When I started freelancing, I wasted hours on manual invoicing. Then I discovered invoicing software—a game-changer for my business. Now there are countless options, making it tough to choose. That’s why I’ve created this list of my top freelance invoice sofware.

These tools do more than just invoicing, often including time-tracking and project management features and more… Let’s explore which might work best for your freelancing needs.

Get Weekly Freelance Gigs via Email

Enter your freelancing address and we'll send you a FREE curated list of freelance jobs in your top category every week.

Best Invoicing Software for Freelancers

| Brand | Description | Rating | Price | Links |

|---|---|---|---|---|

Best Overall  | Freshbooks•FreshBooks is an easy-to-use accounting software designed for business owners and accountants. It simplifies invoicing, payments, expense tr... |

| Starts at $19/moTry free for 30 Days | |

Author Pick  | Harpoon•Harpoon is a financial management platform designed for agencies, studios, and freelancers. It combines time tracking and invoicing with for... |

| Starts at $9/moTry free for 14 days | |

| Xero•Xero is a cloud-based accounting software designed for small businesses. It offers a comprehensive suite of financial management tools, incl... |

| Starts at $15/mo75% off for 6 months | |

| Bloom•Manage your creative business in one place. Bloom provides a powerful business management and growth toolset, to help you launch your side-g... |

| Starts at $7/moTry free for 7 days | |

| Bonsai•The business and invoicing management solution that gives you peace of mind and allows you to focus on your work. Used by 500,000+ freelance... |

| Starts at $21/moTry free for 7 days | |

| Honeybook•A tool with everything you need to get business done. Over 100K freelancers trust HoneyBook to manage projects, book clients, send invoices,... |

| Starts at $16/moTry free for 7 days | |

| Quickbooks•Smarter business tools designed for small businesses, freelancers, and self-employed individuals. Save time with automatic expense categoriz... |

| Starts at $20/moTry free for 30 Days | |

| Moxie•Everything you need to thrive as a freelancer. From contracts, proposals, and client management to invoicing, branded client portal, and a t... |

| Starts at $16/moTry free for 14 days | |

| Square Invoicing•Simplify invoicing with customizable templates, seamless payment acceptance, and real-time tracking. Send invoices, estimates, and contracts... |

| Starts at $0Use basic features completely free. |

Our Best Pick Overall

Freshbooks

FreshBooks is an easy-to-use accounting software designed for business owners and accountants. It simplifies invoicing, payments, expense tracking, and more, helping you save time and look professional. Perfect for freelancers, self-employed professionals, and businesses with teams, FreshBooks offers a 30-day free trial to get you started with no risk.

Why we like Freshbooks ‣

FreshBooks stands out as an excellent choice for freelancers and small businesses who want to grow. Its user-friendly interface and seamless onboarding process allow users to set up their accounts and start working quickly. FreshBooks offers a range of features tailored to service-based businesses, including unlimited invoicing, time tracking, and client retainer options even in its most basic plan.

The software's flexibility is particularly appealing, allowing users to easily upgrade as their business grows without losing functionality. FreshBooks also excels in customer support, providing readily accessible phone and email support, which demonstrates their commitment to user satisfaction.

Read the Full Review

Freshbooks Pros & Cons ‣

Pros:

- User-friendly interface with easy onboarding

- Flexible pricing plans that grow with your business

- Unlimited invoicing, time tracking, and estimates on all plans

- Excellent customer support with readily available contact options

Cons:

- Limited to 5 billable clients on the basic plan

- Additional cost for each team member added ($10/month)

Other Great Invoicing Options

Harpoon

Harpoon is a financial management platform designed for agencies, studios, and freelancers. It combines time tracking and invoicing with forward-looking features like revenue forecasting and financial goal tracking. The platform offers predictive project budgeting, automated invoicing, expense management, and comprehensive reporting tools. Harpoon emphasizes profitability planning and financial clarity, helping businesses monitor their financial health and achieve revenue goals. The software includes team management capabilities and integrates with other tools through APIs and Zapier.

Why we like Harpoon ‣

Harpoon offers a unique combination of time-tracking and financial forecasting software designed specifically for agencies, studios, and freelancers. We appreciate Harpoon's focus on forward-looking financial management, helping businesses not just track time and send invoices, but actively plan for profitability. The platform stands out for its ability to help businesses set and achieve financial goals while providing clear visibility into future revenue.

