Freelancing isn’t a niche career path anymore. It’s the new normal. Between 2020 and 2024, the freelance market in the U.S. grew by 90%, and by 2027, the number of freelancers is expected to reach 86.5 million. That’s more than half the country’s total workforce.

With so many people ditching their 9-to-5s, modern freelancers are no longer the stereotypical creatives and contractors. They’re full-fledged businesses. Just like any regular occupation, freelancers must stay on top of responsibilities, like taxes.

Missing a quarterly payment can lead to the IRS coming knocking, slapping penalties and interest on your business.

👋 Psst...Have you seen the all-new Feedcoyote yet? They've got a new look, more freelance opportunities, and the best collaboration tool for freelancers! Join over 100,000 fellow freelancers who network, find clients, and grow their business with Feedcoyote. Join for Free »

Even more minor issues, like failing to track your expenses properly, mean you’re leaving money on the table when it’s time to file.

Tax apps make these responsibilities easier to manage—and often at a fraction of the tax preparation cost you’d pay for a traditional accountant. Instead of juggling spreadsheets, trying to remember every deduction, or keeping an accountant on retainer, you get access to purpose-built tools.

Many include features like mileage tracking, estimated tax calculations, and a receipt tracker for taxes that helps keep records organized year-round.

In this guide, we review the top 10 tax apps for freelancers based on features that matter: smart integrations, user experience, support options, and tools designed specifically for independent work.

The 10 Best Tax Apps for Freelancers

Before choosing a tool, think about how you work. Do you need something lightweight that covers the basics, or a more robust system that handles receipts, deductions, and multiple income streams?

Each of the options below is designed with freelancers in mind, but they offer different strengths depending on your workflow and tax requirements.

