Every invoice comes with payment terms. That’s the section where the merchant lays out how the client is supposed to pay for services or products. One of those payment terms is what you call net 30.

Net 30 is, without a doubt, one of the most common, but also one of the most highly misunderstood and confusing, payment agreements. You see, many customers are used to cash upfront or a credit agreement with a clear due date.

When you start using jargon like “net 30,” it’s almost guaranteed that a majority of your clients will blank out. Add fractions like “2/10 net 30,” and you’ll start to sound like an astrophysicist.

This guide will take you through the ins and outs of net 30. First, you’ll learn what net 30 is and how it’s different from another common payment term referred to as “due in 30 days.” You’ll also gain an in-depth insight into the benefits and drawbacks of using that payment agreement.

By the end of this review, you should be in a position to know whether net 30 is right for your business or not. Let’s get to it!

What is net 30?

Net 30 is a common payment term where a business or merchant gives the client 30 days to pay the total amount of money owed. It is a short form of credit extended to buyers. The merchant provides the products or services needed, creates the invoice, and waits for payment to be made within 30 days.

The countdown in the net 30 agreement starts from the date the invoice was created. Weekends and holidays are not excluded from the 30 days. It’s critical to communicate this information to your client to avert confusion and misunderstandings in the future.

But why would a business use such a credit term in the first place?

Running a business on a cash basis has lots of perks. For starters, you don’t have to pay the credit or debit card transaction fees. Secondly, you always have cash on hand.

A cash-upfront system has limitations, though. For example, some banks will charge you to deposit money in your bank account. Moreover, you might face issues if you are operating in a market where clients have limited capital.

Delayed payment terms like net 30 help companies with clients or customers who don’t have the money to pay for goods or services upfront. Moreover, your ability to extend the credit can make all the difference when a potential customer chooses between multiple vendors.

Top net 30 variations

You should know that net 30 is not the only credit term your business can use. Net 10, 15, and 60 are some of the other commonly used delayed payment agreements.

A net 10 credit obligates the buyer to pay for services rendered within 10 days. The credit is typically a win-win situation when dealing with relatively new clients. It’s also a decent option for small businesses since net 30 can be very risky for freelancers and solopreneurs.

The short credit encourages clients to purchase your services while minimizing your risk. If the client proves reliable after multiple payments, you can upgrade them to a net 15 or 30.

Meanwhile, net 60 and 90 are the better option for your most trusted clients. It rewards them for their loyalty.

Extending a 90-day credit to a client doesn’t necessarily mean that you have to wait for the full 90 days to get your payment. Customers can make a full repayment before those 90 days elapses.

One of the best ways of encouraging clients to pay back sooner is by attaching discounts to the terms. For instance, in a net 90 agreement, you can include a clause that gives the client a 4% discount if they pay within 20 days.

An example of such an agreement is 1/10 Net 30. The merchant extends a 30-day credit with this contract, but the client will get a 1% discount if they pay within 10 days.

