Note: This article contains legal advice. We recommend you consult a lawyer before making legal decisions in your business.

Long-time freelancers have learned this the hard way, and will tell you over and over again: have a contract with your client that includes relevant freelance payment terms.

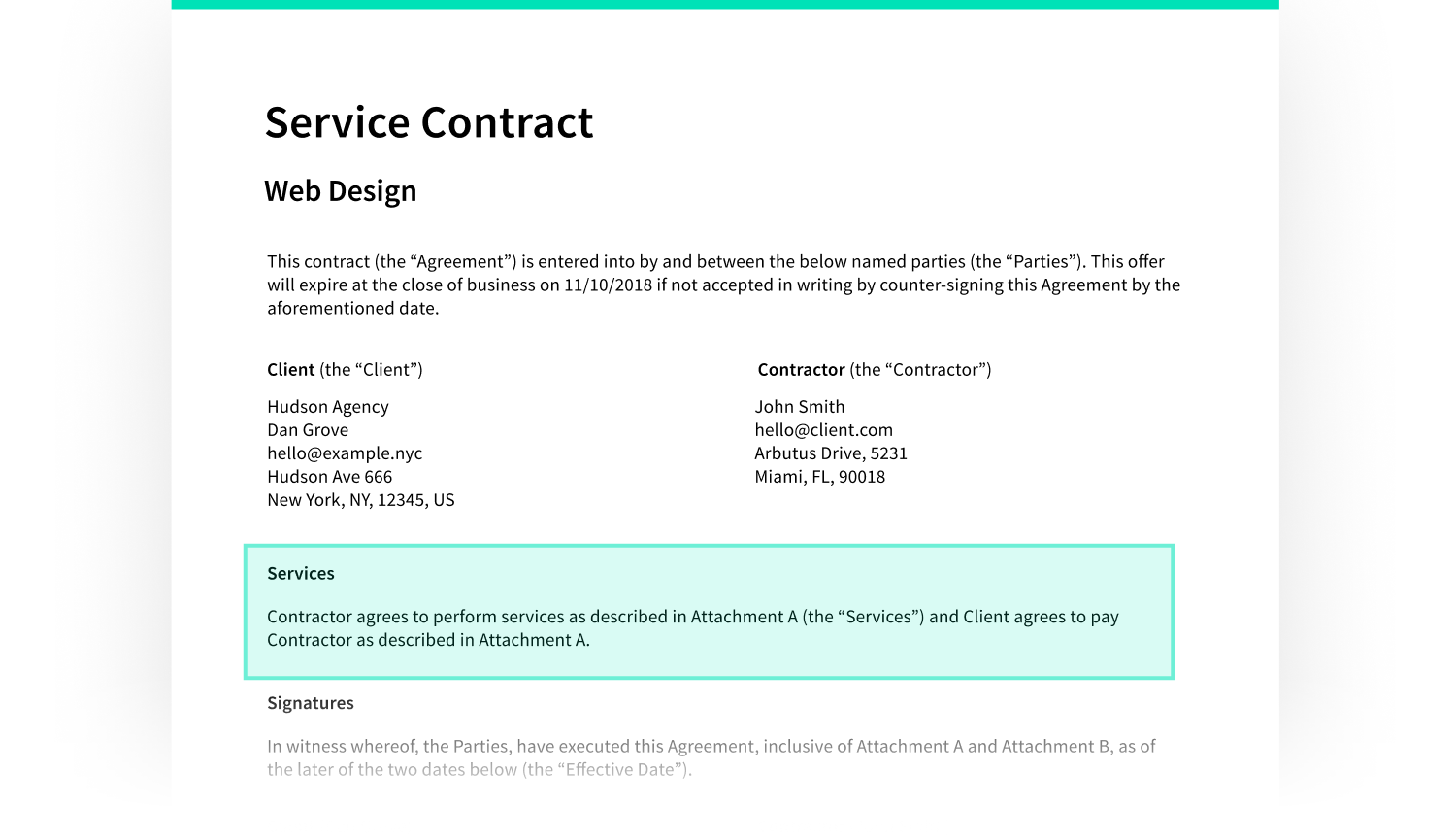

Operating without a contract is asking for trouble in case of any dispute. A contract builds trust with clients, sets clear-cut expectations, terms, and conditions that dictate project outcomes.

Upon completion of your project, you will send an invoice to your client to get paid. Timely and in full payment of that invoice depends as much on the quality of your work as on the payment terms you included in your contract. Let’s look at ten payment terms that you should know about and include in your contract.

Getting to know freelance payment terms

Freelancing is your business, and like all businesses that need a cash flow from their clients to pay bills and make a profit, you too require a regular cash flow from your clients. While raising your invoice gets you paid, your invoice is only as good as the freelance payment terms in your contract.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

Without clearly defined payment terms, if the client wants to delay your payment, all they have to do is nit-pick on your delivery and start re-negotiating terms.

