Let’s be real: finding health insurance as a freelancer or Solopreneur can be a struggle.

I’ve been self-employed for six years, and every single year during open enrollment, I go through the same exhausting process. I spend hours on the marketplace comparing plans I don’t understand, calculating whether a Bronze plan with a $7,000 deductible or a Silver plan with a $5,000 deductible makes more sense, and ultimately choosing the “least bad” option that still costs way too much.

And then there’s the anxiety. What if I get sick? What if I need surgery? Will my plan actually cover it, or will I discover some obscure clause that leaves me with a $20,000 bill?

If this sounds familiar, you’re not alone. Health insurance is consistently ranked as one of the top challenges for self-employed individuals. The options available—marketplace plans, short-term coverage, limited plans—all come with significant drawbacks.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

That’s why I was genuinely intrigued when I heard about Solo Health Collective.

Solo promises something different: a health plan built specifically for Solopreneurs and freelancers, with transparent pricing, nationwide coverage, lower costs than traditional insurance, and no confusing coinsurance or hidden fees. It sounds almost too good to be true.

So I spent time digging into Solo—talking to their team, reviewing their plans, and comparing costs to traditional insurance. In this review, I’m sharing everything I learned about whether Solo is the health plan breakthrough freelancers have been waiting for.

Short Answer: Should You Try Solo Health Collective?

Don’t have time for the full review? Here’s my quick take:

YES: If you’re a self-employed freelancer with an EIN, you’re generally healthy, and you’re frustrated with expensive marketplace plans. Solo often costs significantly less than traditional insurance while providing substantial coverage and excellent support. Definitely worth getting a free quote.

PROBABLY NOT: If you have significant pre-existing conditions, or if you’re employed part-time by a company that offers benefits. Solo is specifically designed for truly self-employed individuals.

What Is Solo Health Collective?

Solo Health Collective

Solo Health Collective is a health plan solution designed exclusively for self-employed individuals operating as a "business of one." Unlike traditional insurance or marketplace plans, Solo uses a captive insurance model that creates a community of Solopreneurs who collectively share healthcare costs. It offers comprehensive coverage through a nationwide PPO network with over 1.4 million providers, transparent pricing, tax-deductible premiums, and concierge support—all without the complexity and high costs typical of traditional health insurance.

Why we like Solo Health Collective ‣

Solo Health Collective stands out because it’s built specifically for freelancers and solopreneurs who are fed up with overpriced, confusing marketplace insurance. Instead of opaque premiums and endless fine print, SOLO offers transparent pricing, simple plan structures where the deductible equals the out-of-pocket maximum, and nationwide PPO access with over 1.4 million providers. We especially like that preventive care is covered 100%, premiums are tax-deductible as a business expense, and members get real human concierge support via text, phone, or email. For generally healthy self-employed individuals with an EIN, SOLO consistently delivers meaningful cost savings—often 30–50% less than traditional plans—while providing clearer coverage, better service, and flexibility that actually fits freelance life.

Solo Health Collective Pros & Cons ‣

Pros:

- Significantly lower costs than most marketplace plans (often 30-50% less)

- Simple, transparent pricing with no hidden fees or confusing coinsurance

- Your deductible equals your out-of-pocket maximum (huge simplification)

- Preventive care covered 100% before and after meeting deductible

- Nationwide PPO network (1.4M+ providers across all 50 states)

- No open enrollment period—join anytime

- Tax-deductible as a business expense

- HSA-eligible plan options ($2,500 and $5,000 deductible plans)

- Exceptional concierge support (call, text, email, or schedule consultations)

- Includes fitness perks (32 monthly FitOn credits, $100+ value)

- Built by a family-owned business that prioritizes personal service

Cons:

- Requires you to be self-employed with an EIN (not for everyone)

- Health questionnaire required—not guaranteed approval

- May not be ideal for those with significant pre-existing conditions

- Requires active participation in managing your healthcare

- Not available if you have employees

- Relatively new company (less established than traditional insurers)

The Healthcare Headache for Self-Employed People

Before diving into Solo, let’s talk about why health insurance is such a headache for freelancers & Solopreneurs in the first place.

