With the explosion of the ecommerce industry, there has been a rise in tools and services that enable you to shop online. PayPal and Stripe are two of the leading names in the payment processing market.

But which one should you choose? In this guide, we will look at the features of both platforms that can help you make the decision. We will also go through some factors you should keep in mind to decide on the Stripe vs PayPal debate. Let’s start!

Stripe

Stripe is fast becoming a popular choice in the ecommerce industry. It is an online payment service that allows you to accept and send money from anywhere in the world.

Launched in 2011, the payment processor already boasts of clients like Amazon, Lyft, Uber, and Shopify. With operations in over 120 countries, millions of users turn to Stripe for its convenient features.

👀 The way clients search for freelancers has changed — stay visible across Google, ChatGPT, and AI platforms with Semrush One and land your next freelance client. Click here to see what you’re missing »

This section will look at those features Stripe provides and some of its benefits and drawbacks.

Details and features

The platform is particularly popular among businesses that have in-house programmers because of its customizable development tools. It is an all-in-one processor that combines the functions of a third-party payment processor with that of a payment gateway.

The platform is specifically geared towards the needs of an ecommerce business. It has a suite of tools that can be easily integrated with any ecommerce site. It also supports numerous currencies and has features that can help you navigate value-added taxes and exchange rates.

Stripe’s online payment processing tools include support for credit cards, ACH, and localized payment methods. It enables invoicing, recurring billing, and subscription tools.

You can also add features like Stripe Billing, including Stripe’s invoicing, recurring billing, and subscription tools. It also offers fraud management tools (Stripe Radar), marketplace and platform-building tools (Stripe Connect), and business intelligence services (Stripe Sigma).

In addition to these, there’s the Stripe Issuing feature. The Stripe Issuing feature allows you to create physical and virtual cards like an employee expense account.

Funds transferred through Stripe usually appear in the bank account within two business days, but it can take a bit longer in other countries. Stripe also handles PCI compliance for its merchants.

Stripe complies with industry standards in that most US-based merchants will see funds deposited in their bank account within two business days. In other countries, your payout time may be a bit longer.

Stripe handles Payment Card Industry compliance. There are a set of procedures to make online transactions secure and protect against identity theft for its merchants.

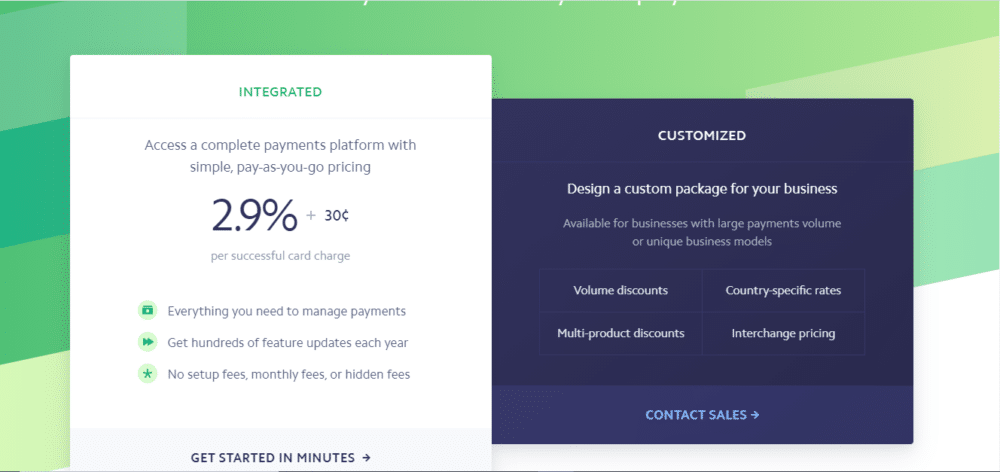

Pricing

Stripe offers a pay-as-you-go plan that charges 2.9% and an additional 30 cents for each successful card charge. If there is currency conversion required or if it is an international card, the charge bumps up to 3.9%.

You can create customized packages based on your preferences and business needs. Stripe charges 2.7% plus 5 cents for its point of sales services. An additional 1% is charged to the POS rate for international cards.

Pros

The platform offers a wide range of payment options, and it has easy-to-use features. One of the striking features of the platform is that you can integrate various third-party APIs like WooCommerce and MailChimp.