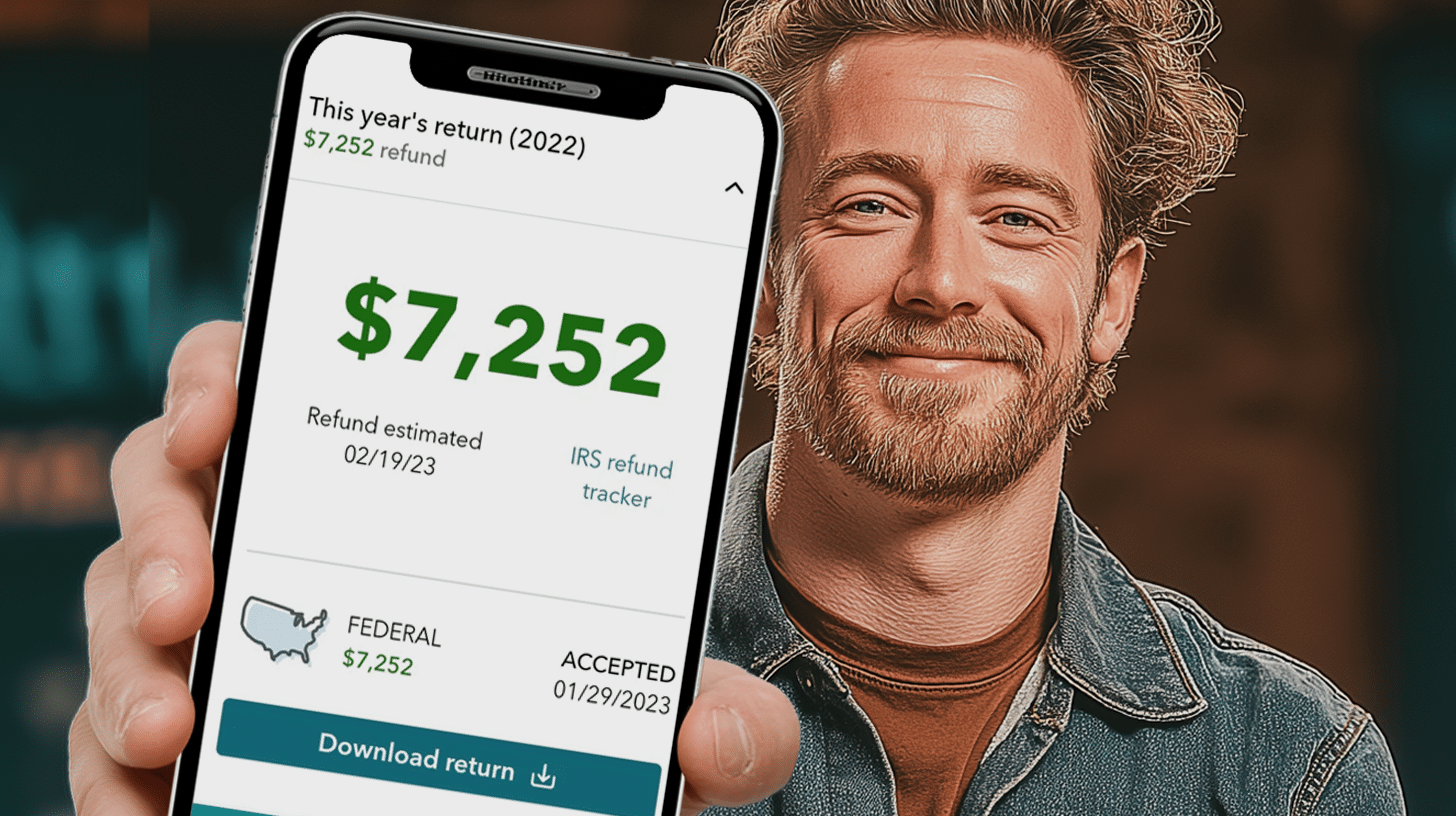

1. TurboTax Self-Employed

TurboTax Self-Employed is designed specifically for freelancers and independent contractors. The Q\&A-style setup takes you through each step of the tax filing process by prompting you with questions to uncover relevant deductions and handle mixed income types with less guesswork.

If you’re unsure how something works, the platform includes tutorial videos and help articles that explain key tax topics in plain language.

Key Features:

- Industry-specific deductions: Identifies write-offs unique to various freelance professions, such as design, consulting, or even rideshare driving (Uber or Lyft).

- QuickBooks Self-Employed integration: Includes a complimentary year of QuickBooks Self-Employed for easy tracking and mileage logging.

- 1099-NEC and 1099-K snap and autofill: Upload tax forms using your phone’s camera or gallery, which is helpful if you juggle multiple clients and don’t want to spend hours typing in income details.

- Live expert support: Offers access to tax professionals for real-time assistance and review.

- Audit assessment: Provides a personalized review of your return to identify potential audit risks.

Best for: New freelancers or anyone just starting out who wants extra guidance and peace of mind when filing.

2. H\&R Block Self-Employment

H\&R Block Self-Employed is a good fit for freelancers who want the flexibility of filing online, but with the option to get real help when they need it. You can work through the return on your own, but if you get stuck, live chat and AI-driven prompts are built in to answer questions as you go.

There’s also the option to hand things off to a tax pro. This is a helpful fallback if things get complicated or you don’t want to deal with tax complexities at all.

Key Features:

- Live chat and AI Tax Assist: Get real-time answers while you’re filing, without digging through help docs.

- Mobile upload: Take photos of your 1099s and other tax forms to import them directly into your return.

- Built-in expense tracking: Lets you tag and organize business expenses throughout the year, so you don’t need to rush during tax season to remember what counts as a write-off.

- Option to upgrade to a tax pro: If things get messy, you can hand off your return to a professional.

Best for: Freelancers who want to file solo but like knowing expert help is just a click away.

3. TaxSlayer Self-Employed

TaxSlayer Self-Employed is built for freelancers who know what they need to file, like 1099 income, Schedule C expenses, and estimates, and want a tool that helps them do it quickly. It offers guided assistance for all features, so you don’t miss a single deductible claim.

Key Features:

- Guided 1099 and Schedule C support: Step-by-step assistance for reporting self-employment income and expenses.

