Getting paid as a freelancer can be extremely rewarding or terribly frustrating depending on your situation.

Maybe it’s because most schools never teach students how to get paid as a freelancer—leaving most of us to fend for ourselves when the time comes to collect a check.

But learning how to get paid as a freelancer isn’t complicated or difficult. In our experience working with thousands of freelancers for over a decade, freelancers who get paid on time and well have figured out two simple things:

👋 Psst...Have you seen the all-new Feedcoyote yet? They've got a new look, more freelance opportunities, and the best collaboration tool for freelancers! Join over 100,000 fellow freelancers who network, find clients, and grow their business with Feedcoyote. Join for Free »

- The best apps or tools for getting paid as a freelancer and

- The most effective methods for collecting payment for freelance work.

So in today’s article, we’ll dive into both aspects of getting paid as a freelancer: the best apps for getting paid and the top methods for getting paid while working freelance.

By the end of this article, our goal is to teach you how to get paid as a freelancer so well that you never have to worry again about how to get paid for freelance work.

Let’s jump in:

How do freelancers get paid?

Before we get into how to get paid as a freelancer, let’s make sure we’re all on the same page on how freelancers get paid.

So exactly how do freelancers get paid by their clients? Typically, the process looks something like this.

Here’s how to get paid as a freelancer:

- Enter into an agreement with a client (contract or handshake)

- Create and send an invoice

- Collect payment through a payment portal or by cash/check.

We’ll dive in with much more detail in the article below. Before you continue, if you don’t know how to find clients in the first place, you may have more luck starting here instead.

Here’s how freelancers get paid in more detail:

The 5 Best Tools for Sending Invoices and Collecting Payments

If you need a quick win when it comes to figuring out how to get paid as a freelancer, we recommend using an app to manage your invoices and payments.

Why is this such a quick win?

Because using a tool like Moxie, Bonsai, Lili, or FreshBooks to manage your invoices and get paid for freelance work means way less manual work for you personally.

For example, many invoice apps for freelancers help you create invoices in less than one minute, automatically send those invoices to clients, and allow your clients to pay directly from the invoice (no cumbersome wire transfer or outdated paper check needed).

Plus, my favorite part: an app will automatically follow up with clients who have unpaid invoices for freelance work you’ve already completed so you don’t have to ask for payment yourself.

All without you having to remember or beg for payments.

It’s awesome.

So here are our top 5 recommended apps for getting paid as a freelancer:

Moxie

Moxie, one of the best freelancer-focused software solutions, features easy invoicing that doesn’t sell short. Integrated with one of the leading payment processors, Stripe, you can create modern and simple invoices in minutes. Add your logged time from their built-in time-tracking tool, and you can even itemize it by each time entry. Additionally, Hectic invoicing has features to help make it easy, like recurring invoices, automatic reminders and late fees, and custom payment terms. Download their app so you can invoice on-the-go and get paid with ease.

Bonsai

If you’re looking for something other than FreshBooks, another great option for getting paid as a freelancer is Bonsai.

Bonsai uses data from their tens of thousands of users to help freelancers get paid 13x faster than they do without Bonsai. That’s pretty significant for someone trying to learn how to get paid as a freelancer.

Bonsai is 100% free to try and has a really nice interface with tons of great options, not only for getting paid as a freelancer but managing your entire freelance business as a whole.

Plus, you could really benefit from Bonsai’s amazing invoicing features. You can create beautiful invoices in seconds, set up global payments, send automatic reminders, and get paid faster.

Click here to learn more about how Bonsai might help you solve the problem of getting paid as a freelancer.

FreshBooks

Next on the list is the freelancer invoicing app that comes recommended highly by our community of thousands of freelancers: FreshBooks.

What I like most about FreshBooks is the ability to create an invoice in less than 30 seconds (faster invoice creation = getting paid as a freelancer more quickly) and automatic reminder emails for clients who just can’t seem to pay you for your freelance work in a timely manner.

FreshBooks is completely free to try and 97% of people who sign up would recommend it to fellow business owners. So it’s a pretty safe bet.