Harpoon Pros & Cons ‣

Pros:

- Built-in financial goal tracking and progress monitoring

- Real-time revenue forecasting based on project activity

- Predictive project budgeting for early profitability assessment

- User-friendly time tracking system that teams will actually use

- Automated invoicing with recurring billing capabilities

- Comprehensive expense budgeting and tracking

- Robust reporting with customizable dashboards

- Advanced team management with roles and permissions

- Integration capabilities through API and Zapier

- Guided approach through "The Harpoon Method"

Cons:

- May be more sophisticated than needed for very small businesses

- Limited information about specific pricing tiers on website

- Learning curve to fully utilize all forecasting features

- Some advanced features may require higher-tier plans

- Might require adjustment period for teams used to simpler tools

- Could be overkill for freelancers with basic invoicing needs

Xero

Xero is a cloud-based accounting software designed for small businesses. It offers a comprehensive suite of financial management tools, including invoicing, expense tracking, bank reconciliation, and reporting. Xero emphasizes user-friendliness and automation, aiming to simplify accounting tasks for business owners. The platform supports real-time financial visibility, integrates with various third-party apps, and provides features like inventory management and payroll. Xero's cloud-based nature allows users to access their financial data from anywhere, facilitating collaboration with accountants and bookkeepers.

Why we like Xero ‣

Xero stands out as an excellent choice for freelancers, solopreneurs, and small businesses looking for comprehensive yet user-friendly accounting software. One of Xero's key strengths is its ability to support unlimited users at no extra cost, making it ideal for growing businesses with multiple team members who need access to financial data. The software leverages AI effectively, particularly in areas like bank account reconciliation, which can save valuable time for busy entrepreneurs. Xero's advanced reporting capabilities provide deep insights into business performance, helping owners make informed decisions. With features like automated invoice reminders and receipt capture, Xero streamlines many day-to-day accounting tasks, allowing business owners to focus more on their core operations and less on paperwork.

Xero Pros & Cons ‣

Pros:

- Unlimited users at no extra cost

- Strong AI-powered bank reconciliation

- Advanced reporting and business insights

- Thorough contact records for customers and suppliers

- Good mobile apps for on-the-go accounting

Cons:

- No inventory assemblies feature

- Time entries must be tied to projects

- Navigation can be confusing at times

- Personalized support is email-only

- Invoice approval process may be overly complex for some users

Bloom

Manage your creative business in one place. Bloom provides a powerful business management and growth toolset, to help you launch your side-gig or freelance business.

Why we like Bloom ‣

Bloom.io is a real powerhouse for freelancers and creative professionals. It packs a ton of useful tools into one platform - you've got invoicing, project management, CRM, and even website building all in one place. What really sets it apart is how it takes all those annoying admin tasks off your plate. As a freelancer, you can finally focus on the work you actually love doing. We're big fans of their cool features like instant booking and the way you can customize how you deliver your work to clients. Plus, it's super easy to use and won't break the bank. They even offer a pretty generous free plan. If you're a freelancer looking to grow your business without drowning in paperwork, Bloom.io could be just what you need.

Read the Full Review

Bloom Pros & Cons ‣

Pros:

- Comprehensive all-in-one solution for freelancers

- Innovative features like instant booking and customizable workflows

- Free invoicing and booking features

- Affordable pricing with a generous free plan option

Cons:

- Lacks email marketing capabilities

- No multi-user functionality for team collaboration (though coming soon)

- May be too focused on solo freelancers for those with larger teams

- Some users may find certain features overly simplified

Bonsai

The business and invoicing management solution that gives you peace of mind and allows you to focus on your work. Used by 500,000+ freelancers globally.

Why we like Bonsai ‣

Bonsai caught our eye as a solid tool for freelancers who want to spend less time on paperwork and more time creating. It's like having a personal assistant who handles the boring stuff - contracts, invoices, time tracking - all rolled into one neat package.

What's cool is how it connects the dots: you can whip up a proposal, turn it into a contract, and then boom - your invoices are ready to go. It's not trying to be everything to everyone, but for solo freelancers who need the basics covered without fuss, Bonsai hits the sweet spot.