- Access to tax professionals: Unlimited phone, email, and live chat support for tax-related questions.

- Quarterly tax payment reminders: Sends alerts so you don’t miss IRS deadlines. This is especially useful if you earn from multiple clients and need to plan ahead for payments.

- Audit assistance: Support from certified tax professionals in case of an IRS audit.

Best for: Freelancers and independent contractors seeking an affordable, no-frills tax solution with essential support features.

4. TaxAct Self-Employed

TaxAct Self-Employed has become a popular app for freelancers because of its simple interface and straightforward filing process. It provides step-by-step guidance through income reporting and deductions. If you want to dig deeper, you can sift through the 300-term tax glossary.

Key Features:

- Deduction Maximizer: Helps you find industry-specific deductions to reduce taxable income for what you do specifically.

- Self-Employment Tax Calculator: Estimates how much you’ll owe, so you can plan for quarterly payments and avoid surprises at tax time.

- Xpert Assist: Provides on-demand access to tax experts for personalized guidance.

- Real-time refund tracking: Shows how your refund or balance due changes as you add income and deductions, so you always know where you stand.

Best for: Freelancers with straightforward finances, like writers, consultants, or early-stage contractors, who want a simple, affordable filing tool without extra add-ons.

5. Cash App Taxes

Cash App Taxes provides a 100% free platform for filing both federal and state tax returns (only available in the U.S.). The app guides users through the process, supporting various tax situations, including self-employment. While it lacks live expert support, its straightforward interface is suitable for those with relatively simple tax needs.

Key Features:

- 100% free filing: No fees for federal or state returns, regardless of income type or complexity.

- Supports various tax forms: Handles 1099 income, investments, and cryptocurrency transactions.

- Mobile-friendly: File taxes directly from your phone using the Cash App.

- Audit defense included: If you’re audited by the IRS, a representative will help you respond to notices and navigate the process at no extra cost.

Best for: Freelancers with straightforward tax situations who need a completely free, mobile-friendly filing option.

6. QuickBooks Self-Employed

QuickBooks Self-Employed is built for freelancers who want to stay tax-ready year-round, not just in April. It connects to your bank and credit card accounts, and you can log road mileage for expenses. You also get a running estimate of what you’ll owe each quarter, making it easier to budget and avoid unexpected charges.

Key Features:

- Automatic transaction categorization: Connect your bank and credit card accounts to import and categorize income and expenses automatically.

- Mileage tracking: Use the mobile app to automatically track and categorize business mileage using your phone’s GPS.

- Real-time tax estimation: Receive estimates of your quarterly tax obligations based on your income and expenses.

- TurboTax integration and export features: Easily export your data to TurboTax Self-Employed for fast filing. This also helps facilitate big data integration, which means combining large volumes of data from multiple sources. The export feature on QuickBooks is robust enough to help freelancers keep track of data with much more ease.

Best for: Freelancers who drive for work and charge expenses, like photographers, consultants, or rideshare drivers.

7. FreshBooks

FreshBooks is an accounting software tailored for freelancers who manage multiple clients and projects. While it doesn’t handle tax filing directly, it simplifies preparation by organizing invoices, expenses, and billable hours throughout the year. FreshBooks makes it easier to hand off clean records to an accountant or prepare for filing yourself.

Key Features:

- Invoicing and payments: Create professional invoices, accept online payments, and set up recurring billing to get paid faster.

- Expense tracking: Automatically import expenses from your bank account and categorize them for tax time.

- Mileage tracking: Use the mobile app to track business mileage for deductions.

- Financial reports: Generate profit and loss statements, tax summaries, and other reports to understand your business’s health.

Best for: Freelancers who handle multiple projects or clients and want organized records to simplify tax prep. It’s also ideal if you prefer managing tasks like basic accounting and email tracking within a single platform.

8. Keeper Tax

Keeper Tax uses AI to scan your bank and credit card transactions. It also functions as a powerful receipt tracker for taxes, organizing deductible expenses automatically so you don’t miss a thing.