Click here to learn more about how FreshBooks can help you get paid as a freelancer

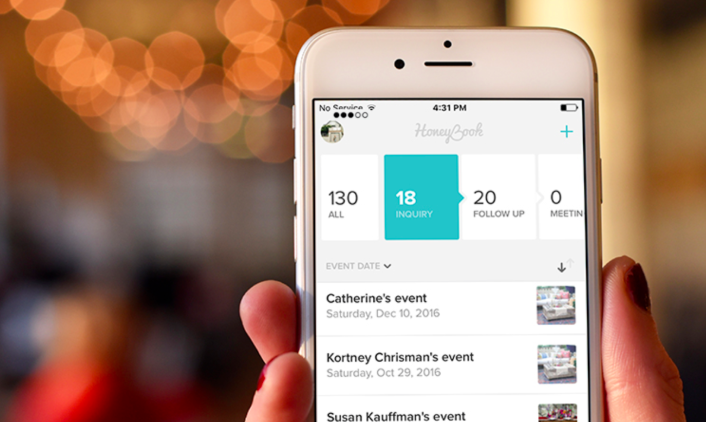

Honeybook

Finally, if neither of the other two options works for you, it may be worth considering Honeybook to help you figure out how to get paid as a freelancer.

Honeybook not only helps you get paid as a freelancer but also arms you with reports and tips for growing your creative services business.

Click here to try Honeybook completely free and see how it can help you get paid as a freelancer.

If none of those work for you, there’s also Quickbooks, Fiverr Workspace, and a whole bunch of other options. Be sure to review our list of best invoicing software for freelancers.

Of course, if you do most of your freelance work on sites like Fiverr or similar marketplaces, you don’t really have to worry about getting paid as a freelancer since these platforms handle the transaction for you.

Bloom.io

Bloom.io is a powerful business management and growth toolset that gives freelancers access to basically all of the features they need to run a business. It’s good to note that Bloom is also a free invoice generator for freelancers.

Its invoicing is modern, customizable, and free. Freelancers can create and send professional invoices with contracts in minutes. They have set a new standard for how freelancers offering creative services invoice and receive payments.

Bloom does not monetize these features. That’s cool!

Still, they allow you to:

- Collect a retainer and/or enable tipping.

- Offer clients instant 0% interest financing on the payments.

- Android and iOS apps enable on-the-go invoicing.

- Bloom is available in over 25 countries and supports 135+ different currencies.

Learn more with our in-depth full review of Bloom.io.

Lili

The Lili Banking App designed specifically for freelancers and small business owners. Depending on your business needs, you may choose to use it strictly as a business account, or as a personal account or hybrid. While it’s a checking account, Lili allows you to save in separate buckets. You can create buckets for tax expenses or an emergency fund, for example, and set up a percentage of your deposits to go into buckets automatically.

It’s also great for sending invoices via the Lili Pro plan and helps you create, manage and organize your invoices from the Lili app. Click here to sign up for Lili.

4 Pro Tips for Actually Getting Paid as a Freelancer

Of course, technology doesn’t handle every issue you’ll face you learn how to get paid as a freelancer.

Once you’ve got the right tools in place, you’ll have to employ the right methods for getting paid as a freelancer.

We’ve met a ton of freelancers who can’t seem to get paid for freelance work they complete. And we’ve also met lots of freelancers who always have plenty of money in the bank.

Here are a few ways to increase your chances of getting paid as a freelancer:

Collect payment upfront

Whether you choose to collect a partial or full payment, collecting before you begin your freelance work is a critical piece of figuring out how to get paid as a freelancer.

Getting paid upfront can be a little intimidating depending on how long you’ve been freelancing, but it’s not all too uncommon. If your client is hesitating to pay you for freelance work before it’s completed, compromise by collecting a deposit—refundable if you fail to uphold your end of the bargain.

My friend Chris Green compiled a list of advice from top-notch freelancers on how to get paid. Here’s what long-time designer and agency owner, Marksteen Adamson said:

“Scope out your project. Show the clients all the stages, including costs, and mention to them at the start that you will be charging 60% upfront and the rest on completion of the initial concept stage.”

