There are a lot of different ways to get paid as a freelancer. There are automated software programs, scheduled bank transfers for retainers, PayPal invoices, simple digital transfers, and a myriad of other options. I even have a client or two who still cut paper checks and send them to me in the mail.

As long as the money ends up in my account at some point, I’m totally open to whatever payment method is convenient for the people I work with.

Although Venmo and similar services are nipping at its heels, one of the most common payment avenues is still PayPal. If you’ve been working as a freelancer for any amount of time, it’s likely you have been asked to send a PayPal invoice.

Other than having to keep track of all of your different accounts and keep everything secure across platforms, there’s not much of a downside to allowing clients to use a PayPal invoice to pay you.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

This article will walk you through the process, so that when someone inevitably asks you, “Can you bill me via PayPal invoice?” you’ll have your answer (and your account) ready and waiting.

What is a PayPal invoice?

Casual PayPal users are probably pretty familiar with sending and receiving dollars through the service. But for businesses, did you know that you can send official invoices instead of just a money request? (If you’re unfamiliar with invoicing in general, brush up here before you read on.)

The PayPal invoice is pretty much what it sounds like—an invoice generated through PayPal. If you’ve bought something from an online seller, you may have even seen one and used it to pay your bill.

It’s simple to use, and actually pretty convenient.

Is a PayPal invoice the same as a PayPal money request?

A PayPal money request is something you send off that just shows the amount owed and maybe a 1-line description of what it’s for.

Unlike a money request, a PayPal invoice has fields to include all kinds of information, like what work you are billing for, the amount, the due date, a short description, and any notes you want to include to the customer.

You can add your logo, charge tax, use the same invoice to bill multiple clients, and even upload attachments like art files or a purchase order. All of this info is sent to the customer through PayPal, and they can pay right from an embedded link that goes to your account.

Sure, it’s quicker to send a money request, but a PayPal invoice is incredibly versatile and helps you keep track of your business in a more detailed way.

When to use a PayPal invoice

Using a PayPal invoice is a more professional way to do business than simply requesting payment, but that doesn’t mean that every time you bill a client, you should use a PayPal invoice.

There are tons of invoicing software options for freelancers, and it’s a good idea to do your research before committing to a single medium. Here’s just a few things to consider about when to use a PayPal invoice:

Pros of PayPal:

- PayPal is a pretty easy way to send an invoice, with almost no backend setup for you. You just set up your account, fill in some preset fields, and you’re good to go.

- It’s integrated with your self-employed bank account, so you can get paid faster. When clients pay you through PayPal, you can either leave the money there and use it for other purchases, or transfer it to your bank and use it however you need to. It takes a few days to make the transfer, so plan accordingly.

- Most clients will be familiar with PayPal. The service has been around a long time, so lots of individuals and businesses are already set up to use it. This can help bypass the red tape involved in getting a check cut or another payment option approved.

- You have the ability to take credit cards. If you send your own invoice and simply wait to get paid, you might have a long delay while you wait for a check or a frustrated client who tracks business expenses through a credit card. Using a service like PayPal solves this problem.

Cons of PayPal:

- There are fees associated with PayPal—PayPal takes a small percentage of every business transaction in PayPal. It varies by country, but in the US it is around 3%. It’s higher for international transactions. There’s no way to avoid a transaction fee when using a PayPal invoice, but this is pretty standard for e-commerce payment solutions.

- Invoices are not customizable to match your brand. You can upload a logo if you want, but you can’t change fonts, colors or the basic layout. This isn’t necessarily a deal-breaker, but it is something that affects your business. I recommend uploading your logo at the very least. Remember, every chance to get your name in front of clients is an opportunity!

- PayPal uses its own internal invoice numbering system, so if you use other forms of billing, it won’t match up. You can resolve this with good record keeping, but it’s an extra step in your process. And we all know, time is money.

Security

A big reason to use a PayPal invoice instead of sending your own is the built-in security. PayPal allows you to get paid directly without revealing your financial information. They monitor transactions and help reduce fraud.

For sellers, there is also protection against unfounded complaints. This mostly applies to physical goods, but freelancers that charge for their time may be protected if they can show proof of fulfillment. You should still think about how to protect yourself independently, but this can be an added layer of peace of mind.