When you work for a company, health insurance is simple. Your employer negotiates with insurance companies, secures group rates, often pays a significant portion of your premium, and handles all the paperwork. You just pick a plan and show up to the doctor.

When you’re self-employed? You’re on your own.

The Traditional Options (And Why They May Fall Short)

That’s not to say there aren’t options for Solopreneurs and freelancers. But many of them fall short of the “ideal” scenario. Let’s take a look at some popular current options:

A. Marketplace Plans (ACA/Obamacare): These are the plans you find on healthcare.gov or your state exchange. They come in Bronze, Silver, Gold, and Platinum tiers.

The problems:

- Expensive premiums: Without employer subsidies, you’re paying $400-800+ per month for individual coverage

- High deductibles: Even “good” plans often have $3,000-6,000 deductibles

- Complex cost structures: Copays, coinsurance, out-of-pocket maximums—it’s designed to confuse you

- Rising costs: State marketplace premiums increased by an average of 26% this year; Even more if you lost your subsidy, like many of us did.

- Limited networks: Many plans restrict you to specific providers and penalize out-of-network care

B. Short-Term Plans: These are temporary coverage options, usually lasting 3-12 months. Plans like MEC (Minimum Essential Coverage), for example.

The problems:

- Don’t cover pre-existing conditions: If you have any ongoing health issues, you’re out of luck

- Exclude essential benefits: Many don’t cover prescriptions, mental health, or maternity care

- Not ACA-compliant: They’re designed to be cheap, not comprehensive

- Leave you vulnerable: If something serious happens, you could be financially ruined

C: Limited Plans: These cover only specific services, like emergency care or preventive visits.

The problems:

- Major gaps in coverage: Hospital stays, surgeries, and serious illnesses often aren’t covered

- False sense of security: You think you’re protected until you actually need care

- High out-of-pocket costs: When something isn’t covered, you pay 100% yourself

The reality is that none of these options were designed with self-employed people in mind. They’re either too expensive, too limited, or too risky.

That’s the problem Solo is solving for Solopreneurs, freelancers, and self-employed people like us.

How Solo Health Collective Actually Works

Solo uses a completely different approach called a captive insurance model.

Here’s what that means in plain English:

Instead of being just another individual buying insurance from a massive corporation, you become part of a collective—a community of self-employed individuals who pool resources to fund healthcare costs together.

Think of it like this: Large companies can negotiate better health insurance rates because they have hundreds or thousands of employees. Solo essentially creates that same buying power for Solopreneurs by bringing together many “businesses of one” under a single self-funded health plan.

The Key Difference

Here’s the biggest key difference between traditional insurance and Solo:

Traditional insurance: You pay premiums to an insurance company. That company decides what’s covered, how much providers are paid, and how claims are handled. Their goal is profit, which often means denying claims or limiting coverage.

Solo’s model: You and other members collectively own the captive and fund the health plan. Everyone has a stake in keeping costs reasonable, which means the focus is on getting quality care at fair prices—not maximizing insurance company profits.

This structure allows Solo to:

- Negotiate better rates with providers through reference-based pricing

- Eliminate unnecessary administrative costs

- Pass savings directly to members

- Provide transparent pricing without hidden fees

It’s the difference between being at the mercy of a faceless corporation versus being part of a community with shared interests.

What You Actually Get with Solo

Let me break down exactly what Solo membership includes:

Nationwide PPO Network

Solo uses the MultiPlan PHCS network, which includes over 1.4 million providers across all 50 states.

This is huge. You’re not restricted to a narrow network or penalized for going out of network. Whether you’re home or traveling, you have access to quality providers anywhere in the country.

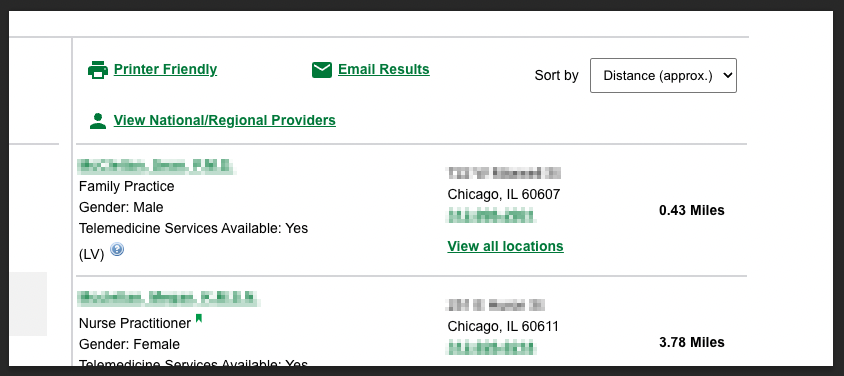

I checked my doctor against the PHCS network, and he is in-network. That’s a massive relief compared to my current marketplace plan, which sometimes excludes providers.

