Accounting errors can cost you big time. Whether you accidentally bill a client incorrectly or miscalculate your supplies’ cost, you lose. Plus, come tax time, you won’t have an accurate reflection of income and expenses. So having reliable bookkeeper software is important.

But how do you choose one that works best for your business?

There are plenty of tools to pick from, and you can get help in any shape or form, from automated invoices to a self-employment tax calculator.

Here is a list of 10 great bookkeeper software options to keep your books balanced and your company organized.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

| Brand | Description | Rating | Price | Links |

|---|---|---|---|---|

Best Overall  | Freshbooks•Stop wasting hours on invoices and expenses. FreshBooks automates your accounting, so you can focus on what you do best: your freelance work... |

| Save 60% on FreshBooks Now60% off for 4 months | |

Editor Top Choice  | Collective•Collective is an all-in-one financial solution for self-employed entrepreneurs. It offers services including business formation, tax optimiz... |

| Starts at $296/moSave $10,000+ in taxes | |

| Bloom•Manage your creative business in one place. Bloom provides a powerful business management and growth toolset, to help you launch your side-g... |

| Starts at $7/moTry free for 7 days | |

| Wave•Wave is a financial management platform for small businesses and freelancers. It integrates invoicing, accounting, and payroll tools in a us... |

| Starts at $16/moUnlimited Free Basics | |

| Xero•Xero is a cloud-based accounting software designed for small businesses. It offers a comprehensive suite of financial management tools, incl... |

| Starts at $15/mo75% off for 6 months |

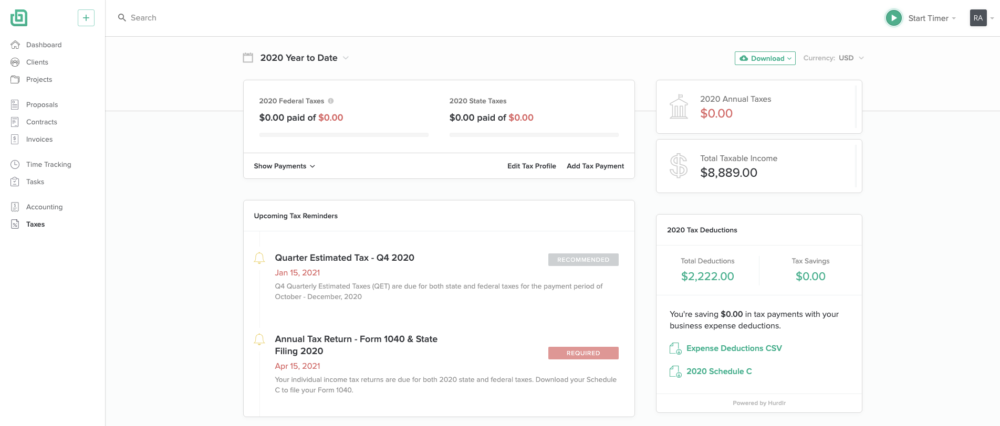

1. Bonsai & Bonsai taxes

Bonsai makes it easy to send and track invoices, create contracts, and send proposals. It’s easy to get paid, stay organized, and balance your books. You can also choose whether your clients will pay the processing fees.

With Bonsai taxes you can quickly analyze all your expenses, either manually added or imported, to automatically identify self-employment tax deductions, and estimate quarterly taxes.

The only drawback to this bookkeeper software is the interface can come across as fairly simplistic. But if you’re looking for a clean look with easy navigation, this may be the solution for you.

Price: $19 – $29 per month. There is a free 14 day trial available.

2. QuickBooks

QuickBooks is a great accounting tool for small to medium sized businesses. It offers invoicing, accounting integrations if you use multiple programs and online support. Plus, it’s helpful come tax time to account for what tax deductions you can take.

Because of its vast offerings, it does run a bit slower than other bookkeeper software options. And this could be an issue when you need to download things like reports quickly.

Price: $12.50 – $62.50 per month; There is a free trial available.

3. FreshBooks

FreshBooks offers a double-entry accounting platform that allows for invoices, estimates for taxes, expenses, time tracking, and projects. It’s a great option for freelancers and small business owners.

While it’s fairly easy to use and the navigation is simple, it has gone through a few updates which brings with it some glitches for new users.

Price: $4.50 – $15; Free trial available.

4. BetterLegal

BetterLegal sets themselves apart from the rest by claiming to have the fastest turnaround time anywhere (file with your state same day) along with transparent affordable fee structures and dedicated support team to help your freelance journey – be it business formation or managing your routine legal activities from time to time.

