Whether you run a small business or you’re a freelancer, you’ll need to get paid at some point — this is when the invoice comes in.

While many of us have heard of invoices, it’s totally a different game when it’s time to create one.

What is an invoice exactly? What info do I need to add to it? What format? When do I send it?

In this article, we are going to answer all these questions and many more in detail. You can also review our guide: Freelancer Invoicing 101 for more information. So, without further ado, let’s get started.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

What is an invoice?

When you work for yourself, a critical part of getting paid on time and keeping your cash flow going is having an effective invoicing process. That’s because if your invoicing methods aren’t up to scratch, it will take longer for your clients to pay you and that’s just not good for business.

The precise definition of an invoice is a document that is created when a person owes you money for some goods or services you’ve provided. They can be sent by post mail or more commonly these days, by email. They will display the due balance and a detailed description of what the owed monies are for.

Essentially, invoices represent a record of sales that are used by both the buyer and the seller to document purchases from both sides. It forms part of what’s needed by companies and freelancers to work out their yearly profit, loss and their tax liabilities.

What is an invoice used for?

Invoices also serve a number of other functions within the business sphere;

A Legal Agreement – An invoice is a legally binding agreement between the seller and the buyer to document a transaction between both parties on the goods provided, the conditions of payment and the price quoted. This legal proof will also protect both sides in the event of any kind of dispute.

Tracking of Payments – Invoices are very useful in helping businesses and customers to keep track of what monies are owed for goods and services received. This is especially useful for long-standing business arrangements where payments might otherwise become confused.

Analytics – Another useful function of an invoice is to help businesses glean data on their customers and buying patterns. This kind of data can prove invaluable to help freelancers and companies develop their strategies for marketing.

What is the difference between an invoice and a bill?

When considering the question “what is an invoice?” it’s important to make a clear differentiation between invoices and bills. The fact is that, to many people, the terms ‘bill’ and ‘invoice’ are interchangeable, but in reality, they are two different types of business paperwork.

Let’s take a look at the two in isolation.

While an invoice is technically the same as a bill – in that it is a piece of documentation that marks a transaction between the seller and the buyer – it has quite different connotations. When an invoice is sent, there is typically no immediacy of payment required and more often than not, there is some kind of credit being extended to the person it’s being sent to.

A bill, on the other hand, usually has to be settled straight away, which is why you’re never likely to get an invoice when you go out for a meal at a restaurant. Also, a bill, depending on who’s issuing it, will not be as detailed as an invoice and will usually only briefly describe why the funds being demanded are changing hands.

What is an invoice when compared to a purchase order?

Something else that is regularly confused with an invoice is a purchase order. Yet they serve different functions in business.

Difference #1 – An invoice is used to let the buyer know that payment for goods and/or services is due, whereas a purchase order is used as a tool to order said goods or services from the seller. It is, as the name would suggest – a request to purchase.

Difference #2 – Another major difference between the two, which will now be obvious after the information provided in ‘Difference #1’, is that invoices are sent by the seller, whereas purchase orders are sent by the buyer or client.

Difference #3 – Purchase orders also differ from invoices because of the fact that they define the terms of the purchase, rather than confirming that a sale has taken place.

What are the different types of invoices?

When discussing invoices, it’s also important to discuss the fact that under the umbrella term, there are six sub-variants, each with its own reason for existing. Let’s take a look at each one.

Type 1: Pro forma invoices

The first type of invoice on our list is the pro forma kind, which is used to inform customers what they will be expected to pay when the stated work has been finished. What a pro forma invoice isn’t, is a demand for money.

Type 2: Interim invoices

The next type is the interim invoice, which is used in big projects where staged payments are made when certain milestones have been reached. This type of invoice is useful in helping businesses to manage cash flow in projects that span several months.

Type 3: Recurring invoices

When ongoing services are provided, usually incurring the same cost each time, a recurring invoice is used. You’ll typically find this kind of invoice in use for subscriptions or membership services, as well as retainers.

Type 4: Past-Due invoices

In the event of an invoice remaining unpaid by a customer or client, a past-due invoice is issued as a polite reminder to settle the debt.

Type 5: Final invoices

The penultimate type of invoice on our list is the final invoice, which is issued as an official confirmation that all work has been carried out and that the last payment will complete the business between the client and the supplier.