Designer Thad Cox also agreed on this method for getting paid as a freelancer and said:

“I find that a watertight contract and a 50% deposit helps. I use a client questionnaire as a filter to flush them out and won’t agree to anything unless a deposit is secured and a contract is signed. All good clients have no problem doing this, only the dodgy ones.”

Get clients that are used to paying for creative work

You’ll be much more likely to get paid as a freelancer if you focus on finding clients that are used to paying for creative work. Here’s how Chris’s friend and Illustrator Andy J. Miller put it:

“I know this is a really common problem, but for the most part I work with people who are used to paying for illustration on a regular basis and have good systems in place to make this happen systematically.”

Our mutual friend and talented illustrator Alex Mathers agreed:

“The best way to avoid being paid late is to work with good, respectful and professional clients. This comes from being a pro yourself, and finding a lot of client work, so that you can say yes to the better clients.”

Make your invoice super-clear

Depending on how big your freelance clients are, it’s possible your invoice goes from your client to their accounts payable department, to someone you’ve never met or talked with.

So it’s important your invoices are as clear as possible. Learning how to write an invoice the right way will ensure you get paid in a timely manner.

Send invoices (and follow up) on a regular basis

Those who have figured out how to get paid as a freelancer have learned that sending your invoice is just the beginning. If you want to get paid for freelance work, you’ll most likely have to follow up on a regular basis with your clients.

Of course, if you’d rather not try to remember to manually follow up to get paid for your freelance work, you can use a tool like FreshBooks to send automatic reminder emails to your clients and get paid for the freelance work you’ve completed.

Taking action = getting paid as a freelancer

To wrap up this article, I want to stress something incredibly important: no freelancer who is unwilling to change or improve will ever get paid on time for the work she completes.

Just like anything when running a freelance business, mastering how to get paid as a freelancer takes time, testing, patience, and dedication.

In time, you’ll figure out the best tools and methods for ensuring you get paid for your freelance work. For now, I hope these quick resource links and tips have been helpful.

Good luck!

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!

Good article. I just started freelancing in NYC, and my client is in Miami. They started switching from Bimonthly to once-a-month payment, which was rough enough to accept, but the fact that i get paid via a paper check sent through standard mail, from FL to NYC, which sometimes takes 6 days, is agony. They dislike the paypal fees…any suggestions i can speed up this annoying process? If they send me the picture of the check, can i somehow plug that into my BankAmerica instant deposit?

I like it! Thanks for sharing!

i have a question. if i work as a freelancer without a bank account and i didn’t withdraw the payments that i receive for a few months, where will my money go? does my money will get loss, or the freelance company will keep it for a while and pay me later anytime i want to get my money.

I am starting a business that will provide writing/editing services. I will be requiring 50% down to start a project, and would like to use PayPal Invoicing (where the buyer isn’t required to have a PayPal account and can pay via credit card) to collect both at the beginning and the end, but I have read a lot of horror stories about disputes and account freezes.

Can anyone shed any light on this for me? Have you had good luck using PayPal for creative (non-tangible) services? Any tips or tricks to make it work well and avoid as many hassles as possible?

Interesting post! This is really helpful for me. I like it! Thanks for sharing!

I have a trouble about a freelancer project. I’m new to the freelancer and yesterday I got a project at very first time. They are asking for a refund of 20$. It’s a typing project and they are going to pay me directly to my bank account or paypal account. I have trouble about that refund and also why they are not going to pay me through freelancer? Can anyone help me please……… I’m fear to pay 20$.

Beware of using PayPal for services or digital goods! Recently a client reversed the payment with their bank, opened a dispute with PayPal, and PayPal took the money from me. I provided all evidence of the work done. PayPal 15 days later said that they don’t provide seller protection for intangible goods. PayPal also charged me a $20 chargeback few on top of it.

Check out http://getworkweek.com/. They do online invoicing that is integrated into your portfolio website. I’m so looking forward to their launch!

I normally charge 50% upfront and 50% on completion via direct bank to bank transfers, but often have to chase payments (always the second payment!).