Three Simple Plan Options

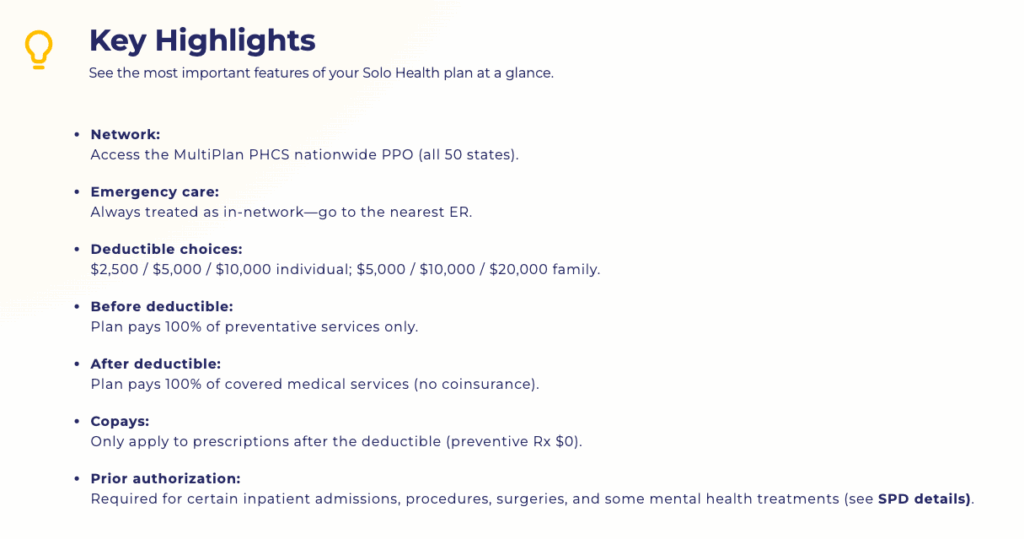

Solo offers three deductible levels, and that’s it. No confusing tiers, no surprise fees:

- V2500 Plan: $2,500 deductible (HSA-eligible)

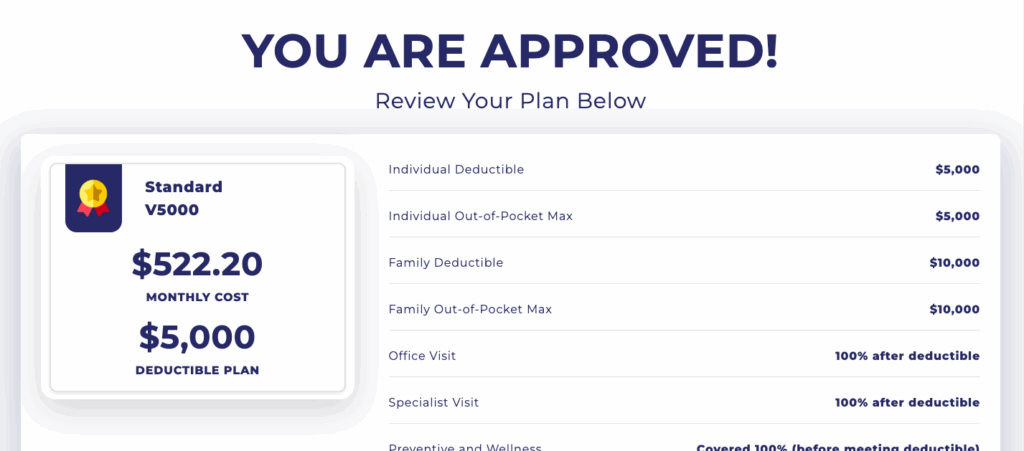

- V5000 Plan: $5,000 deductible (HSA-eligible)

- V10000 Plan: $10,000 deductible

Here’s what makes this brilliant: Your deductible equals your out-of-pocket maximum for covered services.