How to create and send a PayPal invoice in 8 steps

Whether you choose to use PayPal for all of your transactions, or you just need it in your back pocket for those clients who specifically request it, it’s great to be armed with the knowledge of how to create a PayPal invoice.

It’s pretty simple:

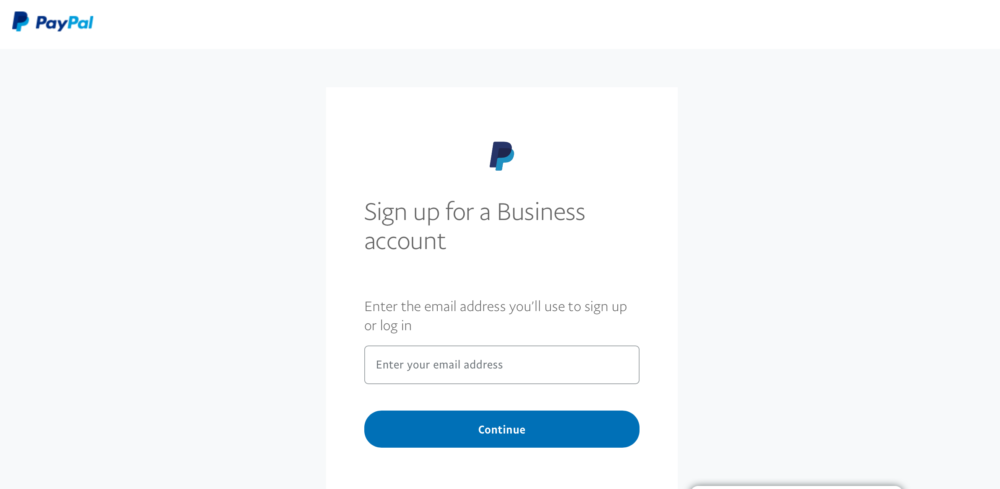

1. Create a PayPal account. To use the invoice function, you need to choose the “business” account option. Don’t worry, there’s no extra fee involved for small businesses.

2. Once you’re logged in, you’ll need to add your bank information to your account so that you can get paid.

3. Now that you’re all set up, select “Tools” from the top menu. You’ll find “Invoicing” in this dropdown. This will bring you to the general invoicing screen, where you can create drafts, track sent invoices and see what is overdue.

4. When you’re ready to send your PayPal invoice, hit the blue “Create” button on the right-hand side.

5. Enter your client’s email address. DOUBLE CHECK THIS INFORMATION. You don’t want to send the invoice to the wrong PayPal customer, and wind up delaying payment or worse, getting paid by the wrong person and having to resolve that mess! You can expand this menu to include a client name and address if you’d like.

6. Enter the full cost of the invoice. You can choose how much detail to include––hours worked, a description, additional notes, etc.

7. Preview your PayPal invoice. Trust me, no matter how many times you have sent an invoice, there will be errors sometimes. It’s always best to preview the full invoice before sending it to a client.

8. Hit “send,” and you’re done! Clients can pay you directly from the email they receive. It’s a cinch for you and for them.

If you’re more of a visual learner, or still unclear on the process, PayPal has a great explainer video that covers the basics. It also has a helpful section on tracking invoices once they’ve been sent. If you’ve got three minutes, it’s worth checking out:

Conclusion

Buying and selling with a PayPal invoice is a common way for contractors to do work and get paid.

Where there is no perfect payment solution, PayPal is at least a very basic solution that covers a lot of needs for both freelancers and the people hiring them.

It’s secure, allows credit cards, and is customizable enough to include whatever information you need to get across. And if you expand your business to include some kind of passive income (which I highly recommend), PayPal is often easily integrated with marketplace websites.

At the very least, every freelancer should have a PayPal business account and be familiar with the platform. PayPal is still the largest online payment processor in the world. Whether you work with large or small businesses, it’s almost inconceivable that you won’t be asked to use a PayPal invoice at some point.

As long as you have a good bookkeeping system in place to track all of your payments, adding PayPal to your repertoire of business tools is pretty much a no-brainer.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!