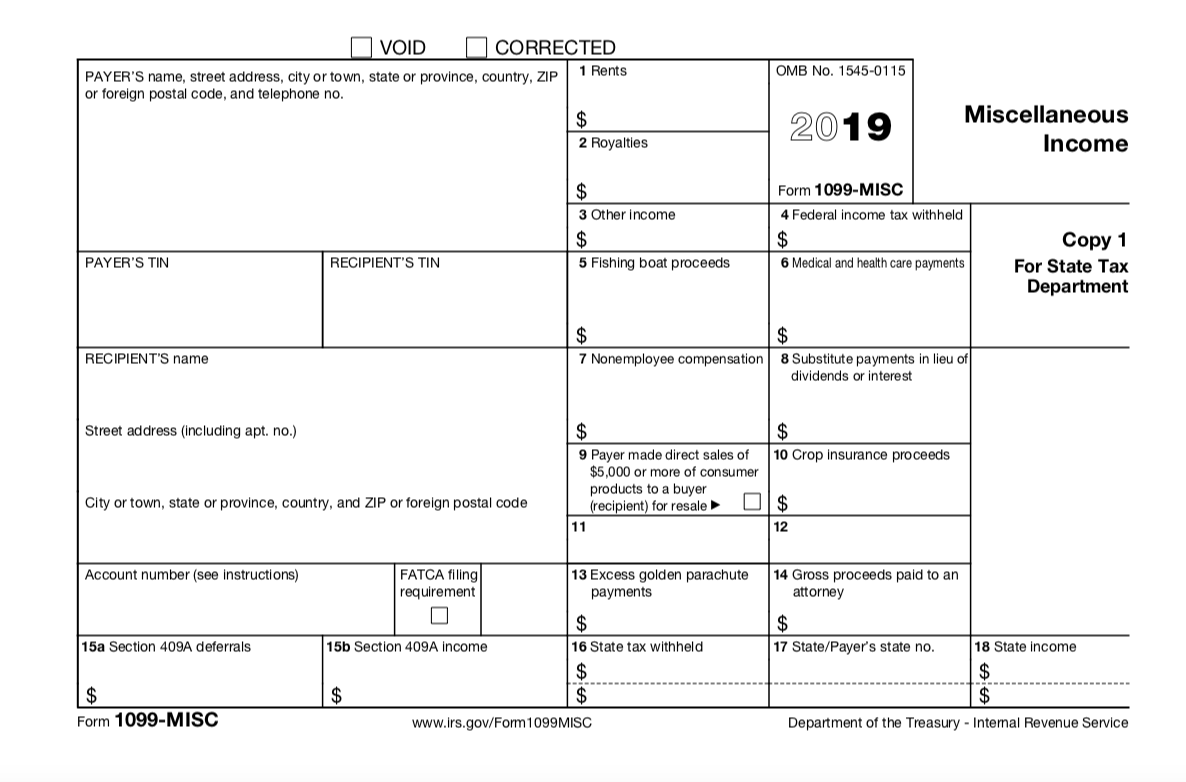

To give a visual, one of the most common forms, the 1099-MISC, looks like this:

Who gets a 1099?

As a freelancer/independent contractor/side hustler, you will receive a 1099-MISC form from any company or organization that hired you and paid you $600 or more during the calendar year.

You then use the 1099-MISC as documentation towards your business income received when doing your business taxes. If you juggle many clients throughout the year, you could end up receiving quite a few 1099s.

Tip: Use accounting software like Freshbooks or Bonsai to keep track of your income from your clients. Then, when you receive your 1099s in January/February, you can refer back to your own records to verify the amounts are all correct. You always want your actual income received to match what is shown on the 1099-MISC.

Who is supposed to send out a 1099?

A company or individual that hires an independent contractor, and pays them more than the $600, as mentioned above, needs to submit a 1099 to the IRS with their taxes, as well as send a copy to the independent contractor themselves.

An independent contractor includes anyone who classifies as: an individual, a partnership, a Limited Liability Company (LLC), a Limited Partnership (LP), or an Estate.

3 Questions about form 1099 you’ll want to know

1. What is the difference between a W-2 and a 1099-MISC?

Despite the fact that both forms report income, they are very different.

If you are a company hiring a full-time employee, you will need to issue a W-2 form. If you are an employee, you’ll receive this W-2 as a form of documentation of your income, including taxes withheld from Social Security, Medicare, your State, and more. All of these are dependent on your withholdings and where you live, so refer to the IRS website for accurate information.

On the other hand, if you are a company/person hiring someone just as an independent contractor, you’ll issue a 1099-MISC form. Be sure you collect a W-9 first and meet the deadline requirements for sending out your 1099-MISC forms — we’ll cover more on both of those later.