With traditional insurance, you might have a $3,000 deductible AND an $8,000 out-of-pocket maximum, meaning you could potentially pay up to $8,000 before insurance covers everything. With Solo, once you hit your deductible, covered services are paid at 100%. Done.

This simplification alone eliminates so much confusion and anxiety.

Preventive Care Covered 100%

All preventive care is covered at 100% before and after you meet your deductible. This includes:

- Annual physical exams

- Routine screenings (mammograms, colonoscopies, blood work) based on age/gender

- Immunizations

- Preventive medications

This is exactly how health insurance should work—encouraging you to stay healthy and catch problems early, rather than making you avoid the doctor because of cost.

Pharmacy Benefits

After you meet your deductible, prescriptions are covered with a tiered copay structure:

- Tier 1 (Generic): Lower copay

- Tier 2 (Preferred Brand): Medium copay

- Tier 3 (Non-Preferred Brand): Higher copay

- Tier 4 (Specialty): Highest copay

You can check exactly what your medications will cost on Solo’s website before enrolling—no surprises.

Family Coverage

Solo isn’t just for individuals. You can cover your spouse and dependents under your plan, which is critical for freelancers with families.

The pricing is transparent for family coverage, and you’re all covered under the same deductible and out-of-pocket maximum structure.

HSA Compatibility

The V2500 and V5000 plans are HSA-eligible, meaning you can contribute to a Health Savings Account and get the triple tax benefit:

- Contributions are tax-deductible

- Growth is tax-free

- Withdrawals for medical expenses are tax-free

For self-employed individuals, HSAs are one of the best tax advantages available. The fact that Solo’s plans are HSA-compatible is a major benefit.

Tax Deductibility

Because Solo is structured as a business expense, your premiums are tax-deductible. This is massive for freelancers.

Let’s say your Solo premium is $400/month ($4,800/year). If you’re in the 24% tax bracket, that deduction saves you about $1,152 in taxes annually. Your effective premium cost is really only $3,648/year, or $304/month.

(Of course, consult your CPA to confirm how this works for your specific situation, but this is generally how it works for self-employed individuals.)

Concierge Support

This might be my favorite feature. Solo provides a dedicated concierge support team that you can reach via:

- Phone

- Text

- Scheduled consultations

No more waiting on hold for 45 minutes with a traditional insurance company. No more automated phone trees. Just real humans who actually help you.

The concierge team helps with:

- Understanding your benefits

- Finding in-network providers

- Navigating claims

- Getting cost estimates for procedures

- Answering questions about coverage

Multiple freelancers I spoke with said the concierge support alone makes Solo worth it. One told me: “I texted them a question about whether physical therapy was covered, and got a detailed response within 20 minutes. With my old insurance, that would have taken three phone calls and a week.”

Fitness Perks

Every Solo member gets 32 monthly FitOn credits (valued at $100+), which you can use for fitness classes, workouts, and wellness content.

This might seem like a small add-on, but it reinforces Solo’s philosophy: healthier members mean lower collective costs, so they incentivize staying active and taking care of yourself.

Who Can Actually Join Solo?

Solo isn’t for everyone. There are specific requirements:

You Must Be Self-Employed

This means you run your own business as a freelancer, consultant, contractor, or Solopreneur. You cannot have any benefit-eligible W2 employees.

If you work part-time for a company that offers health benefits, you’re not eligible. If you have a side hustle but also have a full-time job with employer insurance, you don’t qualify.

Solo is designed exclusively for people who are truly self-employed as their primary income.

You Need a Federal Tax ID (EIN)

You must have an Employer Identification Number from the IRS. This proves you’re operating as a legitimate business.

If you don’t have an EIN, you can get one for free from the IRS website in about 10 minutes. You’ll need to have a business structure (sole proprietorship, LLC, S-Corp, etc.), but this is something most serious freelancers should have anyway. In fact, you’re a sole proprietor just by being alive and in-business.