Type 6: Miscellaneous invoices

Our last invoice types are the miscellaneous invoices, which are multi-purpose invoices that are sent out when what’s being charged for doesn’t necessarily fit into a specific category.

With all of these types of invoice available, it’s perhaps understandable why some people get confused about which one they need to issue!

Who uses invoices?

The answer to this question is quite easy, but all-encompassing, as anyone who is employed in the provision of goods or services will have a need to issue invoices. Any business, contractor, freelancer or entrepreneur who has been employed in a paid capacity will issue an invoice to their clients as an official way to confirm work has taken place.

Whether you know it or not, you will have been receiving invoices your whole life from companies who sell goods to you. They’re so widely given out that if you’ve ever had a mobile phone contract or magazine subscription in your life, you’ll have had one as a way of informing you that payment is expected by a certain date in the future.

How is an invoice used?

What we’ve not yet discussed in our quest to precisely answer the question “what is an invoice?” is how different types of people interact with them. Here we look at how different parties in the business sphere deal with invoices.

By clients

As we’ve mentioned previously, invoices are provided by suppliers to clients, which are sent as an indication that monies are owed. Once received, clients will typically pay by the due date, with the invoice then being archived for profit, loss and tax purposes. From a client perspective, invoices also provide a handy way for customers to catalogue what they’ve paid for future reference.

By employers

When freelancers work for multiple employers, they need a framework that allows them to be paid for the work they do and that framework is the invoicing process. So, during a typical employer-freelancer transaction, a quote for work will be accepted, with an invoice being issued upon completion of said work. On some occasions, full or part payment will be required for the work to commence, which will require an invoice to be raised prior to work starting.

By contractors

Another set of nomenclature that can be wrongly interchanged is that of the freelancer and the independent contractor. While there are a lot of similarities between the two, freelancers will more often work for multiple clients, invoicing as they go. They will pay their own income tax, set their own hourly rates and work pretty much as they choose. Invoicing for a freelancer is on a job by job basis for an agreed fee.

Contractors, on the other hand, will often work for single employers for long periods of time and can belong to an agency. In this scenario, they may have their tax and National Insurance sorted out by the agency, but not exclusively. Invoices, in this case, will typically be issued by the contractor for hours worked and sent at the end of each month to the employer.

What to include on an invoice

When putting your invoice together, it’s important that it contains all of the vital information, so that your customer understands every aspect of the transaction and knows exactly what to expect. In this section, we look at every element you should include so that nothing gets missed.