Fastest turnaround time anywhere, transparently affordable fees, extra help along your business journey after formation, and the first interactive dashboard to manage changes down the road.

Price: Set your business starting from $299 onwards.

5. Xero

Xero is a smart option for small business accounting. Some of its strengths include account reconciliation, data imports, inventory management and project tracking. There are also reports and a way to manage your documents through the system.

If you’ve never used a bookkeeper software, Xero offers minimal help on getting set up so this could be a drawback for first-time software users. Also, the mobile apps could use some improvement in terms of functionality.

Price: $9 – $60 per month; There is a free trial available.

6. Sage

SageAccounting is an online accounting software that works well across different technologies from desktop to laptop to mobile phone. Some of the key features include managing cash flow, sending and tracking invoices, and storing information on a cloud-based server.

While the features of Sage are great, their customer service and billing customers incorrectly are a couple drawbacks.

Price: $10 – $25 per month; There is a free trial available.

7. Wave

The most attractive feature of Wave is that it’s free so this makes an ideal bookkeeper software for a freelancer or for very small businesses. The company also offers regular updates and has added new tools like improved reconciliation and an instant payment option.

The drawbacks of Wave are really if you need more robust features. For example, it doesn’t have time-tracking, a comprehensive mobile app, nor a detailed payroll function like others on the market.

Price: Free; $20 – $35 per month for payroll option.

8. Pabbly

Pabbly is a subscription management software that automates your subscription billing lifecycle and automates the billing process. Some of the features include managing invoicing/payment processing, creating products/plans. And if you are a SaaS company, there are no per-transaction fees, extensive reporting and integrated affiliate management system.

The negatives are their customer service needs improvement and they are slow to fix system bugs. And if you don’t have a dedicated IT person on staff, the UI can be a bit confusing to get up and running quickly.

Price: $9 per month

9. ZipBooks

ZipBooks is bookkeeper software that does accounting, invoicing and time tracking for small businesses, contractors and accountants. The company also offers easy-to-use reports, industry best practices and suggested recommendations to get you up and running quickly.

If you are outside of the U.S., this may not be the best system for you as it’s hard or not possible to connect foreign banks. In addition if you are looking for high-level reporting such as a balance statement or a breakdown on your income statement, you are best to use a more robust system.

Price: Free – $35 per month; There is a free trial available

10. OneUp

OneUp was designed for a mobile platform so it’s great for a remote business or team members who are frequently on the road. It offers support for transactions, an inventory management system and product pricing tools, a CRM, and the ability to categorize.

However if you rely heavily on detailed reports or need payroll add-ons or time tracking, you’ll need to use a different bookkeeper software.

Price: $9 – $169 per month; There is a free trial available

11. Holded

Holded is a business management software for sole proprietors to large companies. It helps manage your sales, expenses, and time. Some of the features include invoicing, accounting, a CRM, project management and inventory.

This is another bookkeeper software that is better suited for U.S. based companies and it could do a better job with integrating automation software.

Price: $25 per month – $159 per month; There is a free trial available.

12. Lili

Lili Bank and the Lili App were designed specifically for freelancers. Depending on your business needs, you may choose to use it strictly as a business account, or as a personal account or hybrid. Packed with features that freelancers will love, like no minimum monthly balance and no monthly service fees. Think Lili might be too niche? They have all the great perks of a national bank, such as mobile check deposits, a mobile banking app, and a VISA debit card for easy purchasing.

Also, the Lili Pro plan allows you to create, manage and organize your invoices from the Lili app. Click here to sign up for Lili.

Price: Apart from the fee-free Lili Standard account, Lili users have the option to upgrade to a Lili Pro account, which has a monthly fee of $4.99.

How do you decide which bookkeeper software is right for you?

We’ve given you 10 great options for your bookkeeper software needs. But if you are between a few, what ultimately drives your decision? There are a few questions you should ask.

- What are your accounting skills? Do you have a dedicated accountant on your team?

- What features do you really need?

- Do you need a cloud-based format? Will you need access via mobile or desktop?

- What is your budget?

- Do you need add-on features or integrations?

- Who else can you tap into at your organization to help make your decision?

Once you create a short list of bookkeeper software options, answer these questions. Then compare and contrast each option on your list against your answers.

This should give you the best option to fit your needs. In the end, having an automated accounting software will give you the checks and balances you need to properly run your business.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!