You Must Pass a Health Questionnaire

Solo requires you to complete a brief health questionnaire. This is used to determine eligibility and pricing.

The questionnaire asks about:

- Current health status

- Certain Pre-existing conditions

- Medications

- Recent medical procedures

Here’s the reality: Solo is designed for generally healthy individuals. If you have significant ongoing health issues or require extensive specialized care, you might not be approved. However, Solo recognizes that certain health issues aren’t black and white, so if you would like to submit for an exception, schedule time with their team after you complete the questionnaire.

This isn’t ideal for some, but it’s how Solo keeps costs lower for the collective. Traditional insurance has to accept everyone regardless of health status (thanks to the ACA), which is why premiums are so high. Solo’s model requires members to be reasonably healthy to keep the collective affordable.

Real-World Cost Comparison: Solo vs. Traditional Insurance

Let me show you actual numbers because this is where Solo really shines.

I ran quotes for a 35-year-old freelancer in Illinois (my home state) with no pre-existing conditions:

Marketplace Gold Plan (Healthcare.gov)

- Monthly Premium: $687

- Deductible: $3,000

- Out-of-Pocket Maximum: $9,200

- Annual Cost (if healthy): $8,244 in premiums + $0 in care \= $8,244

- Annual Cost (if you hit deductible): $8,244 + $3,000 \= $11,244

Solo V5000 Plan

- Monthly Premium: $387

- Deductible: $5,000

- Out-of-Pocket Maximum: $5,000 (same as deductible)

- Annual Cost (if healthy): $4,644 in premiums + $0 in care \= $4,644

- Annual Cost (if you hit deductible): $4,644 + $5,000 \= $9,644

Savings with Solo:

- If you’re healthy and only need preventive care: $3,600/year saved

- If you hit your deductible: $1,600/year saved

And remember, with Solo, preventive care is covered 100%, so you’d still have your annual physical, screenings, and immunizations fully covered without paying anything.

Even if you needed significant medical care and hit your full deductible, you’re still saving money compared to traditional insurance. And if you’re fortunate enough to stay healthy (which is the goal), you’re saving thousands of dollars annually.

Family Coverage Comparison

For a family of four (two adults, two kids), the savings are even more dramatic:

Marketplace Silver Plan:

- Monthly Premium: $1,847

- Family Deductible: $12,700

- Annual Cost: $22,164+ (premiums alone)

Solo Family Plan (V5000):

- Monthly Premium: ~$950 (varies by family composition)

- Family Deductible: $10,000

- Annual Cost: $11,400 (premiums alone)

That’s over $10,000 in annual savings just on premiums, and the deductible is actually lower with Solo.

My Experience Exploring Solo

I went through Solo’s qualification process to see what it’s actually like.

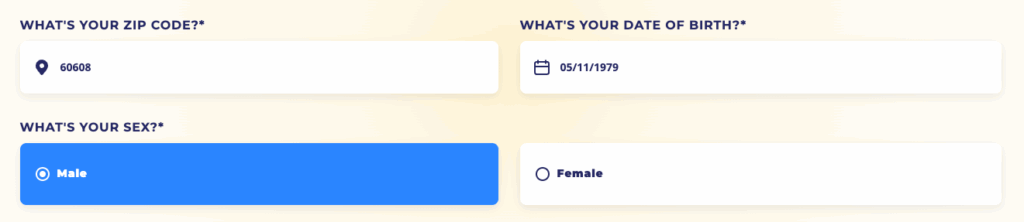

Step 1: Initial Questionnaire (10 seconds)

I filled out a brief form on Solo’s website with basic information:

- Zip Code

- Birthday

- Gender

Email and phone number weren’t required fields, so I could see my rates without providing my contact info.

