Tax season may be over, but many questions continue to linger when it comes to knowing how to track expenses throughout the year. It is a perennial, often overlooked challenge.

But ultimately, the need to track business expenses boils down to one simple truth: How else will you know if your business is truly profitable if you don’t know how much you’re spending to run it?

Expense tracking is also a legal requirement. Once you report yourself as self-employed, the IRS will have you fill out the Schedule C form when it’s time to file your taxes to reflect the income, expenses, and profit or loss for the year. Then, you have to pay taxes on the profit from your business.

To uncover the expense tracking habits, the roadblocks, and what tax season really feels like when you’re your own boss, we surveyed more than 1,000 solopreneurs in the U.S. to get to the truth.

💔 Break up with bad clients: There are better clients waiting for you. And SolidGigs can help you find them. Get a team of gig-hunters and a custom dashboard. Starting at just $31/mo. Learn more »

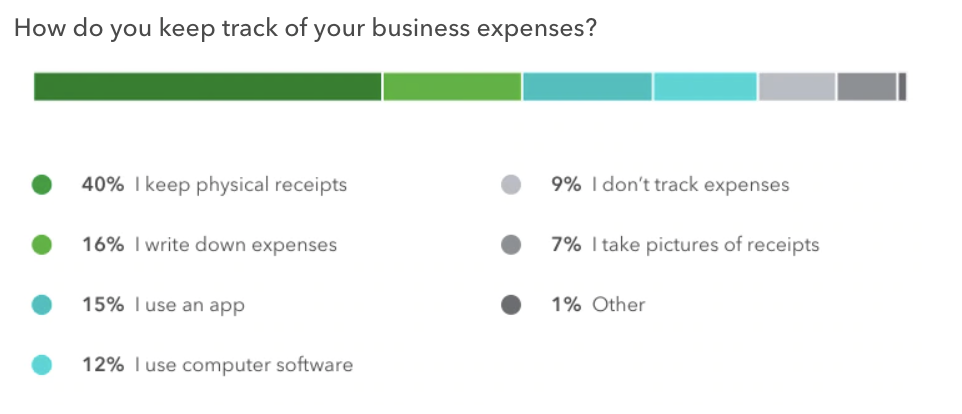

39% track expenses with paper receipts

In the QuickBooks survey, almost 40% of respondents track expenses with physical, paper receipts, while almost 16% write down their spending by hand, bringing the manual work involved to a combined 55% of respondents. Only 26% use an app or software, while 9% boldly admit to not tracking their expenses at all.

When asked about the top reasons given for those not tracking their business expenses, respondents say that:

- I don’t have enough expenses.

- My business isn’t big enough.

- It’s too much work.

And that’s unfortunate, given the IRS requires businesses to keep at least three years of business records. This includes timesheets, pay stubs, receipts for business expenses, invoices, and bank statements, just to name a few. Lugging around three years’ worth of physical records can’t be an enticing thought to anyone.

But help is already available. Many expense management tools allow users to scan or snap a pic of receipts via mobile apps to track all expenses (big and small) for easy reconciliation later. So you could be saying good to manual entry sooner than you think.

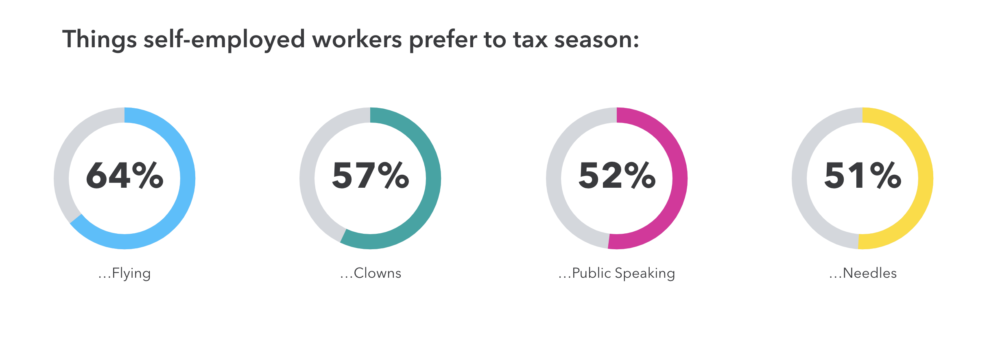

Business owners prefer pain and torture over taxes

WalletHub’s 2019 tax season survey found folks would rather perform jury duty, miss a connecting flight, or talk to their kids about the birds and the bees than do their taxes.

In the survey, respondents chose to tackle their fears of flying, clowns, public speaking, and being poked with needles over dealing with taxes. Some are even willing to break a bone, get trapped in a room full of snakes, or deal with the spirit world.

The way you file taxes can vary greatly, and any task can appear daunting if it is new or the rules have changed due to a new tax reform rollout. The key is not to do it alone.

Your accounting software probably already has an integrated tax preparation assistant of some kind. When information easily syncs between the two, there’s little to no work for you. Breaking a bone is starting to sound less appealing, hopefully?