When these guys launch I’ll give them a shot… www.promisepay.com They charge your clients upfront and once the work is done you’re paid straight away 🙂

I am glad to see Intuit’s IPN listed here. I have been using it for about a year or so now and I really like it. With PayPal you have to be careful depending on your type of service or product being sold. You really have no “seller protection” if you sell certain products or services. You really should read the Terms or Service before diving in deep. That being said, I really do like the fees on IPN if the client does not choose to use the CC option for payment. You can opt out of CC payments, but I left it on. The fees are comparable to PayPal so not outrageous. However, I have clients that pay with the Bank Draft and it is only 50¢ per payment!!! MUCH more affordable and they are happy to use the secure service. I still have my check writers, but everyone who has used the IPN service has been happy and said that it was easy enough to set up and use on their end. I have not set up the “easy pay” options at my bank but I think it would be just as easy and secure. I just need to check the fees that are involved if any if they choose to pay via CC (or if they even can). It would make it so much easier to get paid by some.

Payment processing is one of the hardest object of Freelancing with international clients. I was used to provide my services as a freelance to local bodies, however, recently I just jumped over the international platform and now facing different difficulties.

There are several ways & methods to get paid faster, but in my area, it is one of the biggest problem. We guys don’t have a Paypal supported in our country, and the rest options are too risky to go. I prefer Wire Transfer 75% upfront, and the rest after completing the project.

99% of our clients pay with check and the others utilize PayPal (it syncs up beautifully with Freshbooks). As a side note: A client of ours used to utilize Square and was recently badly burned when 2/3 of her transactions didn’t make it through to her one busy selling day. She found terrible customer service when she tried to contact Square and she lost thousands. SO if you utilize Square, keep a close eye on your receipts, etc.!

Thanks for the great artical. I use CashBoard (cashboardapp.com) and paypal for all my online invoicing and estimating. I like it because I can do all of my estimating, invoicing, and project tracking through one interface and it has a client login area for communicating to keep all of our communications in one place. It’s a little techie to get set up and maybe not the most sleekest interface but it’s also very cheap for their freelancer plan. For all physical transactions I use PayPal with PayPal Here which even allows you to take pictures of checks with your mobile phone for easy deposit. That coupled with their credit card/debit card and am all set and ready to go anytime anywhere!

I find that the square works very well. On the phone or when I have to show up on location and do a photo shoot first thing. It’s great in person and for my client in other states online purchases works very good also. I prefer having them on the phone for most all transactions. This gives the client direct opportunity to tie up loose ends or clarify the small things that will sometimes postpone payments. Bank to Bank will be great but I’ve ran into some inconsistencies and sometimes new clients need some heavy persuasion.

Well well well, I checked out my Wells Fargo bank account and sure enough, they have WF SurePay, which sounds a lot like bank to bank transfers (within the US only).

They don’t specifically say there’s a fee, but they don’t mention it’s free either. Thanks for the comments, everyone, I’m going to sign up and see how it works.

Best, April

Fantastic April! That’s the power of an excellent article followed by awesome comments. You increase your knowledge and (possibly) reduce your fees! 🙂

The payment method depends on the customer.

– Local customers: Bank transfer or Cash (if small amount)

– International customers: Paypal

I’m now also trying a payment terminal: SUM UP – https://sumup.co.uk/go/filipe (affiliate link) that could be handy sometimes.

I didn’t knew that bank transfers are not common in the US. In Europe they are quite popular.

Interesting article. A lot of the sites we build via our Web123 ProPartner system has a lot of inbuilt payment solutions. We like to try and make it easy on our Austrlian clients.

I like to use the online invoice system from HarvestApp.

You pay a low monthly fee and can send a large amount of invoices at no cost.

Harvest sounds great. I try to not be tied to subscription software. So I like Activecollab better. – https://www.activecollab.com/

Thanks for your article, April. I’m based in Australia, and a common form of payment here is bank transfer, where the client simply transfers the money online from their bank account into the supplier’s bank account. It’s easy, safe and has no fees. Smiles all round. 🙂

One thing no-one seems to have mentioned – and I use a lot of is BACS payments (Bankers Automated Clearing Services Limited) Which is a direct online payment from their bank account into yours. the client trusts it because it is through their own bank. I like it because it there are no fees.

I do accept cheques too, but its slow and time consuming.

I accept Paypal for the Child and Toddler behave charts I sell direct from my website, as it was easy to set up and the fee per transaction is minimal.