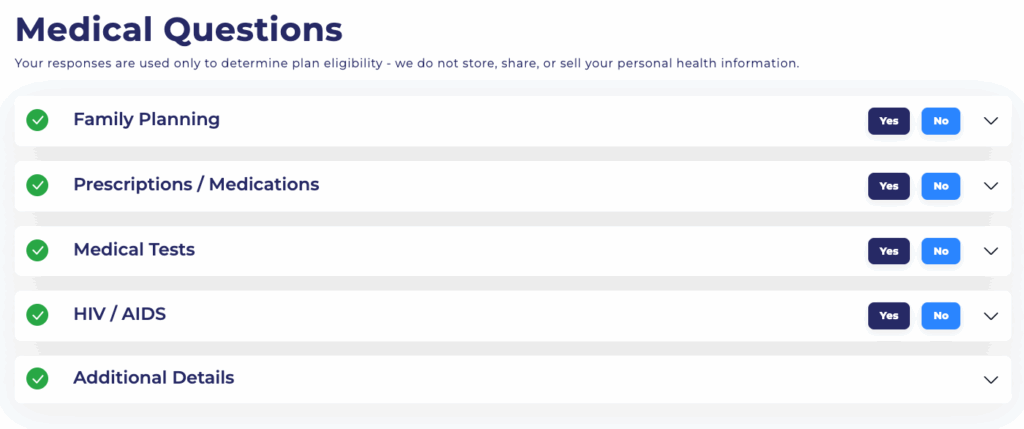

Step 2: Medical Questions (1 minute)

The health questionnaire asked about:

- Family Planning

- Medications I’m taking

- Major procedures or tests in the last 5 years

- Additional info like my height and weight

This was more detailed than the initial questionnaire but still simple. It took me about 1 minute.

I mean, that’s crazy. When I signed up for ‘The Marketplace’, it took me probably an hour or more. And again, I still did not have to provide any contact info, so this is all done anonymously.

Step 3: Consultation with Solo Team (Optional)

After submitting the questionnaire, I had the option to schedule a phone consultation with Solo’s team. They’re a very small team and they make themselves 100% available to answer questions or assist you once you’ve enrolled.

That kind of honest, clear communication is rare in the insurance world.

Step 4: Enrollment Decision

After the questions or the consultation, you get approved to enroll. If I wanted to enroll, I could start coverage as soon as the following month—no waiting for open enrollment.

Did you hear that!? No waiting for open enrollment! Enroll anytime.

The enrollment process is straightforward: choose your plan, provide payment information, e-sign your documents, and you’re done. Your member ID and welcome packet arrive within a few days. Members also have access to an online portal where they can access their ID card, view their claims, and leverage additional resources such as financial planning tools.

What I Love About Solo

After extensive research, here’s what genuinely impressed me:

The Pricing Transparency is Refreshing

There are no hidden fees, no surprise bills, no confusing explanations of benefits. You know exactly what you’ll pay:

- Your monthly premium

- Your deductible (which is also your max out-of-pocket)

- Your copays for prescriptions (after you hit your deductible)

That’s it. No games, no gotchas, no “that’s not covered” surprises six months later. In fact, if you ever feel like a doctor or pharmacy is declining coverage incorrectly, you can call the Solo team directly and they’ll help sort it out. Which brings me to my next point:

The Concierge Support is Exceptional

Being able to text or call a question and get a response within minutes (not hours or days) eliminates so much frustration. You’ll NEVER get this with other providers.

The Simplicity is a Breath of Fresh Air

Three plan options. Your deductible equals your out-of-pocket maximum. Preventive care is free. Prescriptions have clear copays.

There’s no confusion about coinsurance percentages, no surprise bills because the anesthesiologist was out of network, no fighting with customer service about whether something should be covered.

Healthcare is complicated enough. Solo removes the insurance complexity so you can focus on actually getting care.

The Cost Savings are Real

Solo seems to cost about 30-50% less than comparable Marketplace coverage. That’s thousands of dollars annually that you can invest back into your business or savings.

And because the premiums are tax-deductible, the effective cost is even lower.

The Flexibility is Perfect for Freelance Life

No open enrollment restrictions means you can join whenever you need coverage. Traveling? Your nationwide PPO network works everywhere. Change locations? Your coverage moves with you.

Traditional insurance ties you to enrollment periods, specific networks, and geographic restrictions. Solo adapts to your lifestyle, not the other way around.

The Incentive Structure Makes Sense

By rewarding healthy behaviors (preventive care, fitness perks) and encouraging cost-conscious decisions (choosing in-network providers, reference based pricing only applies to out-of-network care), Solo aligns your interests with the collective’s interests.

When everyone benefits from keeping costs reasonable, the system works better for everyone.