Since payment terms are either not included in the contract or are vague, it comes down to your word against theirs. Guess who will win and lose in this dynamic?

That’s why you need to include clear and concise payment terms in your contract. You need to include terms that cover areas like sign-off on the quality of deliverables, the payment period, up-charge for late payments, and discounts for early payment, to name a few.

Clearly defined freelance payment terms will help you maintain a steady cash flow and enable you to create a budget and make financial forecasts just like all commercial businesses.

Put another way, the success of your business depends on the invoice payment terms that you build into your contract.

Let us now look at ten common payment terms you should understand and include in your client contract.

1. Project completion sign off

While this is not a payment-related term, it directly impacts ensuring timely and complete payment. After your project, make sure you get a sign-off from the client on satisfaction with the delivery time and the quality of your work. Remember the nit-picking client from above?

We want to shut the door on them. Of course, not all clients will be like that. The majority will pay according to agreed terms. However, as all businesses would do, it’s about hedging your risk.

2. Term of the sale

The term of sale covers the terms that you and your client agree on for completing the project. These terms cover areas like pricing, total cost, delivery period, payment method, and when the payment is expected or due. These terms are also an essential part of any invoice.

In short, it covers all the expectations of you and your client and removes the potential for any misunderstandings and disagreements down the line.

Both parties have clear expectations, and they agree to the same. Terms of sale are widely used in international trade (think working for an overseas client). You can create a ready-to-use email template for this to help you manage multiple clients.

3. Net 7, 15, 30, 60, 90

Let’s get down to the nitty-gritty of payment terms. The terms mentioned above are some of the most commonly used payment terms for freelancers. They specify the time between the invoice date and the payment date. For instance, let’s say you’re working on net 30 days. Now, if your invoice is dated April first, you would expect to be paid before April 30.

The freelance payment terms you choose are influenced by several factors, including the total cost of the project, the project length, and your own cash flow needs.

Generally, more prolonged, more prominent, and high-budget projects have a longer payment term, while shorter and lower-cost projects have a shorter payment cycle.

You should specify when the 30 day period starts. That would typically be the date from which you submitted the invoice.

4. Early payment terms

Let’s say your negotiated payment term is net 30 days, i.e., 30 days from the date of your invoice. Do you want to get paid earlier? Well, to do that, you have to incentivize the client to pay earlier than the negotiated period.

Make sure to include an incentive for early payment in your contract. A term like 2/10 net 30 means that while the invoice is due in 30 days, should the client choose to pay in 10 days, they would get a 2% discount. Again, the terms you offer will depend on your needs.

If you have a stable cash flow and an early payment would only help marginally, you could offer a 2% discount for early payment. If, however, you’re strapped for cash, you could offer a higher discount percentage for early payments. With 5/7 net 30, you’re offering the client a 5% discount for payment within seven days.

You can also rephrase the term for greater clarity. Hence, even something like “Please pay within 7 days to save 5 percent” will work.

5. Late payment terms

Late payment is a recurring issue for many freelancers who rely on prompt payment to maintain a steady cash flow and pay their bills. Having a chunk of your payments running late means you’re going to be out of pocket to meet your obligations constantly. An effective way to ensure timely payments is to tag a late payment charge in your contract.

A late payment charge is generally a monthly interest that you will charge for the overdue period. Start with doing some research to see how much interest you can legally charge in your state.

Next, discuss with your client and notify them of your late payment policy. Once this is done, you can start building in this clause to all your contracts and invoices.

The late payment clause in your contract can be a simple statement like, “I appreciate your business. The in-full payment is due within 30 days. However, all late payments will incur a 1.5% interest per month on late invoices.”

Of course, the best way to prevent late payments is a regular follow-up with your client. Contact the client a week before your payment is due as a reminder. A weekly follow-up is a must until the invoice is paid if the payment is more than a week late.

6. Interest invoice

We have seen some of the challenges faced by a freelancer due to late payments. What are the consequences when a client doesn’t pay the invoice on time?

If the client is running late on payments, you need to generate an interest invoice. Remember, when calculating the interest on the late payment, you’re only charging for the number of days that the payment is past due.

Let’s say you charge a 5% per interest rate on all late invoices, and a client invoiced for $1,500 is 60 days late. You would simply divide 60 by 365 and multiply that result by .05 ( 5% interest) and then by 1,500 (the invoice value on which you’re charging interest. The interest charge would come out at $12.33 for the 20 days.

(60/365)*0.05*1,500 = $12.33

Now you would have to reissue the invoice at $1,512.33. Keep in mind that an interest invoice is both a reminder of overdue payment and a revised invoice that includes the relevant interest charges and settlement date. As a process, send these invoices every month with the adjusted calculation.