Plus, with features like auto-payment reminders, it's like having a polite but persistent collections department working for you 24/7.

Read the Full Review

Bonsai Pros & Cons ‣

Pros:

- Seamless flow from proposals to contracts to invoices

- Built-in legal templates save on lawyer fees

- Time tracking that integrates directly with invoicing

- Nifty auto-follow-up for unpaid invoices

- Bitcoin payment option for tech-savvy clients

Cons:

- Project management features are pretty basic

- Expense tracking could use some beefing up

- Reporting tools are more bare-bones than data-rich

- Might be too simple for larger agencies or complex projects

Honeybook

A tool with everything you need to get business done. Over 100K freelancers trust HoneyBook to manage projects, book clients, send invoices, and get paid.

Why we like Honeybook ‣

HoneyBook is like the Swiss Army knife for freelancers who are ready to level up their game. It's not just about keeping your ducks in a row; it's about transforming your kitchen table operation into a smooth-running business machine. What really caught our eye is how HoneyBook connects all the dots in your workflow - from the first "hello" with a client to the final "ka-ching" in your bank account. It's got that perfect mix of automation (hello, instant follow-ups!) and customization (brand those invoices, baby!). Plus, at $9 a month to start, it's like hiring a mini-assistant for less than the cost of a fancy coffee. For solo acts looking to hit the big time without drowning in admin work, HoneyBook might just be your ticket to the freelance big leagues.

Read the Full Review

Honeybook Pros & Cons ‣

Pros:

- All-in-one solution: proposals, contracts, invoices, and scheduling in one place

- Slick automated workflows that make you look super professional

- Customizable templates save time and brain power

- Affordable entry point for solopreneurs

- Built-in payment processing (including auto-payments for retainer clients)

Cons:

- Initial setup can be time-consuming

- Some users find the interface could use a luxury upgrade

- Might be overkill for freelancers with just a handful of clients

- Learning curve can be steep for tech-averse users

Quickbooks

Smarter business tools designed for small businesses, freelancers, and self-employed individuals. Save time with automatic expense categorization, mileage tracking, and seamless tax preparation.

Why we like Quickbooks ‣

QuickBooks is a robust accounting solution that caters well to established and rapidly growing businesses. Its extensive feature set includes advanced capabilities like inventory management, detailed project profitability tracking, and built-in mileage tracking. QuickBooks offers superior connectivity, boasting over 700 third-party app integrations, which allows for seamless incorporation into various business ecosystems. The software also provides options for more comprehensive financial support, including the ability to partner with a live bookkeeper for professional assistance. QuickBooks' scalability makes it an excellent choice for businesses anticipating significant growth or those requiring more complex accounting features.

Read the Full Review

Quickbooks Pros & Cons ‣

Pros:

- Extensive feature set including inventory and project profitability tracking

- Large number of third-party app integrations (over 700)

- Built-in mileage tracking

- Option to work with a live bookkeeper for additional support

Cons:

- Steeper learning curve compared to other tools

- More expensive, especially after promotional period ends

- Cannot upgrade from Self-Employed plan to other plans

- Limited number of users even on higher-tier plans

Moxie

Everything you need to thrive as a freelancer. From contracts, proposals, and client management to invoicing, branded client portal, and a ton more.

Why we like Moxie ‣

Moxie stands out as an all-in-one solution designed specifically for freelancers, addressing their unique needs and challenges. Its comprehensive suite of tools covers everything from project management and invoicing to time tracking and accounting, all within a single, user-friendly platform.

Moxie's affordability, combined with its focus on simplifying the administrative side of freelancing, makes it an attractive option for both new and seasoned independent professionals. The software's ability to grow with the user, from solo freelancer to small agency owner, adds to its appeal as a long-term business management solution.

Read the Full Review

Moxie Pros & Cons ‣

Pros:

- Absolutely great customer service—you can even reach the CEO

- All-in-one platform combining multiple essential freelance business tools

- Affordable pricing with no hidden fees or upsells

- Designed specifically for freelancers' needs

Cons:

- Some features may be too simplistic for more complex business requirements

- Relatively new product, which may mean fewer integrations or advanced features

Square Invoicing

Simplify invoicing with customizable templates, seamless payment acceptance, and real-time tracking. Send invoices, estimates, and contracts effortlessly, get paid faster, and manage your business efficiently with Square's comprehensive invoicing tools.