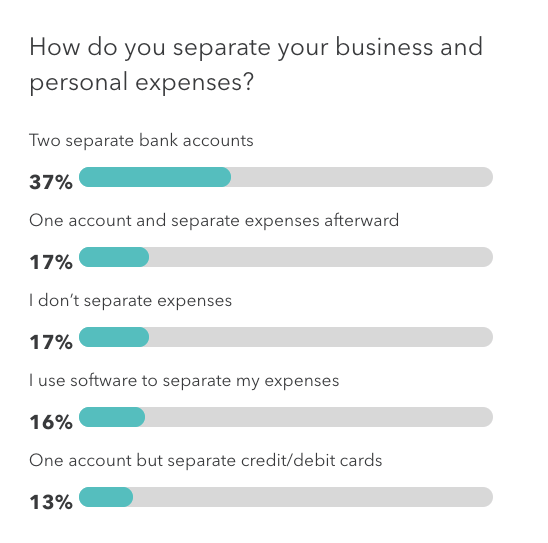

44% operate from their personal bank account

The good news is that over 1 in 3 solopreneurs (36%) have separate self-employed bank accounts accounts to draw a clear line between life and work. A confident 14% say they never charge a business expense to their personal account. Another 16% declare they simply do not separate expenses.

Most of the respondents operate from their personal accounts in one way or another.

- 16% have one account but separate the expense manually afterward.

- 15% use the same account but separate the expenses using a software.

- 13% use different credit or debit cards from the same account.

More than half pay for deductible items themselves

When self-employed workers leave money on the table come tax time, it’s almost always because they simply don’t know what’s deductible. The IRS qualifies businesses expenses as “ordinary and necessary.”

An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.

For example, if you are a rideshare driver, your vehicle is the ordinary expense. But the water and snacks you provide for your customers—even car washes—may qualify as the necessary expenses that will help to improve and grow your business.

In the QuickBooks survey, 1 in 4 respondents spend $100,000 or more on their business each year, but only 19% deducted that amount from their taxes. Many paid for deductible expenses themselves, on items such as:

- Magazine subscriptions (77%)

- Car maintenance (73%)

- Advertising (59%)

- Business insurance (57%)

- Office rent (55%)

- Mileage (54%)

Many self-employed workers only pay for accounting or bookkeeping services as needed. But what if your tax preparation software like Quickbooks could provide you with real-time help from a real-life tax professional? Think of it as deduction maximized and nothing missed.

Confident about an audit, but not an unexpected expense

This is not to say that respondents don’t know where to look hen they need help. 39% say they are already consulting their accountant to learn about what’s tax-deductible.

Another 22% turn to Google for answers, while a combined 19% either takes a wild guess or trusts their gut instinct. More surprising, perhaps, is how 81% say they would be confident should they get audited, even though only 23% were accurate in predicting what they thought they’d owe in taxes from the year before.

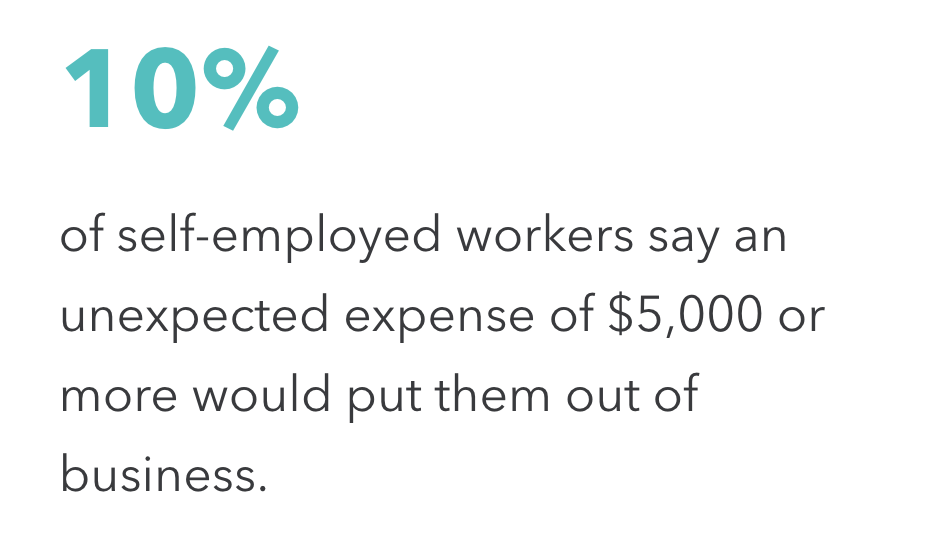

However, the positive turns sour when it comes to an unexpected expense. More than 80% say they have a budget for their business, but only 22% always stick to it. The No. 1 culprit for this? Unexpected expenses.

29% say they don’t have any emergency savings for their business.

So when asked if they would be able to pay for a surprise expenditure of $5,000, 6 out of 10 say they’d have to get into debt by using their business or personal credit card. One in 10 says the amount would put them out of business.

Automate the process to control your finances

With all the moving parts involved in tracking business expenses, leveraging technology is one of, if not the easiest, way to stay on top of your business expenses.

Many expense tracking apps can track and sort your expenses automatically and connect with your bank account and third-party apps to sync seamlessly across platforms and devices.

You can even customize sorting, so deductible expenses will be sitting pretty and ready to go for tax time.

Having visibility into your expenses is crucial to managing your business’ cash flow, which will ultimately reveal the state of profit and loss.

It may seem like a huge undertaking, but armed with the right tools, support, and year-round effort, it can become second nature.

So instead of wondering about whether the supplies for your cleaning business are deductible, you can just focus on growing your business and keeping your books in the green.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!