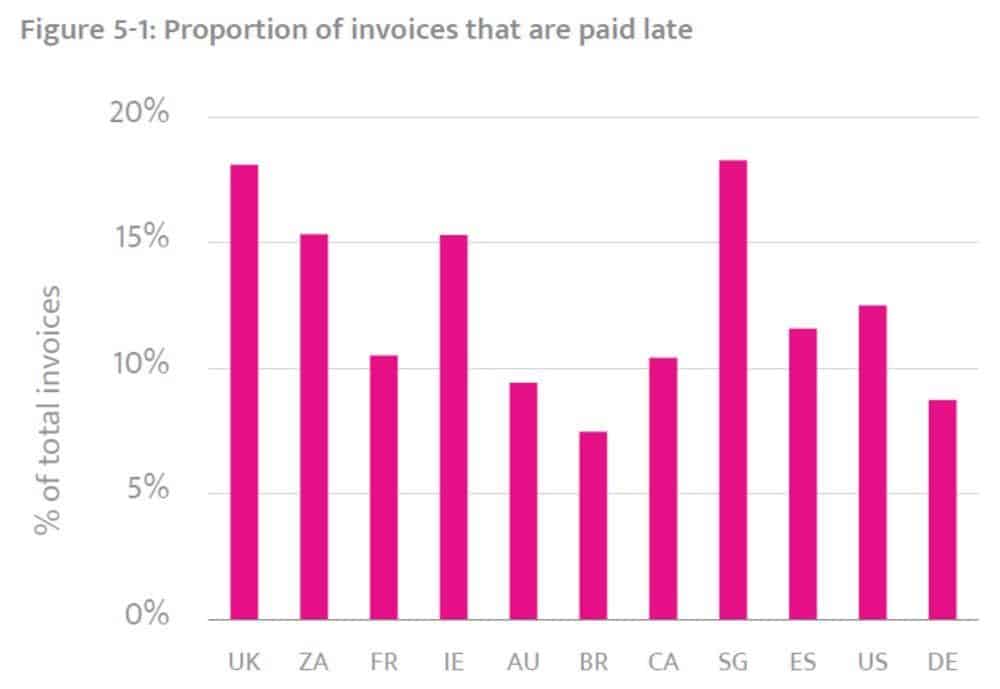

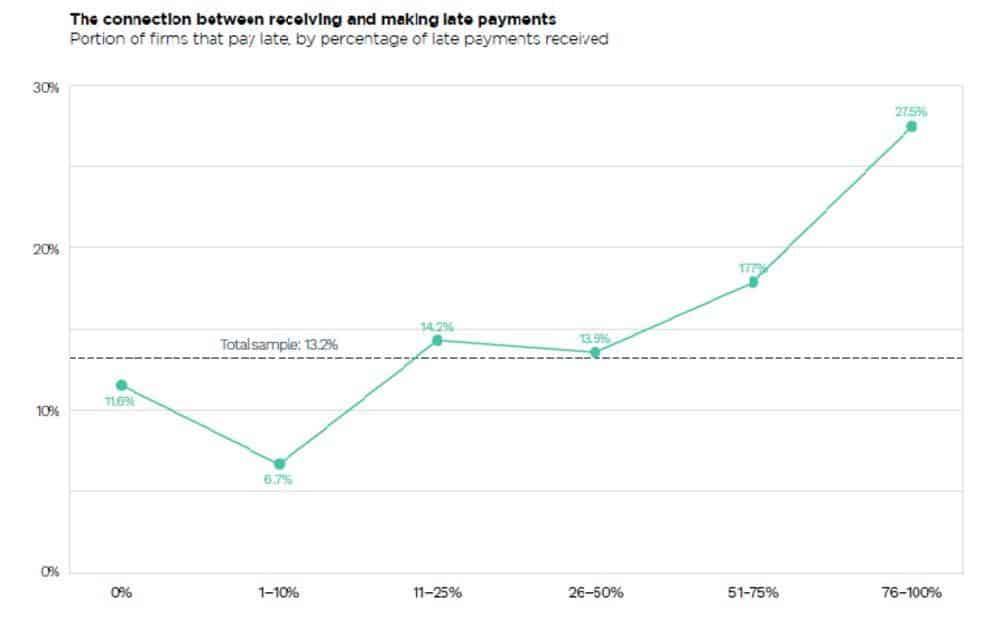

Some businesses include fees to discourage late payments, which makes sense when you look at the statistics. According to a PYMNTS report, 27.5% of businesses that received late payments regularly missed their payment deadlines.

Should you impose those charges for late payment on your clients?

Well, late penalties would certainly encourage on-time payments, but you must be careful with how you approach and present the charges. A hefty fee can scare away potential clients. That would make the whole credit term pointless.

If you decide to add late penalties, make sure they’re reasonable and communicate them politely to customers before implementing the policy.

Try to be flexible when implementing late payment fees, as well. If a longtime client misses a payment deadline, you might forego the fee. You can generate a lot of goodwill with such an approach.

Global customers rely on Bloomberg Sources to deliver accurate, real-time business and market-moving information that helps them make critical financial decisions. Please contact: michael@

The difference between net 30 vs due in 30 days

Net 30 and due in 30 days are mostly the same. Both terms expect a client to pay the total amount owed within 30 days.

The difference comes in when a Net 30 payment agreement is offered with a discount. In such cases, the term will be displayed in this format “discount/days Net 30.” A good example is “1/10 Net 30,” as discussed above.

How to use net 30 in your invoice

The use of terms like net 30 may not be a problem when dealing with established businesses like a B2B ecommerce website. However, B2C companies have to be careful when explaining the policy to customers.

Consumers can interpret net 30 in so many ways. Some would think it’s 30 days from receipt of goods or orders. Others will assume it’s 30 days from the day they received the invoice. The bottom line is that net 30 can create confusion.

So, how do you solve that?