Stripe provides a vast library that houses popular frameworks and is popular among code-savvy teams for its customizable tools. Its trial period also covers delayed payments.

Stripe allows you to manage discounts, coupons, and subscriptions and provides a seamless checkout experience. It has a neat billing system where you do not have to save card information, and it does not charge a fee for a refund.

Cons

Though Stripe is available for business in more than 35 countries, it still has a limited presence. Sure, it does accept payments from across the world, but its limited presence remains an issue for business owners from the countries that are not on its list.

The many customizable tools of the platform also often require one to use developer resources on technical skills. Though the setup is easy, you may need some coding skills to maximize the platform’s potential.

Stripe has also seen higher decline rates due to issues with banks. Its customer service also remains an issue for some merchants and can be a problem for its users.

Now that we know how Stripe works, we will take an in-depth look at PayPal. It will help us compare Stripe vs PayPal better when it comes to the best in class online payment processors.

PayPal

PayPal is an industry giant and is easily one of the biggest names in the ecommerce space. PayPal has a unique arm for merchants named PayPal Commerce and offers point-of-sale services through PayPal Here.

Founded in 1998, the brand has grown to cover 202 countries and supports multiple currencies. This section will look at the features and pricing and the pros and cons of the platform.

Details and features

PayPal offers customizable developer tools to its users and is seen as a user-friendly tool. With service plans like PayPal Pro, you can get standard PayPal features, a virtual terminal, and a hosted checkout page for a monthly fee and processing costs.

Many of PayPal’s plans also cover PCI compliance and are known for their transparent policies. However, if you are a PayPal Payments Pro user, the merchant does cover some PCI compliance. The platform, though, offers tools to help make the process simpler.

With online and in-app invoicing and mobile POS under PayPal Here, the platform is a great addition to ecommerce platforms. PayPal also offers several integrations with flat pricing for in-person sales.

PayPal offers almost instant transfer of funds by depositing them in PayPal wallets. Merchants with their business debit cards can then spend the PayPal balance anywhere, for as long as that place accepts Mastercard.

You can also send these funds from the wallet to your bank account. The funds will get reflected in one to two business days or will be transferred as an instant deposit for a 1% fee.

Pricing

PayPal’s standard fee is 2.9% plus 30 cents for every transaction. However, if your funds originate from outside the U.S., the fee is 4.4% in addition to a fixed fee based on the country.

The pricing for an in-store location is a little different. For cards that originate in the U.S., the platform charges 2.7% of the amount. However, for international cards, it applies a 4.2% charge on the total amount.

Pros

The platform has a built-in option with WooCommerce and is seen as an easy-to-setup and use platform. The pricing policy is also quite simple, adding to ease of use.

PayPal is known for its fast processing systems and offers safe encryption to secure your payments. It keeps meticulous and easy-to-access records for all transactions on its site.

The platform is excellent for merchants and is also an excellent platform to send money to friends and family at no charge. It also has a great mobile app.

4. Cons

One of the drawbacks of PayPal is that it charges a rate even when you receive money. It also levies some additional transaction fees if you are dealing with some specific banks.

The platform boasts of solid security measures. However, this also means that it has a lengthy verification process before you can start using the platform. Over the years, it has also gained a bad reputation for freezing accounts.

Now that we know how both platforms work, let us look at the Stripe vs PayPal debate.

Stripe vs PayPal: Breakdown in comparison

The two platforms clearly offer different bundles and services. But to give you a more holistic view, in this section, let’s take a closer look at how each payment processor compares with the other in specific areas:

- Micropayments: While the pricing fee for both platforms is almost similar, they differ when it comes to micropayments (amounts under $10). PayPal charges 5% of the amount plus its country rate. However, Stripe charges 2.9% plus a transaction amount. These are important to consider, especially if you are a freelancer or a small agency that deals in micropayments.

- Dispute costs: These are costs that the merchants incur when a customer demands their money back. PayPal categorizes them into three categories—dispute/claim, chargeback, and bank reversal. When the chargeback is initiated, PayPal refunds the customer first. You are charged a processing fee that reaches up to $20. Stripe does not have different categories and levies a flat $15 fee.