It’s built for freelancers who want to track write-offs without doing it manually. You can review, categorize, or set rules for recurring expenses. When tax season rolls around, Keeper can even file for you using the deductions it’s already tracked.

Key Features:

- Automated expense tracking: Connect your accounts and let Keeper flag tax-deductible expenses for review.

- AI-powered deduction finder: Suggests write-offs based on your spending habits and freelancer profile.

- Custom rules: Set up recurring tags to automate how certain expenses are categorized.

- Optional tax filing: File directly through Keeper, with all your tracked deductions already included.

Best for: Part-time freelancers and gig workers who need hands-off deduction tracking with the option to file through the same app.

9. Bonsai Tax

Bonsai Tax offers self-employment software to track expenses and estimate taxes. It connects to your financial accounts, highlights deductible expenses, and gives you a running estimate of what you owe. It doesn’t file taxes, but it organizes your finances so filing becomes a lot easier.

Key Features:

- Automated expense tracking: Monitors transactions and categorizes them in real time.

- Deduction identification: Flags write-offs based on freelancer-friendly categories.

- Tax payment forecasting: Estimates your quarterly obligations, helping you set aside the right amount and avoid surprise IRS penalties.

- Simple reports: Summarizes income and expenses to prep for tax filing.

Best for: Independent professionals with a predictable workload who want clean deduction tracking without extra features.

10. FlyFin

FlyFin pairs AI-powered deduction tracking with CPA-filed tax returns for a full-service experience for freelancers. The app scans your expenses to identify potential write-offs and provides real-time tax estimates. When it’s time to file, you can submit all documents through the app.

Key Features:

- AI-driven deduction tracking: Automatically analyzes expenses to uncover eligible tax deductions.

- CPA-prepared tax filing: A certified CPA reviews your information and files your taxes on your behalf.

- Quarterly tax estimates: Calculates how much you’ll owe each quarter, so you can set aside the right amount and avoid surprise IRS penalties.

- Audit protection: Includes audit insurance, with CPAs handling communication with the IRS if needed.

- Unlimited tax support: Access to CPAs for questions and guidance throughout the year.

Best for: Tech-forward freelancers, like digital nomads, who want to use the latest AI and marketing tools, like Brevo, so they can offload the time-consuming parts of freelancing, especially during tax season.

How To Choose the Right Tax App (and Receipt Tracker for Taxes)

The right app depends on your workflow, goals, and how hands-on you want to be. Here are some quick tips for choosing your app:

- Match the tool to your work style: Gig workers and contractors, from graphic designers to rideshare drivers, often benefit from apps with mileage tracking and automatic expense categorization. Creators and consultants may prefer tools with invoicing or time-tracking features.

- Decide if you need built-in filing: Some apps include tax filing with CPA support, while others focus solely on organizing deductions. Choose based on whether you plan to file yourself or want it handled for you.

- Look for a built-in receipt tracker for taxes: This can help you stay organized throughout the year, especially if you manage a lot of business purchases or work with physical receipts (that are easy to lose).

- Stick to your budget: Free apps work well for simple needs. If you need more automation or hands-on support, a paid option may end up saving you money.

- Check for useful integrations: Look for tools that sync with your bank, invoicing platforms, or accounting software to cut down on manual entry.

- Prioritize usability and support: A clean interface and access to real humans (if needed) can make tax season less stressful.

Checking these boxes will help you narrow it down and avoid switching apps mid-year.

Final Thoughts

Tax apps can take a major weight off your shoulders, saving time, keeping your finances organized, and most importantly, ensuring your setup stays compliant. Whether you’re just starting out or deep into a freelance career, a little structure (and technology) goes a long way.

Many of these tools offer free trials, so don’t be afraid to test a few and see what fits your setup.

For more tips on building a sustainable freelance business, check out the latest articles on Millo or explore more of our best tools for freelancers and entrepreneurs.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!