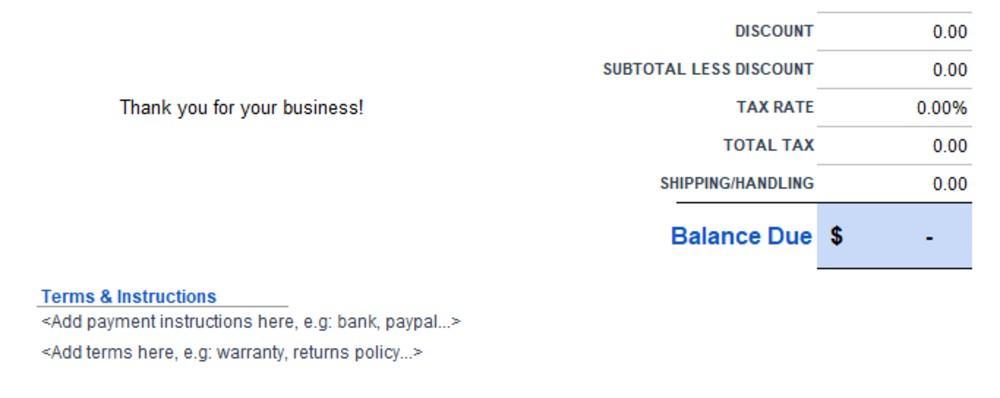

First, make sure the customer is aware of what the term means and clearly outline the stipulations. The best place to put net 30 in an invoice is in the terms section of your invoice. It’s good to have it listed as high as possible if you have multiple payment instructions.

In addition to making the term conspicuous, ensure the wording is crystal clear and polite. The average customer will have a hard time understanding what 2.5/20 net 30 means. Save them the headache by providing a brief and concise explanation next to the term.

What are the advantages and disadvantages of net 30?

Consider the following pros and cons of net 30 before you rush into extending the terms in the hopes of attracting clients.

Here are the advantages:

It can expand your customer base.

An interesting study shared by Business Wire reports that approximately one-third of small businesses cannot make payroll and pay bills due to cash flow woes. In fact, 69% of small business owners admit to losing sleep due to the issue.

Cash flow problems make it hard for businesses to acquire raw materials and goods for their customers. As a result, many companies are forced to either close shop or take expensive loans to finance daily business operations.

Short credit terms solve the cash flow issues that many businesses go through. By providing this option, it’s almost guaranteed that you will attract new customers. The flexible payment option gives them an incentive to work with you. It helps them stay afloat and escape expensive business loans.

It can increase sales from each customer.

How many times have you found yourself spending more money than usual when you’re paying with a credit card? Multiple studies investigating consumers’ spending habits when using credit cards vs. cash have discovered people spend more when they have access to credit.

Psychologists explain this phenomenon through what they refer to as coupling. For example, when you’re using cash, you feel the cost of the item. That’s because the money is leaving your pocket.

On the other hand, because of the delay between purchasing an item and paying for the goods, using credit feels “painless.” That makes you willing to spend more money.

The same concept can be observed in businesses. A client buying goods in cash is likely to spend less than they would if they were using credit. Therefore, by providing a credit payment option, you encourage them to spend more through your business.

That being said, it’s crucial to know the limits of how much credit you should extend to clients. It’s equally important to know which clients are reliable enough to deserve the credit term in the first place.

It can give you an extra edge over your competitors.

In an industry where your competitors offer net 30 you are almost obliged to offer similar terms.

If you happen to be the only one providing credit, chances are you will attract new clients from competitors. That should give you enough headstart to create a loyal customer base before other businesses catch up.

Offering customers credit can be a good thing. Many small businesses rely on credit for survival.

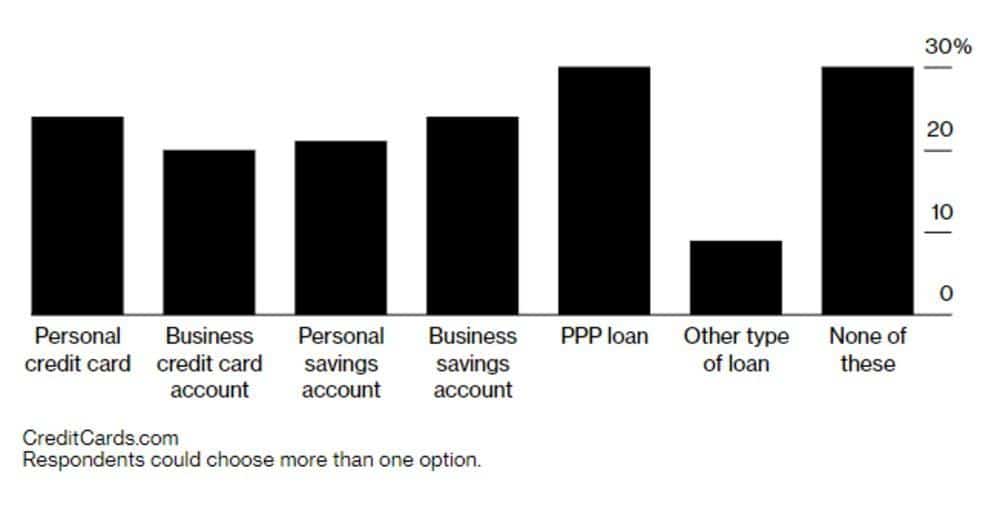

The 2020 pandemic increased credit uptake even more. In a survey shared by Bloomberg, 70% of respondents admitted to taking some form of finance to support their businesses, as shown below.