Why we like Square Invoicing ‣

Square Invoices is the unsung hero of the small business world, making the dreaded task of billing as painless as possible. It's like having a tiny, tireless accountant in your pocket, ready to whip up professional-looking invoices in minutes. What really sets it apart is how it plays nice with Square's other tools, creating a smooth flow from sale to paid invoice. The cherry on top? It's user-friendly enough that even the most tech-phobic business owner can master it quickly. For small businesses and freelancers looking to get paid without the hassle, Square Invoices might just be the secret weapon you've been searching for.

Square Invoicing Pros & Cons ‣

Pros:

- Super easy to use, with a quick learning curve

- Seamless integration with other Square products

- Professional-looking, customizable invoices

- Fast payment processing with multiple payment options

- Automatic payment reminders and tracking

Cons:

- Higher transaction fees for invoices compared to in-person payments

- Occasional issues with emails going to spam folders

- Limited options for handling split payments

- Some users find more advanced features lacking for larger businesses

- Initial account setup and verification can be time-consuming for some users

How to use these invoice tools to actually get paid

Running my own small business, I work with freelancers and contractors all the time. And I’m constantly shocked at how many new freelancers don’t understand freelancer invoicing basics, like how to send an invoice or make it easy for clients to pay you for your work.

I guess I shouldn’t be surprised, most freelancers went to school to be marketers, designers, writers, or work in some other specialty.

Freelancer invoicing just wasn’t in any of their class curriculums.

So before wrapping up, I’d like to offer my own “class” on freelancer invoicing: a simple yet effective guide to invoicing as a freelancer.

We’ll start with the basics of freelancer invoicing and then move to more advanced tips and techniques to help you send invoices quickly and get paid on-time, or you can get paid early if you know who to ask.

We’ve also got tons of other freelancer invoicing resources on the blog including

But if you’re just getting started with freelancer invoicing, all of that can wait until later. You’re probably asking yourself some pretty basic questions (yet, frustrating if you’ve never done it before) such as:

- How do I make my own invoice? or

- What should you put on an invoice?

So let’s dive into this guide and make some serious progress in your freelancing. This is Freelancer Invoicing 101.

5 Big Questions About The Best Freelancer Invoicing Apps (FAQ)

To start, I want to answer some of the biggest questions you might have about invoicing as a freelancer. This will allow us to start with a common foundation for the remainder of this freelancer invoicing guide.

How do I make my own invoice?

Making an invoice can be as simple as opening a word document and typing a few details including business name, services rendered, cost of services, and terms of payment. Many people choose to use invoicing software to make the process easier.

How do I write a simple invoice?

Writing a simple invoice is pretty easy and you’ve got lots of options. You can download and use a free invoice template or you can fill out the fields of an invoice generator which will then automatically create your invoice.

The key is to keep your process fast and simple because you typically can’t bill loads of hours to creating invoices (more on that later).

What should you put on an invoice?

If you’re not sure what should be included on a freelancer invoice, you’re not alone. It’s really quite simple. At a minimum, you should include the following when invoicing as a freelancer:

1. The word “INVOICE”

I know this seems obvious, but your invoice is more likely to get paid if you include the word “Invoice” somewhere large, bold, and at the top of the page. This signals to people they have a bill due and they’re more likely to process it quickly.

2. Your business name

Every invoice should include your own name. If you’re a solo freelancer, this can simply be your personal name. If you have a business name or work on a team, this should be your company name.

3. Your client’s business name

If you’re doing work for a company, include the full company name when invoicing. If you’re doing work for an individual, just use their own personal name on the invoice.

4. Description of services rendered

In the main area of the invoice, provide an itemized list (use a table or bullet points) of services you’ve rendered to your client to outline exactly what the invoice is for.

5. Cost of services rendered

Next to each item on the list of services, include how much it cost. Alternatively, you can just include the total cost for all services if you don’t want to break out each item.

6. Payment terms (when and how to pay)

Prominently feature payment terms (such as “Due on Receipt” or “Net 30”) on your invoice as well as clear instructions on how to pay. Using a tool like Freshbooks or Bonsai will remove any confusion on how and where to pay your invoice.