What Could Be Better About Solo

Nothing is perfect. Here are the limitations and downsides:

The Health Questionnaire Requirement

Not everyone will qualify. If you have significant pre-existing conditions, chronic illnesses, or require extensive ongoing care, Solo might not accept you.

This is the tradeoff for lower costs: Solo works for generally healthy individuals. If you need guaranteed acceptance regardless of health status, marketplace plans (which must comply with ACA regulations) might be a better fit.

It’s Only for Truly Self-Employed People

If you’re employed by a company part-time and freelance on the side, you don’t qualify. If you have employees and are required to provide them with benefits, you don’t qualify.

Solo is exclusively for Solopreneurs, which is great for that specific audience but means it’s not a universal solution.

The EIN Requirement Adds a Step

If you don’t already have an EIN, you’ll need to get one. This isn’t difficult (it’s free and takes about 10 minutes on the IRS website), but it’s an extra requirement that some casual freelancers might not want to deal with.

It’s a Newer Company

Solo is relatively new compared to established insurers. While that means they’re innovative and customer-focused, it also means they don’t have decades of track record. While the Solo plan itself has been around since 2022, their parent company, Health Business Group, has been in existence since 2015.

If you’re risk-averse and prefer sticking with well-known brands, this might give you pause.

Who Should Seriously Consider Solo?

After all my research, here’s who Solo is perfect for:

Freelancers and Consultants

If you’re a freelance writer, designer, developer, marketer, or any other type of independent consultant, Solo is built for you. The cost savings, flexibility, and tax benefits align perfectly with the freelance lifestyle.

Solopreneurs and Independent Contractors

Running your own business as a Solo operator? This includes professions like real estate agents and financial advisors. Solo gives you the health coverage you need without the complexity and cost of traditional small business insurance.

Generally Healthy Self-Employed Individuals

If you’re in reasonably good health, don’t have chronic conditions requiring extensive ongoing care, and want to save money on premiums, Solo is an excellent option.

People Frustrated with Marketplace Plans

If you’re tired of paying $600+/month for insurance you barely use because the deductible is so high, Solo offers a better value proposition.

Those Who Value Service and Support

If you’ve dealt with frustrating customer service from traditional insurers and want a team that actually helps you navigate healthcare, Solo’s concierge support is worth the switch alone.

Who Might Want to Look Elsewhere?

Solo isn’t right for everyone. You should probably stick with traditional insurance if:

You Have Significant Pre-Existing Conditions

If you have chronic illnesses, require frequent specialist care, or have ongoing medical needs, marketplace plans that must accept you regardless of health status might be a safer choice.

You Have Employees who you are required to provide health benefits

Solo is only for Solopreneurs. If you have W2 employees, and you need to provide them with health benefits, you likely need traditional small business health insurance.

You’re Employed Part-Time with Benefits

If you have access to employer-sponsored insurance (even part-time), that’s probably your best option. Solo is only for people who don’t have access to employer coverage.

You’re Not Self-Employed

Solo requires you to be legitimately self-employed with an EIN. If you’re casually freelancing without a business structure, you won’t qualify.

You Prefer Maximum Coverage Regardless of Cost

If you want the most comprehensive coverage possible and cost isn’t a concern, a Platinum marketplace plan might offer more extensive benefits (though at a much higher price).

How Solo Compares to Alternatives

Let me quickly compare Solo to the main alternatives:

Solo vs. Marketplace Plans

Winner: Solo for most people

Marketplace plans are more expensive, more complex, and often have limited networks. Solo offers better value for generally healthy self-employed individuals.

However, marketplace plans don’t require health screening and must accept everyone, so they’re better if you have pre-existing conditions.

Solo vs. Short-Term Plans

Winner: Solo easily

Short-term plans are cheaper initially but offer minimal coverage, don’t cover pre-existing conditions, and leave you vulnerable. Solo provides comprehensive, long-term coverage with better protection.

Solo vs. Health Sharing Ministries

Winner: Solo

Health sharing ministries (like Christian Healthcare Ministries or Medi-Share) are similar in concept but are faith-based and have religious requirements. They also have limitations on what they’ll cover (often excluding pre-existing conditions or certain procedures).