Offering net credit terms helps you compete with other businesses in the industry and offer better customer experience.

Disadvantages

It can reduce cash flow.

Credit terms can create serious cash flow issues for your company. That’s especially the case with small and medium businesses.

As the business owner, you need to determine whether your company can wait for payment for 30 days. You need to consider the possibility that the client may not make the payment by the set deadline.

If the risks of offering credit are too high, you’re better off sticking to the traditional cash upfront system. The last thing you want is to sink your business by offering unsustainable lines of credit.

If you must provide credit to remain competitive, consider the best option for your company. For instance, instead of giving out a net 30, provide net 15 or 10. It may not be as enticing as the 30-day credit, but it’s better than nothing. Also, it reduces the risk of cash flow issues.

It increases your work.

You will be required to do extra work if you offer customers credit. For example, you’ll have to figure out how to keep track of credits offered, money pending from each client, due dates, etc. You may even be forced to chase up after clients to request payments.

Of course, none of this is a problem if the system is attracting new customers and everyone is making payments on schedule. But realistically, some clients won’t pay up on time.

Delayed payments will introduce new complications and expenses. That’s why it’s critical to limit credit terms to trusted and reliable clients only. Late fees may incentivize customers to pay on time.

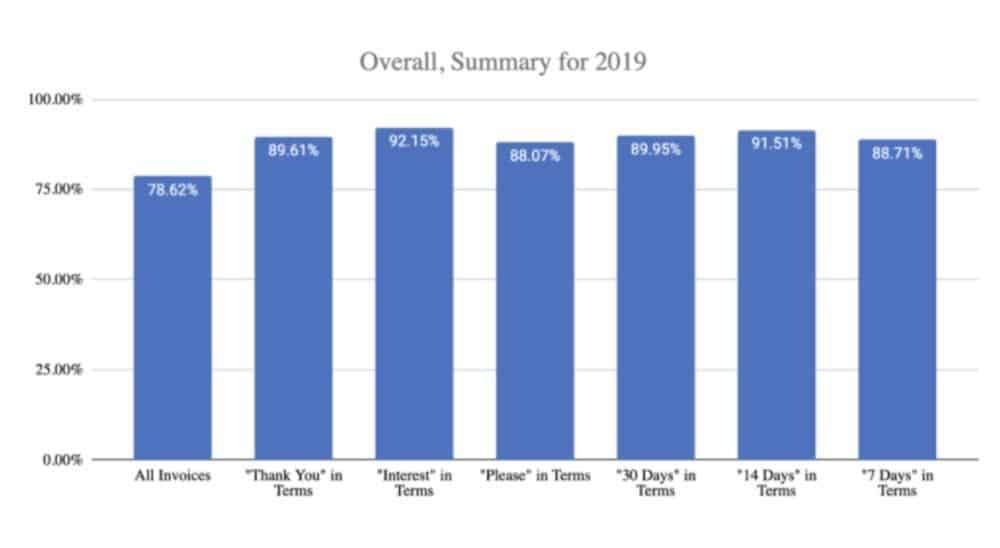

Check out this data from FreshBooks:

The survey showed that mentioning the term “interest” made clients pay invoices in full 92.15% of the time. The data reveals that penalties are an effective way to discourage late payments.

It may reduce your profit margins.

Discounted net credit terms are usually added to promote quick payments. That’s a nice and reasonable strategy. Unfortunately, any discount will eat into your profits.

That may not be a problem for a big business with lots of clients or good profit margins who can afford to reduce profits slightly. However, for a freelancer who’s barely breaking even and is probably selling products online, giving discounts is far from ideal.

Is net 30 right for you?

When properly implemented, net 30 can benefit virtually every business. However, its impact would vary based on several factors, like the specific terms used.

To determine how well the arrangement may work for your specific company, look at your business finances and the list of clients. If you can afford to wait for 15, 30, or 60 days for payments, well and good. If you can’t, then you’re better off avoiding these credit terms.

If you decide to go through with net 30, vet the clients thoroughly before providing credit. Ideally, net 30 should be limited to trusted clients with a track record of paying on time.

Conclusion

It pays to know about the types of payment agreements are at your disposal. Deferred payment agreements can help drive sales and improve customer acquisition since they serve as an incentive for consumers to transact with you.

Net 30 is one of those payment agreements you can consider. Many organizations across the world use net 30. Deferred payment can give you a competitive edge, help you grow a loyal customer base, and increase sales from each customer.

That’s not to say net 30 is without risks. Credit arrangements can seriously affect your cash flow. It can also complicate your business operations, especially if you’re extending lines of credit to the wrong clients.

Ultimately, whether to use net 30 or not depends on the business’ willingness to take a risk. In other words, it will vary from one business to the next. However, with the help of this comprehensive guide, we’re confident that you, in particular, will make the right decision for your freelance business. All the best!

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!