- Accepted payment methods: PayPal allows you to add all types of cards, be it credit cards or debit cards, including PayPal itself. For people in the U.S., they also offer a virtual credit card. Stripe, on the other hand, has more options. It allows you to add almost all the major debit and credit cards in addition to other digital payment platforms like Apple Pay, Alipay, and Google Pay.

- Billing and invoicing: PayPal accepts payments from your website, PayPal website, mobile app, and more. It also generates invoices so that you can quickly charge your customers for the service. Stripe also has an excellent system in place and offers value-added services to its billing system like removing cards and managing new customers. Like PayPal, it also has several in-house tools to generate an invoice.

- Third-party integrations: Both platforms offer integrations with other platforms. However, PayPal does not allow you to integrate with CRM platforms. Stripe has a broader range of third-party integrations. Those include Hubspot and Agile.

- Ease in use: While both platforms are easy to set up, PayPal is generally seen as more convenient. As we saw before, to get the most of Stripe, you need some knowledge of coding. Stripe is therefore suited for tech-savvy teams.

- Global presence: Stripe has some catching up to do in this regard. PayPal has a more substantial and broader global presence.

- Fund transfer: With Stripe, it takes about two days to deposit the funds in your bank. However, with PayPal, you can immediately access your funds through the PayPal wallet.

- Place of transactions: With Stripe, the customer can enter their card details on-site without having to leave your website. It means that they have to enter their card details and pay instantly. However, PayPal redirects you to their website and asks the customer to log in. The customer is then redirected back to your website.

In the Stripe vs PayPal debate, there is no clear winner. Each platform has its benefits and drawbacks. The best fit depends on the nature of your business and what you need.

If you are looking for a payment processor with more presence, you should choose PayPal. However, if you are looking for a processor that allows for better integrations, Stripe is the best choice.

So, how do you decide which is the best fit for your business and settle on one in the Stripe vs PayPal battle? In the next section, we will look at a few factors that you should look at to help you make that choice.

How to select the best payment processor for your business

We’ve briefly reviewed Stripe vs PayPal. In the next section of this guide, we’ll look at some of the prime things you should consider when selecting a payment processor for your business.

1. Cost

Arguably, the most important thing you need to consider when choosing a payment processor is the cost. There are three main types of costs—the set-up fee, monthly fee, and transaction fee.

Consider both the volume and value of your transactions. For businesses with high-value transactions, look for platforms that offer a set monthly fee and a low transaction fee.

Take, for example, the fee of 2.9% plus 30 cents. That might work well for businesses with low-value transactions; however, your costs can add up if you have high-volume transactions.

2. Time taken to transfer funds

There is usually a lag between the approval of payments and the money showing up in your account. In the case of Stripe vs PayPal, the money takes about two business days to show up in your account.

However, PayPal also offers an instant solution. This is an essential factor to consider since it has a direct impact on your cash flow.

Suppose you need an immediate and continuous influx of funds. In that case, you should opt for a payment processor that offers you instant access to payments.

3. Multiple currencies

It doesn’t matter if you’re a small or an established business. As a business, you’re still more likely looking to expand to other markets. That means that the payment processor you choose should support the currencies from the different countries you’re looking to expand to.

Another thing to keep in mind is the fees involved in transactions originating out of your home country. It would help if you also looked at any other charge for converting currencies before making your decision.

It is an essential factor for merchants that have a high volume of transactions in the international market. A higher fee will significantly increase their costs and harm the business.

Choosing the right payment processor is the key to the success of any business. Since these businesses deal with the consumers’ financial details, you have to decide on the best while also considering security, add-ons, and integrations.

4. Mobile payments

There has been a rise in the number of people who shop from their mobile devices. Your payment processor must have the bandwidth to offer a smooth mobile experience.

Your payment processor of choice should help you tap into the potential of m-commerce and give your customers a chance to pay across channels. The platform should be equipped to handle large volumes of transactions through mobile devices.

Bottomline

As you can assume from the above, there’s no cut and dry answer in the Stripe vs PayPal debate as it really depends on what your business needs.

Stripe has a variety of customizable tools and integrations. If you are looking for a platform that’s easier to integrate, Stripe is your best bet.

PayPal offers excellent market coverage, but its pricing for international cards can be on the heavy side. If you need a payment processor that offers instant access to funds, PayPal is your best choice.

In a nutshell, identify your business needs and thoroughly check each platform’s terms and charges before you make any decision.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!