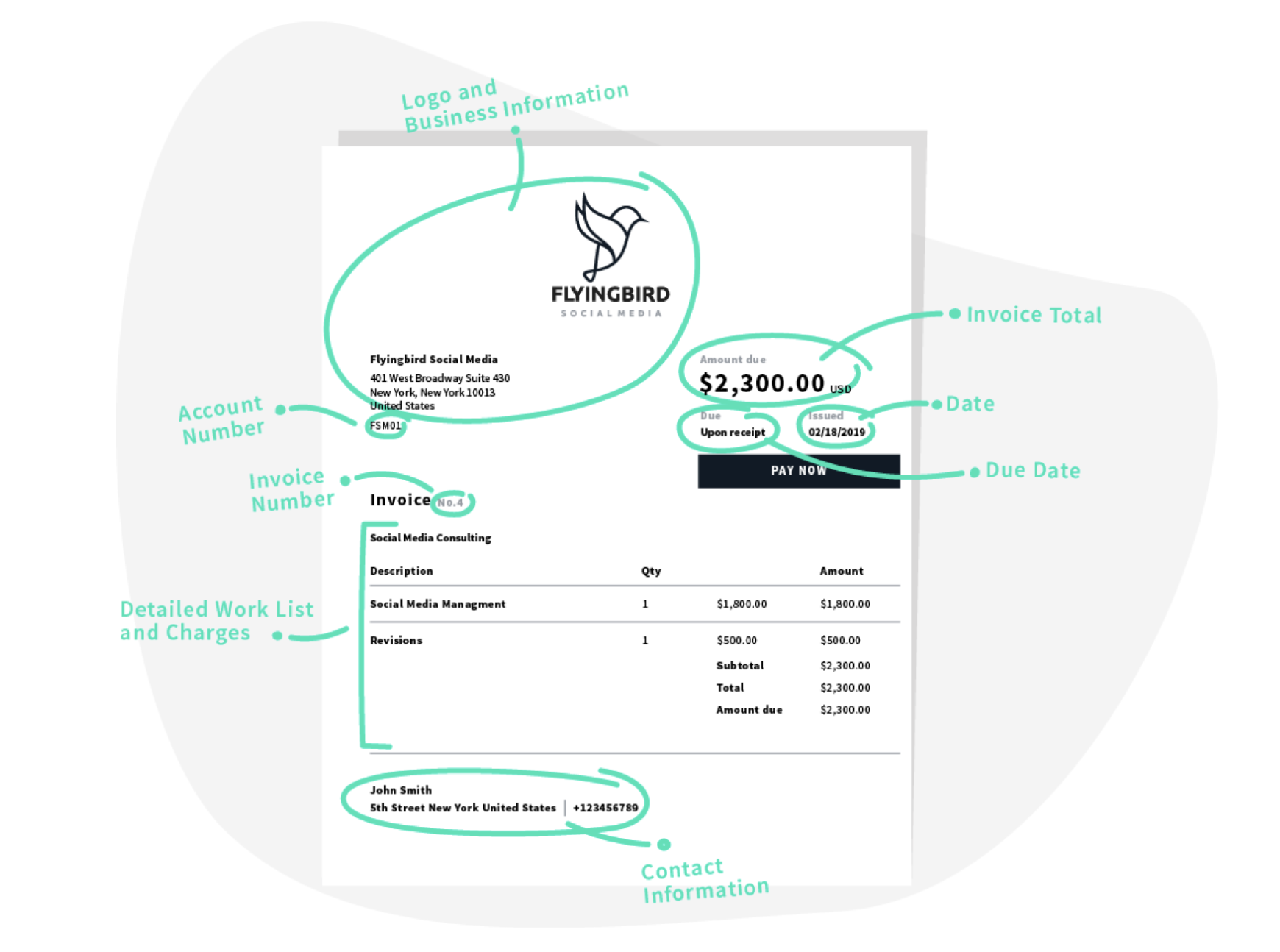

Element #1 – Include the word ‘Invoice’ – This might seem like an obvious thing to include, but it’s important that whatever form your invoice takes, it has to include the word to clearly show the person or company you’re sending it to what it is.

Element #2 – A Unique Number – In order to help you and your clients keep track of their invoices, they each need to have their own serialized number e.g. invoice #001 followed by invoice #002 and so on…

Element #3 – The name of your company and your address – Whether you’re a freelancer or a limited company, your invoice should show your name and/or company name and address, along with details of how to get in touch in case of any queries need to be raised.

Element #4 – A description of the services or goods supplied – Whatever has been supplied to the customer needs to be included on the invoice, with a separate line for each individual part.

Element #5 – Dates – There are two dates that need to be entered onto any invoice you send out: the supply date and the invoice date. These are often the same date, but when they’re not, they highlight when the work/goods were supplied in relation to the date the invoice was created.

Element #6 – Payment Terms – Also listed should be the terms of payment e.g. ‘due on receipt’ or ‘payment due within 7 days’, which will usually appear at the bottom of the invoice. Often times you’ll see payment terms described as ‘Net 15’ or ‘Net 0’, which means 15 days or upon receipt, respectively.

Element #7 – The amount payable – As well as a total amount to be paid, your invoice should also have the individual prices of separate items or services supplied too. This provides clarity to both parties about exactly what has been charged.

Element #8 – The customer’s company name and address – Including the customer’s name and address is standard procedure and it helps you keep a record of who you’ve sold to, as well as helping your customers to claim back VAT when required.

Element #9 – Purchase order number – should you have been supplied with a purchase order number, it should be displayed on your invoice. If one has been provided, this represents a legally binding agreement between you and your customer to which the invoice is referencing.

Element #10 – Payment Options – Last on our list are the available payment options which can include wire transfer, PayPal, bank check or whatever method you choose. Just be sure to check that all details and references provided are 100% correct.

How to make an invoice

There are 3 solutions to make an invoice:

Option 1

Create everything from scratch in the format of your choice. However, there are already templates and free tools out there. If you want to save time, we would advise looking into options 2 and 3.