7. EOM

EOM is the abbreviation for the end of the month. This freelance payment term means that you will be paid on or before the end of the month in which you raised the invoice.

While it has the advantage of assuring any predictable influx of funds at the end of each month, it won’t work with all your clients.

You could also have situations where EOM may not be workable. Let’s say you raised an invoice on the 27th of April. You’re only giving your client three days to receive and process your payments. If we just factor in the time for the client to get internal payment approvals, it’s not very feasible.

However, if you usually send out your invoices at the beginning of every month, this payment term will work because you’re now giving the client 25-30 days to process and pay your invoice. Hence, it’s best to use this if you always send your invoices within the first week of every month. Use email software to set the frequency.

Another variant of this term is recurring invoicing, which we will look at next.

8. Recurring invoicing

Businesses and freelancers engaged in long-term projects with the same client can look at working on this term. These usually are invoices raised for ongoing services like SEO and website optimization, web hosting, and guest posting services.

Typically the invoices are for the same amount each month and are like a monthly membership or subscription. Recurring invoices provide stability to your cash flow.

This makes forecasting a simple exercise and saves you the time of creating and sending the invoices to your client each month. The monthly payment reduces the probability of delayed payments, making your life easier.

It’s easy to set up recurring invoices with invoicing software available online. You’ll typically need to fill in the following information:

- Your customer’s details

- Details on the products/services you’re selling, such as price, quantity, and value.

- The invoicing frequency, starting date, number of occurrences, and sending options.

Once you’ve set up and scheduled your recurring invoice, the software allows you to choose the mode of sending it either manually or automatically.

Manual selection lets you quickly scan the invoice before it is sent and allows for typical situations like price change, end of the contract, or, say, your client is out of town for a month.

9. Method of payment

There are several physical and digital options available today, and freelancers would be wise to accept and set up to receive payments through multiple options. Every client has different needs and prefers different payment methods. Signing up for a wide selection gives you the flexibility to deal with different clients.

By making it easy for your clients to pay you, you will come off as more accommodating to your client, and it will help in getting paid on time. Overall, a better experience for your client.

Some of the common payment methods you need to look at include:

Cash and Checks: Cash and check payments are rare these days, and you probably won’t find many clients using this. The exceptions are old-school clients and cases where the invoiced amount is small. Most clients today would use a digital method of payment.

Credit Cards: Many businesses use corporate credit cards to settle business invoices. The use of credit cards gives the business an additional payment window over and above your payment term. Let’s say you work on 30-day terms and, the credit card company gives the client 40 days to make the payment. Your client is paying you in 30 days, but his outflow is 70 days. This arrangement helps cash flow.

Credit cards will charge you a fee but, including this option may help you get paid faster.

Automated Clearing House: ACH transfers are electronic funds transfers. This includes direct deposit to your account and multiple online options like PayPal, WePay, and Stripe. With ACH transfers, you usually get the funds with an hour or two of the client making the payment.

Wire Transfers: Wire transfers are providers that include Western Union and Transferwise. Here the client transfers the funds to the provider and gives you a transfer number. You go to the nearest branch, give the number, show some ID proof and collect your payment. They can also be set up so that the funds are transferred directly to your bank. However, the fees can add up, especially if it’s a small or one-time payment. Research the best options for your region (and your client’s).

You can set up, maintain, and track multiple payment methods. If you’re just starting out freelancing, setting up a bank account is the first step, then you can link your account to different online payment platforms.

You’ll need to create an account with all the payment gateways that you’d like to offer. Also, open merchant accounts with major credit cards. Make sure you mention the payment methods you accept on your invoices.

10. Factoring services

Ok, when it comes to freelance payment terms, this isn’t one for your contract, but it is a get out of jail card for situations all freelancers face from time to time.

Every freelancer has faced situations where funds are required urgently, and bills are either not due or are running late. What do you do in this situation? Invoice factoring is one viable option if you need money for urgent and unexpected bills or even to grow your freelance business. Be very cautious and know what you’re getting into before going this route.

This involves handing over your invoice to a factoring company that will pay you up to 85% of the invoice value in about one day. This comes in handy when you are stuck in a bind and need to plug holes in your cash flow.

Of course, the factoring companies will charge a fee and make sure that you read the fine print.

Factoring services like BlueVine charge a fee of 0.5 % of invoice value per week. However, most factoring services will allow your clients to continue to make payments under your business’ name.

Wrapping up

When considering the freelance payment terms to include in your service contract, always remember to be polite, keep the terms concise and clear, and offer incentives for early payments.

Tackle potential late payments with interest charges and give the client the flexibility to choose from a wide range of payment options.

With clear, concise, and consistent payment terms, you increase the chances of getting paid on time. And that is your primary goal, isn’t it? Bill like clockwork, be it weekly, fortnightly, or monthly. Make invoicing a priority.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!