2. What are the common types of 1099 forms?

Although there are actually 15 types of the 1099 forms, these are the most common:

1099-MISC: This is the most commonly used out of all of the 1099 form options. Freelancers are the most common individuals who gets a 1099 for their taxes, so long as they meet the requirements.

1099-B: This form is used for brokerage transactions or barter exchanges.

1099-C: When a debt of more than $600 is forgiven, the creditor usually files a 1099-C with the IRS as well as sending a copy to whom the debt was forgiven. In turn, there may be taxes to be paid.

1099-DIV: This form is used when one receives $10 or more through dividends and other stock distributions.

1099-INT: If you earned $10 or more from taxable interest from your bank, credit union, brokerage or another financial source you will receive this form.

1099-R: This form reports the distributions from annuities, pensions, retirements accounts, life insurance contracts, profit-sharing plans, and more.

3. When do I send a 1099?

As an employer/individual, knowing when to send out your 1099 is important. Per IRS guidelines, you must postmark your 1099 forms by January 31st of the following year.

So, for example, any 1099s you need to issue for the 2019 tax year should be postmarked by January 31, 2020.

Preparing your 1099-MISC form

Understanding how to prepare your 1099 form could be the difference of many factors. Because each form has various boxes you could fill out, we’ll focus on just the 1099-MISC form.

Where can I get a 1099-MISC form?

The only place you should be getting a 1099-MISC form is from the IRS website. Now, here’s an important note: you cannot download this form to fill out and send to the IRS — they will NOT accept it.

Instead, you must obtain official copies of the 1099 form. You can do so by ordering them on the IRS website here.

There are options to file electronically, as well as on paper. However, if you file on paper you also have to submit a Form 1096. Just like the 1099, you must order an official 1096 paper form to fill out and submit.

How Form W-9 is helpful (and necessary) for preparing a 1099-MISC

As an employer, the very first step you should take when hiring an independent contractor is having them fill out a W-9. This form you are able to download from the IRS website and have your contractor fill it out and return.

This form provides you valuable information, such as their name, company, tax classification, tax id/social security number, and address so that come tax time you know exactly who gets a 1099 and all of their information.

Where do I report the information given on a 1099 form?

In order to fill out your 1099-MISC form correctly, there are many steps for you to take.

First, you must gather the required information needed. This includes:

- The total amount you paid them during the tax year

- Their legal name

- Their address

- Their tax id number (or their Social Security Number, unless they’re a Non-Resident or Resident Alien)

As we just mentioned in the prior section, all of this is obtained from the W-9 (besides the amount paid), so having that form completed prior to your 1099-MISC is a priority.

Once you have all of the required information, use it to fill out Form 1099-MISC in the fields as indicated on the form instructions.

Upon completing your form, you must submit Copy A to the IRS by January 31st, whether you file by paper or electronically. In addition to mailing Copy A, you must mail Copy B to the independent contractor by January 31st as well. Contrary to Copy A, you are able to download Copy B from the IRS website to fill out and send to your contractor.

Now, if you filed your 1099 form via paper mail, you need to prepare Form 1096 and send it in to the IRS as well. This form is used to track who gets a 1099 for that tax year. This form is also due by January 31st.

Lastly, depending on where your business is located, you may also have to file 1099 forms with your state. Check in with an accountant in your area to ensure you’re compliant with your state’s 1099 filing requirements.

What happens if I ignore the 1099 form?

You definitely DO NOT want to ignore any 1099 form you receive. You can get in serious trouble with the IRS by not filing your taxes properly and could get slapped with fines starting from $50.

When you are receiving a 1099, that means the issuer who sent it to you is reporting it to the IRS on their taxes. Therefore, the IRS will know that you ignored it and, trust me — you don’t want on Uncle Sam’s bad side!

So determine who gets a 1099, fill out that W-9, and stick to the deadlines.

Before you send out a 1099

Now that we’ve covered the 1099 in detail, there are a few exceptions as to who gets a 1099.

As mentioned, if you are an employer with employees, you do not send 1099s. Instead, you send a W-2.

Also, if your independent contractor is registered as a C corporation or S corporation, you do not need to issue a 1099. You can find this out by referring to the Form W-9 they filled out.

So, are you ready to tackle those 1099s?

Filing your taxes can be intimidating. If you do not feel comfortable doing them yourself, you should consider hiring a CPA or professional accountant. It is still of the utmost importance for you to have a good understanding of the process.

Also, if you do decide to hire someone to do your taxes, make sure you do your research and find the right match for you!

We hope that all of the information provided gives you the ability to stress a little less during tax season.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!