BACS is the way to go though.

Hi Linda, we have a similar thing here in Australia, and it’s widely used. Most of my payments are made this way, but my international clients like to pay through Paypal. 🙂

Hi Lucinda, could you please let me know what similar option you have in Australia.

Linda,

Wish we had something akin to BACS in the US. We have wire transfers and “BillPay” through banks, but a bank-to-bank transfer is either not marketed or not available. Bummer! With all the banking fees around this country, though, it’d probably cost. :/

Thanks for sharing!

Allowing clients multiple avenues of payments is smart. I have a payment portal on my web site linked to Paypal. Clients use it. Not all but some do. Some prefer mailing a check and that’s just fine with me. With the new scanning and sending options for deposit, checks are a breeze.

The biggest problem I suffer is prompt payment. I’ll say this, the first time a client goes 90 days or more for no good reason, you need to drop them like a hot potato. From then on, that is if you want to work for them, get your money up front and work to the number. In this economic climate, clients that don’t pay or pay extremely slow are a curse in this business. You can go broke all by yourself, you don’t need their help.

I use PayPal and cash almost always. It simplifies things to no end for me and my clients. However, I’m definitely going to look into some secure on site methods to increase ease of payment and hopefully use the payment gateway as a marketing opportunity for other services!

Thanks for the informative post!

Hi April… this is one topic that I have been struggling with for long. I’m from central america, Nicaragua and paypal doesn’t offer the entire service here so I was looking for alternative for so long… so long actually… and I did found a solution, not just for freelancing but for the e-commerce too… Payoneer, I got the debit card which works with the ATM but what if I need to grow?… well i just realise that the offer the business plan and they settle the online payment and direct deposit to your bank account in countries where Paypal doesn’t get. I found this useful and wanted to share it because I do know that this blog is not only followed by US designer 🙂 … and I thought this could help other business to retake the direction on the ecommerce too. 🙂

Barney,

Thanks for sharing your tips from Central America! You input is greatly appreciated!

April

I use PayPal and love it! You don’t have to have an account with them to make a payment, and they accept credit cards. It should be pointed out that you can claim PayPal fees as a business expense on your taxes, so as long as you can keep track of that, it’s a very trustworthy and straight-forward solution.

Clarify with your buyer that you are not in the credit business. Contractually agree when payment has to happen. Ideally only start working after having been paid (at least partially, e.g., agree to 50% up-front and 50% after the first results are delivered). Send invoice 7 days ahead of the scheduled payment date. Follow-up with the client (not the accounting department) if the invoice has not been paid. In Europe, most corporate clients bay invoices by wire transfer, so tha’t what I use. In addition, costs for both parties are minimal.

Claude – YES – get a deposit/down payment before starting work!

Thanks for sharing!

Ironic that this is the topic for today’s post. I’m currently working with an international client that would like to make payment by bank transfer. I’ve never done this before so I’m a little hesitant due to lack of knowledge. What are your opinions of this method?

I am in the UK, and BACS (Bankers Automated Clearing Services) or bank transfer is very common. You supply your bank account sort code and account number and the client logs onto their bank account and sends a direct payment transfer into your account.

Once they have paid you once then generally their bank saves your details making it quicker for them to pay you again next time.

Security is controlled by whatever method their bank uses – and there are no fees (not that I am aware of anyway).

All together I would recommend this way every time.

You can log onto your bank account and check the transfer has been made.

Linda,

Very cool – thanks for sharing for our readers outside the US. As you have probably noticed, bank transfer is fairly rare inside the US.

April

As you mentioned, it is an international client who wants to send you money from abroad. I do not like to receive bank to bank wire transfers from overseas unless it is someone I trust or if it is a pretty hefty amount. International wire transfers are expensive, and there’s also that security issue, so your client would have to pay a lot more in fees that way. Please ask them to pay via PayPal or use Transferwise, which is yet another trusted payment source, I use both these services to collect money from US/Canada/some parts of Europe. Wire transfer details should not be handed out easily since this info exchanges a lot of hands plus the entire process is tedious and you’re not even guaranteed of the success of the incoming wire.