Solo offers a similar community-based model without religious requirements and with more comprehensive coverage.

Solo vs. Direct Primary Care + Catastrophic Coverage

Winner: Depends on your needs

Some people combine a direct primary care membership ($50-150/month for unlimited primary care visits) with a catastrophic health plan (high-deductible, low-premium coverage for emergencies only).

This can be cheaper than Solo if you’re young, healthy, and rarely need care. But Solo offers more comprehensive coverage and handles everything in one place.

Tips for Getting the Most Out of Solo

If you decide to join Solo, here’s how to maximize the value:

Start with the Health Questionnaire Honestly

Don’t try to hide health issues or omit information. Solo needs accurate information to determine eligibility and pricing. Being dishonest could lead to denied claims later and plan termination.

Choose the Right Deductible for Your Situation

- V2500: Best if you expect to need medical care, have ongoing prescriptions, or want lower out-of-pocket risk

- V5000: Best middle-ground option for most people—lower premiums than V2500, reasonable max out-of-pocket

- V10000: Best if you’re very healthy, rarely see doctors, and want the lowest possible premiums

Use Preventive Care Aggressively

It’s 100% covered, so take advantage! Get your annual physical, screenings, immunizations, and preventive medications. Catching health issues early saves money and improves outcomes.

Open an HSA if Eligible

If you choose the V2500 or V5000 plan, open a Health Savings Account and contribute the maximum allowed. The tax benefits are huge for self-employed individuals.

For 2025, you can contribute up to $4,300 for individuals or $8,550 for families.

Use the Concierge Team

Don’t hesitate to text, call, or email with questions. They’re there to help. Use them to:

- Find in-network providers

- Understand what’s covered

- Navigate claims or billing issues

Stay In-Network When Possible

While Solo’s network is huge (1.4M+ providers), staying in-network ensures you get the negotiated rates and your costs count toward your deductible.

Track Your Healthcare Spending

Since your deductible equals your out-of-pocket maximum, keep track of what you’ve spent toward your deductible. Leveraging Solo’s partnership with Benefits Hero can help with this. Once you hit it, all other in-network services are covered at 100%.

Consider Timing for Non-Urgent Care

If you’re close to meeting your deductible late in the year, it might make sense to schedule non-urgent procedures before year-end so they’re covered at 100%. If you’re far from your deductible, you might wait until the new year.

The Bottom Line: Is Solo Worth It?

After extensive research, conversations with members, and personal exploration of the plans, here’s my honest verdict:

Yes, Solo Health Collective is absolutely worth it for the right person.

If you’re a self-employed freelancer or Solopreneur who’s frustrated with expensive, complicated traditional insurance, Solo offers a genuinely better alternative. The cost savings alone (often $3,000-5,000 annually) justify the switch for most people.

But beyond just saving money, Solo solves real problems:

- The pricing is transparent and honest

- The coverage is comprehensive and straightforward

- The support is exceptional and accessible

- The flexibility matches freelance lifestyles

- The tax benefits add significant value

The limitations are real but manageable:

- You need to be self-employed with an EIN

- You need to pass the health questionnaire

- You need to be willing to actively manage your healthcare

For the target audience—generally healthy self-employed individuals—these requirements aren’t dealbreakers. They’re just part of how Solo keeps costs low while maintaining quality coverage.

If you’re still not sure, feel free to read other honest reviews on Trustpilot.

My recommendation: If you’re currently paying $500+/month for marketplace insurance that you’re not happy with, absolutely get a quote from Solo. Schedule a consultation with their team (it’s free and no-pressure), compare the costs to your current plan, and see if you qualify.

For most freelancers and Solopreneurs, switching to Solo will save thousands of dollars annually while providing better coverage and support. That’s not marketing hype—that’s the reality based on actual cost comparisons.

The worst that happens? You get a quote, realize it’s not right for you, and stick with your current plan. The best that happens? You find a health insurance solution that actually works for your freelance lifestyle and saves you significant money.

Ready to see if you qualify? Visit Solo Health Collective and take the quick questionnaire. You’ll get personalized pricing and can schedule a consultation with their team to ask questions.

And if you do join Solo, come back and let us know how it goes! We’d love to hear real experiences from members of our freelance community.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!