BONUS: Additionally you may want to consider putting the following on your invoice:

7. Business addresses, emails, phone numbers, etc.

Some clients require that you include certain contact information for both their company and yours on your invoice. These can include email addresses, physical addresses (just use your home address if you work from home) or even tax identification information.

8. Invoice number

While not necessarily required, adding an invoice number to your invoice can help referencing invoices later. Instead of trying to find “my last invoice” in your records or even “the invoice you sent on Oct 12”, you can just refer to the invoice as “invoice #1234” when talking with your client.

Beginner tip: if this is your first invoice, don’t make the number “0001” as it will give away just how new you are to freelancing. Instead, make up a number and then just add +1 to the number each time you create a new invoice.

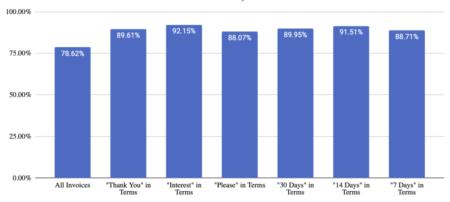

9. A thoughtful note

You may want to consider adding a thoughtful, personalized note to your invoice as well. Not only can these help solidify your relationship with each client, one study showed including “please” or “thank you” on your invoice can increase your likelihood to get paid on time.

How do I invoice as a freelancer?

Okay, now that you’ve got a well-written invoice with all the important details, it’s time to actually send the invoice. Also known simply as “invoicing.”

So how do you invoice as a freelancer?

Simple. You just send the invoice to the client and make it obvious that’s what you’re sending. Here are the most common ways to invoice as a freelancer:

1. Send your invoice via the physical mail

Depending on your client’s preferences and your own business practices, you may want to send your invoice in the mail. This reduces the chances of an email getting lost, forgotten, or ignored by your client. However, it also increases costs and time to get an invoice sent.

2. Send your invoice via email

While historically many invoices were sent by physical mail, the majority of invoices today are sent via email. Lucky for you, this often leads to quicker processing and faster payment for your work.

When sending an invoice via email review these best subject lines for freelancer invoicing—they’ll increase your chances of getting paid on time.

3. Send your invoice with software

Of course, the final option is what most modern workers use (and expect) for freelancer invoicing—that is, to send your invoice using invoicing software.

Do you bill for invoicing time?

Now that you understand the basics of freelancer invoicing, there are a few more advanced questions we need to get to. For example: should you bill your clients for the time it takes to create an invoice?

If you’ve already built these costs into your original bid or have made your client aware of it, billing for invoicing time is perfectly fine. Some choose to simply split administrative costs up between their clients, which would also take care of the hours you spend managing invoices.

Of course, this becomes less of an issue if you choose to use a software like Freshbooks where you can create invoices in less than 60 seconds and then the technology follows-up with clients and manages the invoices for you, dramatically cutting down on billable hours wasted on invoicing time.

The same goes when invoicing for meetings and other miscellaneous tasks. If the client agreed to it or you’ve made them aware of it, great. If not, you shouldn’t bill for it.

The real trick to successful freelancer invoicing

Now that you’ve got a basic understanding of what it takes to create and send a freelance invoice that will get paid, it’s time to get back to the work you love the most (and the work clients pay you for).

The real trick to successful freelancer invoicing is to make it as seamless as possible—working it into your process so well that it happens almost on autopilot (tech helps with this).

That way, you’re not wasting lots of hours every week creating invoices, chasing down invoices, and doing other freelancer invoicing tasks that take you away from your most important work.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!

I use Zoho Invoices and it is great! Its probably free for most individuals.

Also there is inly.io – it’s a new app that makes invoicing and digital contracts a simple and beautiful experience for you and your clients!

This is awesome! Thanks!

Thank you SO much for this thorough post. I’ve copied the link for later, since I’m currently negotiating with some new clients. I’m also checking out your podcasts (I blog about podcasts over at http://podcastmaniac.com/) Thanks again!

I’m just starting up my freelance biz and have been looking for a list just like this! Thanks for sharing 🙂

thank you for sharing! very informative!

Thanks for the info. There’s so many great options to choose from.

Zipbooks is nice too, and free 🙂