Option 2

Use technology to make your life easier. Any invoicing software lets you create invoicing by reusing client and billing information. In 5 clicks, send an invoice to your client and get paid online. There are also ways to set up reminders and even automate follow-ups with your clients when it’s time to pay. We are listing invoice software below, some are even free!

Option 3

Use one of the free invoice generators we are mentioning below. Invoices are downloadable in a PDF format. You can also download invoice templates in different formats: Excel, Word, Google Docs, etc. Client information will have to be entered manually and can create repetitive tasks, but at least you get control over every aspect of the invoice.

Invoicing software for sending your invoices

In this section, we’re going to look at exactly how to create an invoice and we’ll be looking at how to do so with a selection of the leading providers of invoicing software on the market. You might ask, what is an invoice software? Don’t worry, it’s a relatively simple process for each one. So let’s get cracking and get your invoice put together.

Moxie

Moxie gets you everything you need to be a successful business owner. It’s designed specifically for freelancers in mind offering user-friendly invoicing capabilities that are comprehensive and robust at the same time.

Created by a team of freelancers themselves, Moxie continually improves by introducing new features to streamline invoicing, contracts, proposals, CRM, and more. With Moxie’s incredible invoicing functionalities like recurring invoices, automatic reminders, and customized payment terms, invoicing has never been easier.

If you’re curious about Moxie, dive into our detailed review for all the insights. Or better yet, Moxie has a really great free trial you sign up for here.

Freshbooks

Another widely-used invoicing software platform is Freshbooks, which offers a simple invoice creation process which can be seen here. All you need to do is access the Freshbooks Dashboard and then click on the ‘Create New’ button which directs you to the invoice screen. From there, it’s a simple enough path to construct your invoice, with options to change themes and fonts available. You can give it a try for free for 30 days.

Quickbooks

The next major invoicing platform on our list is Quickbooks, which also provides a relatively simple invoice creation process. To put together an invoice with Quickbooks, you simply head to their home page and select ‘Create Invoices’, after which, the software will lead you through each of the elements you need to include. Quickbooks offers a free 30-day trial as well.

Bonsai

Next, we have Bonsai, who also offer a quick and easy method of invoice creation, the complete process of which can be found here. After signing up for a free account, you can navigate to the dashboard where you’ll find the ‘Create Invoice’ button and a good amount of guidance on how to fill it out correctly.

Click here to try Bonsai for free for 14 days or read our Bonsai Review

Lili

Lili is a banking solution truly made for freelancers. Packed with features that freelancers will love, like no minimum monthly balance and no monthly service fees. Think Lili might be too niche? They have all the great perks of a national bank, such as mobile check deposits, a mobile banking app, and a VISA debit card for easy purchasing. On top of that, easily manage your freelance business expenses on the fly, and set up a “Tax Bucket” — a set percentage of your income you choose to set aside for taxes. See what we mean when it’s made for freelancers?

Click here to sign up for Lili or Read our Lili Review

Honeybook

Lastly, but by no means least, is Honeybook – an invoicing platform that offers a free and easy way for freelancers and small businesses alike to invoice their clients. Once your client details have been entered into the software, it’s just a matter of clicking on the project and then entering all of the relevant info, as can be seen here. Each plan comes with a 7-day free trial.

Click here to sign up for Honeybook or read our Honeybook Review

Template and examples of an invoice

Free Invoice Generators

Want to save time and use an invoice generator instead? Create an invoice in PDF format without having to sign up for an account on these sites: Fiverr Workspace, Quickbooks, and Honeybook.

Free Invoice Templates

Find invoice templates that can be used under different formats and customized to your specific needs:

Millo: Freelance invoice template

Fiverr Workspace: Free invoice template downloads

Freshbooks: Invoice templates

Microsoft: Microsoft Word and Excel invoice templates

Invoices: An Essential Business Tool

So, there you have it, our complete invoicing guide in its entirety. Invoices are an essential part of the business machine, as, without them, freelancers would find it much more difficult to get paid. The good news is that creating invoices doesn’t have to be a trauma or hugely costly. Of course, you always get what you pay for, but there are plenty of free or low-cost options available for small businesses and freelancers to use to keep their cash flow moving.

That’s it from us. We hope you have enjoyed reading our blog and that it has proven useful to you in your business pursuits.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!